I’m a little unclear on exactly what Steven Pearlstein has in mind when he writes about “austerity” but he seems to be driving toward the idea that stimulus can be harmful because a stimulus-induced growth boost will undermine political will to enact structural reforms.

My suspicion is that such concerns frequently motivate critics of stimulus, but I think it’s a somewhat confused idea. One particular concern is that it becomes difficult to separate high-minded concern for the long term with simple partisanship. Lots of economists I read, for example, very strongly and very sincerely believe that Barack Obama’s efforts to secure health insurance for poor people is disastrous long-term economic policy. If that were true, then it would also be the case that having the Federal Reserve tank the economy in 2012 would have had beneficial long-term implications ofr the American economy via the causal mechanism of electing Mitt Romney. But for better or for worse nobody seemed willing to openly call for Bernanke to have the FOMC target the 2012 election results with monetary policy. Lots of people who had strong feelings about the 2012 election results were unwilling to explicitly talk about how this was influencing their thinking on macroeconomic stabilization, so we got a lot of sublimated commentary and muddled thinking.

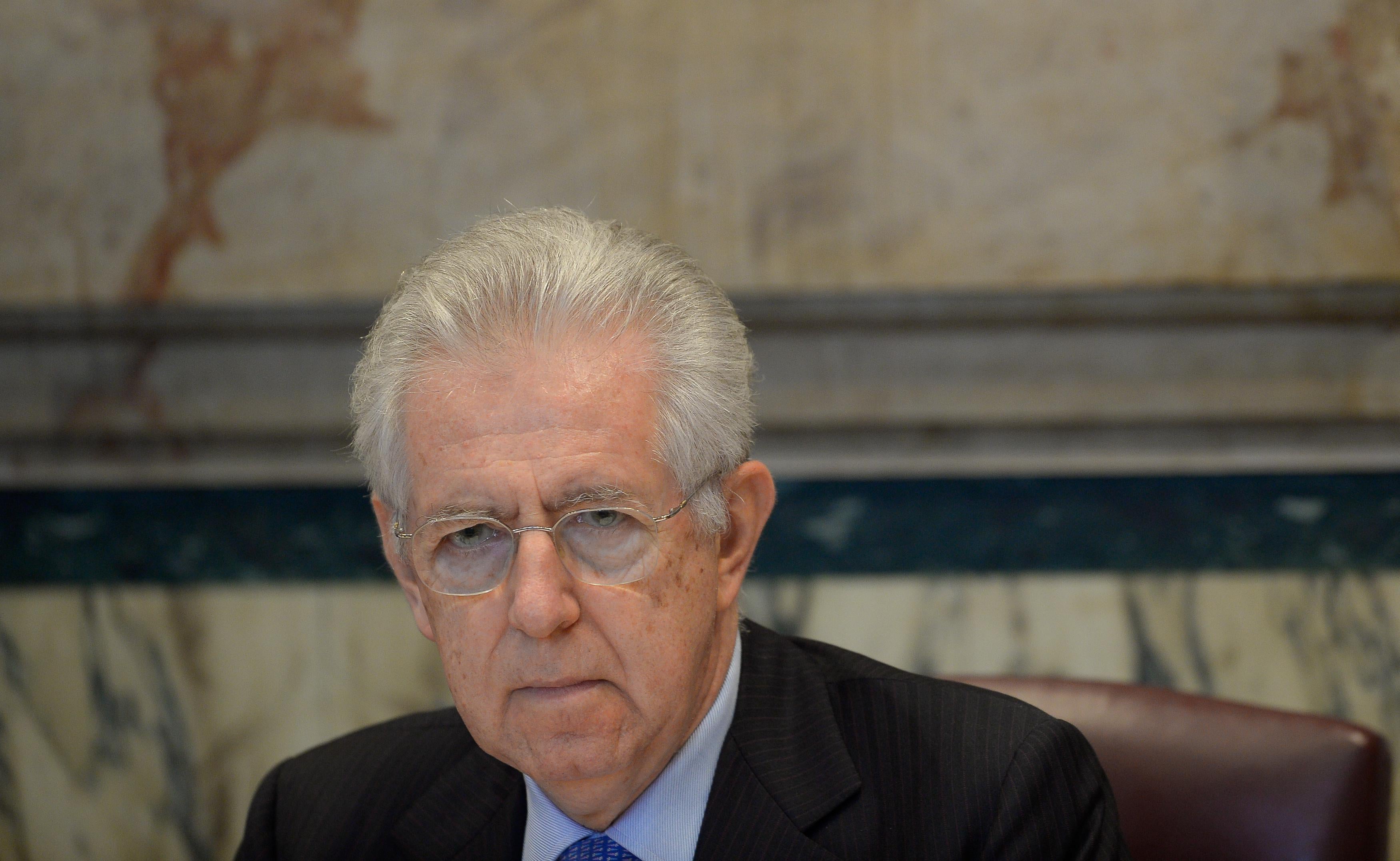

But this kind of consideration can point in different ways. Like most outside observers, I thought Mario Monti’s structural reform program for Italy was a good idea. But it ended in catastrophic failure because Monti was proceeding over a total economic disaster. Contractionary short-term policy didn’t boost support for reform, it undermined support for the incumbent.

It’s important to try to think of a workable, non-partisan strategy for mixing the structural and the cyclical. The best thing, I think, is to empower central banks to conduct helicopter drops and give them exclusive domain over macroeconomic stabilization policy. The job of the central bank is to ensure adequate demand. The job of the parliament is to channel as much of that demand into real output (rather than price inflation) as possible. The key advantage of this approach is that the proof will be in the pudding. Policy reforms will either have the intended result of limiting price increases or else they won’t. Citizens and observers will still argue about which ideas are the good ones and which are the bad ones, but central bankers won’t be asked to guess in distinguish in advance. Political pressure for reform will come from the bottom-up, and it’ll come for the very sensible reason that voters hate price inflation and will want elected leaders to implement effective supply-side policies to minimize it.