Mike Konczal’s GIF-based explanation of Quantitative Easing, the expectations channel, and NGDP level targeting is a must-read.

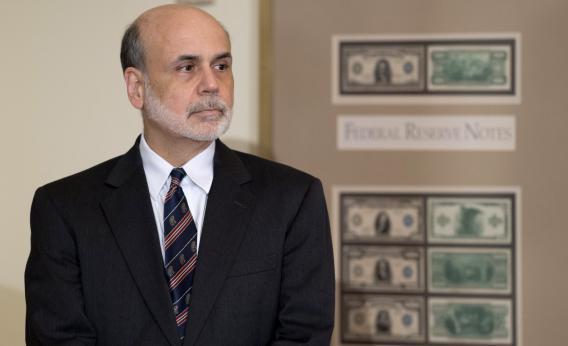

But if you want to understand why Ben Bernanke can’t adopt the policies that would repair the American labor market, all you have to know is this. If he fixes the problem, then people will (rightly) ask why he didn’t do it two years ago and his reputation will be in the toilet. He needs it to be the case that the only tools at his disposal are risky and of questionable efficacy. Large-scale asset purchases conducted without a clear nominal target are at least a little risky, and they’re not very effective. At this point, that’s a feature not a bug for Bernanke. It’ll help a little, but not a ton, and public and elite appetite for doing more would be limited. If he says “hey, Michael Woodford and Christina Romer and Charles Evans and Jan Hatzius are right, let’s start pairing these asset purchases with an explicit nominal GDP level target” and the economy starts rapidly improving, that will show what a disaster his tenure in office has been. So it won’t happen.