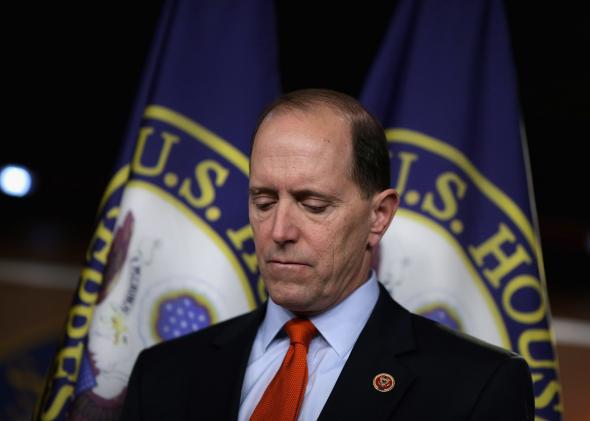

Rep. Dave Camp (R-Mich.) has finally released his long-awaited blueprint for tax reform (PDF), and it’s a bit of an odd duck. It doesn’t raise any revenue and doesn’t make the overall tax code much more progressive, so liberals don’t love it and it’s difficult to see Democrats being eager to vote for it. At the same time, Camp really is pretty bold in taking on some special interests and sacred cows.

He limits the mortgage interest tax deduction in a distributionally progressive way. He also tackles the state and local tax exemption in a way that’s part trolling of blue-state politicians, but also a genuinely sound reform. He has a version of a bank tax. He curbs the “carried interest” loophole. There’s good stuff in here. Too much good stuff for the GOP leadership, which, per Jake Sherman and Kelsey Snell, is not exactly leaping at the opportunity to embrace Camp:

Asked if this bill was reflective of the House Republican position on tax reform, Boehner said “you’re getting a little ahead of yourself.”

“It’s time to have a public conversation about the issue of tax reform,” Boehner said. When pressed specifically on changes to the financial services industry, he replied by saying “bla, bla, bla, bla.”

Obviously this makes Camp look a little bad. When Paul Ryan writes a budget, everyone falls in line behind him. When Camp writes a tax bill, everyone runs for the hills.

But from the standpoint of actual legislating, this is actually the good option. Realistically, the odds of major tax reform passing in 2014 are nearly zero. Same for 2015 and 2016 and so on and so forth because legislating is hard and tax reform is especially hard. But were tax reform to happen it would happen precisely because of collaboration across the aisle between some entrepreneurial legislators. Creating a polarized debate between party leaders would be totally counterproductive.