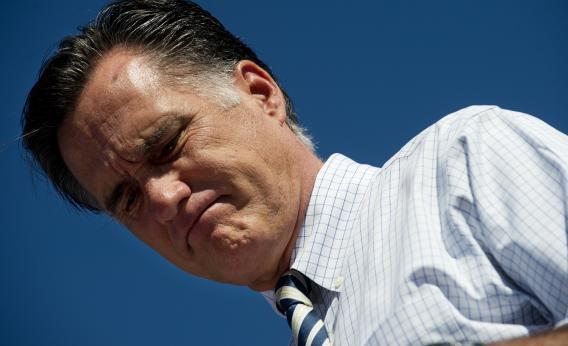

Josh Marshall wisely notes that the tax plan described on Mitt Romney’s campaign website bears relatively little resemblance to the revenue-neutral reform he’s been talking about lately. Which reminds me that alongside his many vague claims, Romney’s made at least one specific commitment to a really terrible idea that I’ve helpfully highlighted:

Now recall briefly that people sometimes make a blunder about how marginal tax rates work and think that if you go into a higher tax bracket you might actually end up with a lower after-tax income than you previously had. Thankfully, the designers of the progressive income tax weren’t dumb and that doesn’t happen. But with Romney’s reforms, it might.

Say you’ve got an AGI of $195,000 of which $175,000 is your salary and $20,000 is interest income. That investment income would, under Romney’s plan, be untaxed. But now your boss tells you that if you and your team manage to buckle down and get the project done by Thanksgiving there’s a $6,000 bonus in it for you.

At first you’re jazzed up, yeah we can do that!

But then you realize that not only will you pay $1,680 in federal income taxes (28 percent) on your bonus, you’ll also have to pay $5,600 in federal income taxes (again 28 percent) on your interest income since you’ll now be above the $200,000 AGI threshold. In other words, $6000 in additional income will hit you with a $7,280 tax bill. Now suddenly you’re urging your team to slow things down and make sure by all means don’t get it done by Thanksgiving.

Bad idea. I’m sure you could tweak things to eliminate this feature of the plan. But if you want to eliminate the marginal tax rates of over 100% while preserving the total elimination of taxes on investment income for middle class households, you’re going to have to make the proposal even friendlier to the interests of high-income tax payers. And that gets you back into an even more severe form of Romney’s Trilemma. Either that extra tax break has to be made up with tax hikes on the middle class, or it has to lead to higher deficits.