Tragically, there’s already buzz on Twitter and on analysis circulating via email that this month’s pretty good Employment Situation Report strengthens the case for Fed tightening or weakens the case for Fed easing. That’s dead wrong. And the fact that anyone is saying it is a reminder of how screwed up the situation has become.

Recall the Federal Open Market Committee’s mandate to “maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.”

Not tolerable employment, maximum employment. Are we at maximum employment? No. Are we at the economy’s long-run potential to increase production? Also no. There is only one excuse for stepping off the monetary pedal when you’re far short of maximum employment, and that’s the pursuit of price stability, which the Fed defines as 2 percent growth in the Personal Consumption Expenditures Deflator. But the PCE Deflator is running below 2 percent. The policy question to ask is “How far above 2 percent should the Fed be willing to go, and for how long in order to achieve its goal of maximum employment?” But with inflation actually running below the target level, merely OK jobs growth isn’t good enough. Especially given that the Fed knows sequestration and other headwinds continue to be in the works, the FOMC needs to think creatively about how to build confidence and continue to stimulate the economy.

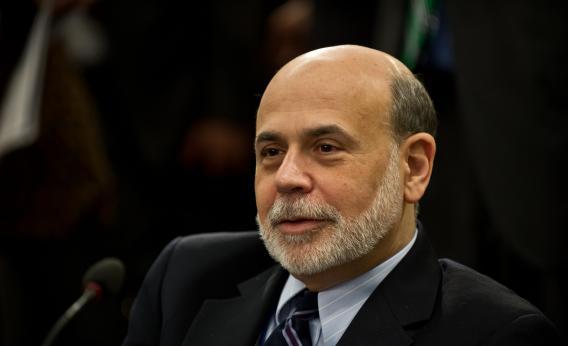

My dream scenario continues to be QE for the People, in which the Fed simply gives people money, but if that can’t be legally or logistically arranged there’s plenty more that can be done. There’s no way in hell this is happening, but what Ben Bernanke really ought to do is organize an emergency conference call and announce this afternoon that in light of today’s jobs report, the FOMC is doubling the pace of asset purchases and that asset purchases will double every month until the Evans Rule threshold of 6.5 percent unemployment or 2.5 percent inflation is met. The positive impact wouldn’t just (or even mostly) be about the assets, it’d be about the huge shock and surprise of seeing that the Fed isn’t content with “meh” and that the governors actually dusted off a copy of the Federal Reserve Act somewhere and read the maximum employment line.