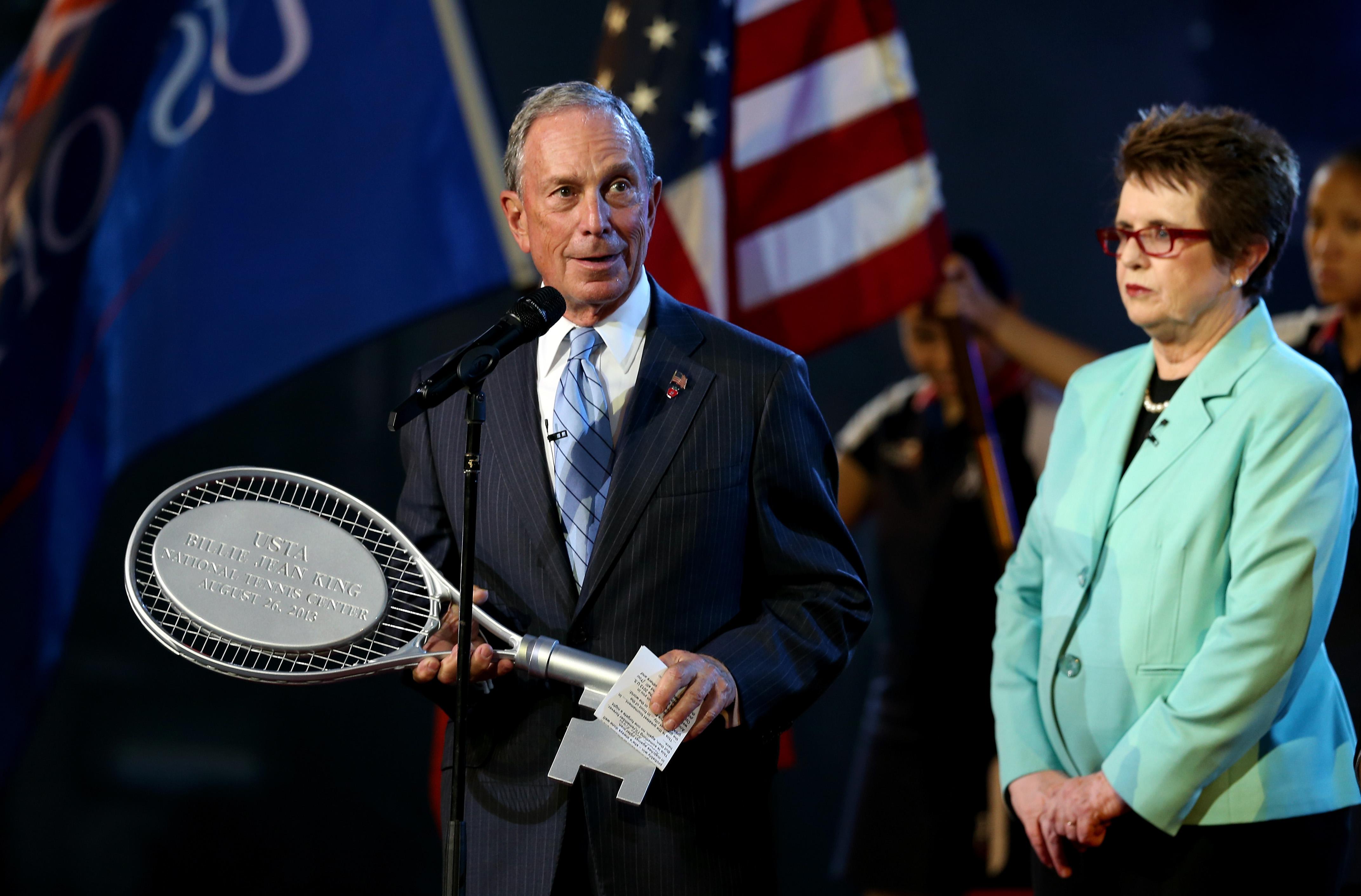

I enjoyed Jonathan Chait’s take on Michael Bloomberg and his political legacy, but I think Chait’s explication of Bloomberg’s consistent elitism ends up eliding some real incoherence in Bloomberg’s view of Wall Street:

Bloomberg has explicated his contempt for the hoi polloi bluntly and repeatedly. His proposed ban on large sugary drinks is insanely intrusive if you believe in the classic tradition of Locke and Mill that people ought to be able to make personal decisions as long as they don’t affect other people. Bloomberg believes people can’t make these decisions for themselves, his evidence being that they’re really fat. Bloomberg’s defense of Wall Street revolves around his contention that it’s unfair to blame the big banks rather than the suckers who made bad investments. (“They should have done the research,” he told Esquire.)

The Michael Bloomberg who banned trans fats in New York City restaurants would have a very different take on this. In some sense, yes, consumers should have done the research on trans fats and reached the conclusion that it would be better to avoid them and then waited for the process of market competition to give them more options free of the stuff. But in the real world Bloomberg-the-paternalist knows that it doesn’t work that way and sometimes what makes sense is to act collectively on behalf of the research-based conclusion.

It seems to me that this kind of somewhat snobby, elitist, and paternalistic brand of politics is exactly what’s been missing from the financial regulation debate in the United States. Arguments such as If you do X, it’ll reduce lending and/or raise borrowing costs have been treated like trump cards in the debate. The missing perspective has been the Bloombergian notion that we know perfectly well that people won’t always do the research. We know that left to their own devices, people will excessively engage in debt for consumer purposes and that politicians will find debt-financed consumption growth to be a politically appealing alternative to the harder but more rewarding task of increasing incomes.

But when it comes to high finance, the emotional side of Bloomberg’s elitism takes precedence over the intellectual side. When the question is gigantic sodas, Bloomberg sees exploited marks and decides to rescue them from themselves. But when the question is financial products, Bloomberg sides with the con artists and says the marks are only suffering because they’re not smart enough. The reality, however, is that the reasons for believing that more paternalistic regulation of debt markets would be broadly beneficial are at least as compelling as the arguments for believing that regulating soda sizes will be.