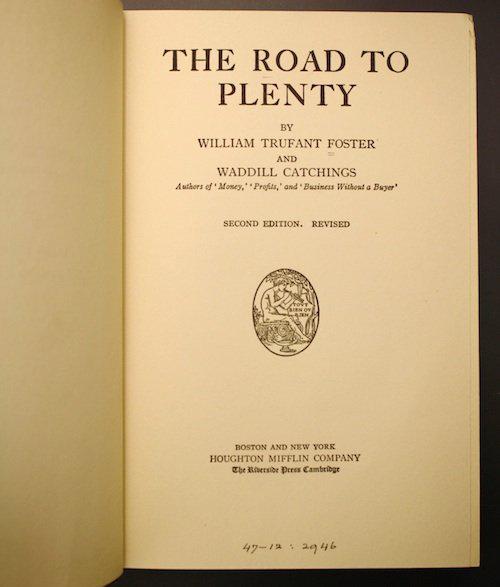

In 1928, William Foster and Waddill Catchings—a university president and a Goldman Sachs financier, respectively—wrote The Road to Plenty. Both men had a serious interest in studying business cycles, and their book presented a proto-Keynesian theory eight years before John Maynard Keynes published The General Theory.

Like Keynes, Foster and Catchings contradicted Say’s Law, or the idea that “supply creates its own demand,” as Keynes put it. Instead, The Road to Plenty argued that “sustained production required sustained consumer demand,” as Eliot Rosen writes in Roosevelt, the Great Depression, and the Economics of Recovery. Foster and Catchings anticipated many of the things Keynes would go on to formalize in his General Theory. And they argued for a significant government role in public spending in order to combat recessions.

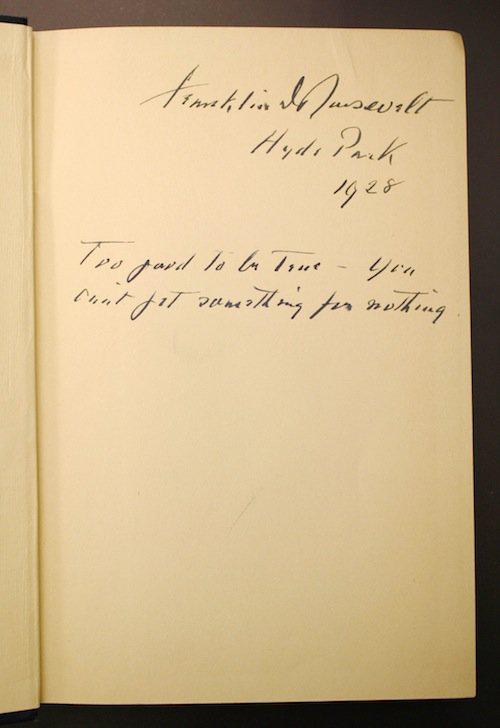

Before he became president, Franklin Delano Roosevelt had a copy of The Road to Plenty. What did he write in the book in 1928, just before the Great Depression began looming into view? Our friends at the FDR Presidential Library snapped a picture:

FDR Presidential Library

FDR Presidential Library

In case you can’t make out FDR’s handwriting, he wrote: “Too good to be true—you can’t get something for nothing.” To FDR, the idea that government spending in times of recessions could boost the overall economy seemed like “something for nothing.”

Though Roosevelt didn’t buy The Road to Plenty’s argument at first, he thankfully later evolved on the issue. As he said on a 1936 campaign stop, “To balance our budget in 1933 or 1934 or 1935 would have been a crime against the American people…But this vicious tightening circle of our declining national income simply had to be broken.” One reason FDR changed course was because of one of The Road to Plenty’s biggest fans—a Utah banker who read it intensely starting in 1931, when the Depression seemed like it would never end. That man’s name was Marriner Stoddard Eccles, who became the Federal Reserve chairman under FDR and an early, major proponent of Keynesian thinking. The rest, as they say, is history. (Except it’s not, because we are currently fighting this all over again—pushing back against ideas like “Austerity will create confidence, and thus jobs.”)

The book itself proceeds as a series of conversations about the contemporary economy among strangers traveling on a Pullman car. A typical exchange:

“But I cannot see,” objected the Professor, “how the savings, either of corporations or of individuals, cause the shortage of which you speak. The money which industry receives from consumers and retains as undistributed profits is not locked up in strong boxes. Most of it is deposited in banks, where other men may borrow it and pay it out. So it flows on to consumers…”

“Yes,” the Business Man replied, “I am familiar with that contention, but it seems to me unsound. Of course it is true that a considerable part of money savings are deposited in banks, where the money is available for borrowers. But the fact that somebody may borrow the money and pay it out as wages is immaterial as long as nobody does borrow it. Such money is no more a stimulus to business than is gold in the bowels of the earth.”

Seem familiar? As UC Davis economics professor Greg Clark noted early on, our debate over the current recession has been “conducted in terms that would be quite familiar to economists in the 1920s and 1930s. There has essentially been no advance in our knowledge in 80 years.” When it comes to economics, we are still spinning our wheels.

This piece is reprinted from Next New Deal, the blog of the Roosevelt Institute.

Mike Konczal is a fellow at the Roosevelt Institute. Follow him on Twitter.