The government of Japan has been making grevious macroeconomic stabilization errors since the leaders of today’s U.S., EU, and U.K. were just young pups, and today’s no exception as the Diet votes to double sales taxes.

It’s easy to see how this will crush the Japanese economy by weakening domestic demand, curtailing business investment, and perhaps prompting the BOJ to implement tighter money in the face of domestic price increases. But what’s so impressively blunderific is that it’s completely impossible to say what problem this is supposed to solve. Allegedly the issue is Japan’s large budget deficit. But again: What problem does tackling this solve? In 1993 the Clinton administration faced the problem of wanting lower nominal interest rates without higher inflation—a problem that tighter fiscal policy can easily solve. But Japan’s nominal interest rates are as low as they can go, and inflation has been nonexistent for a long long time. So what’s the point?

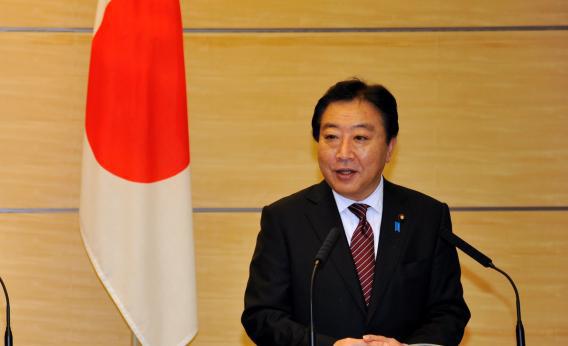

Especially tragically, this error seems to have been made on a broadly bipartisan basis supported by both the ruling Democratic Party of Japan and the main opposition party. The only people talking sense were a dissident faction of the Democrats, whose leader seems to have been discredited in the public eye due to some unrelated corruption.