This Alex Tabarrok post on growth in the face of fiscal austerity annoyed me as did his co-blogger Tyler Cowen chiming in to say Tabarrok had “nailed it”. What annoyed me about it specifically? Well the inclusion of the line “In the 1990s growth was strong even while ‘austerity’ was increasing.”

That kind of thing is a dead giveaway that the author isn’t even stating the argument for expansionary fiscal policy correctly.

What’s the argument? Here it goes: Sometimes an economy falls into a demand shortfall. In those times, unemployment can be reduced and real growth increased through expansionary policy. The agreed-upon, uncontroversial, tractable way of doing this is for the Federal Reserve to reduce interest rates. But when interest rates hit zero, as they have today, things become less clear. The Keynesian view—including the view of the FOMC—is that in such times expansionary fiscal policy can play a useful role in stimulating aggregate demand. But the view does not say that stimulative fiscal policy is useful at all times. In fact it says that during a period of non-zero interest rates, deficit reduction will “crowd-in” private investment and deficit increases will crowd it out. There was a view circa 1999-2001 that budget deficits should be made much larger, but it wasn’t a Keynesian view. It was a supply-side view that the existence of a large budget deficit would be a useful political constraint on efforts to expand the welfare state and/or avoid cuts in Social Security or Medicare benefits.

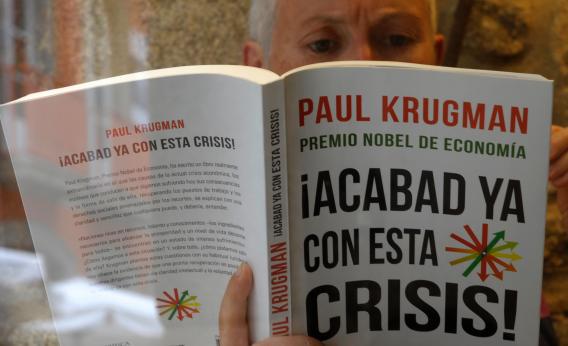

The fact that Paul Krugman is a fierce advocate for expansionary fiscal policy and also a fierce advocate for progressive political causes in general often seems to me to create a distraction for small-government types. I think the general shape of the debate would be improved if opponents of stimulus theories would use Ben Bernanke as their bearded-Jewish-Princeton-economist-foil. Is Bernanke confused about the monetary policy response function? Just lying? My view is that he’s probably screwing up and actually could engineer a rapid convergence to full employment in the face of austerity, but that given the actual stance of monetary policy fiscal expansion would be helpful.