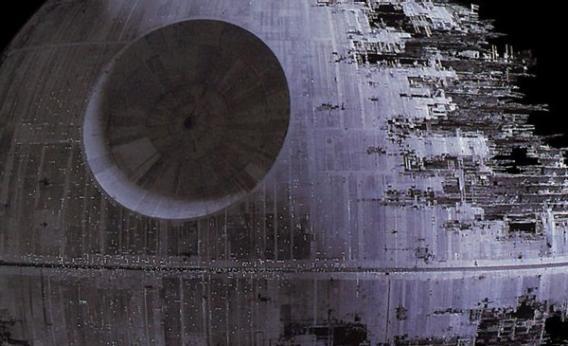

Matt O’Brien’s excellent article on monetary policy and Star Wars analogies did overlook one crucial line that I think helps explain the European Central Bank’s refusal to cut interest rates this morning:

Fear will keep the local systems in line. Fear of this battle station.

That’s Grand Moff Tarkin’s explanation of how the Emperor is going to be able to run the galaxy without using the Imperial Senate as an intermediary. And you can think of Europe as facing a somewhat similar problem. Europe has a bunch of big collective decisions to make about transfer payments, labor market policies, bank regulation, deposit insurance, and fiscal policy but the European Parliament isn’t empowered to make those decisions. In fact nobody is empowered to make them. But the European Central Bank, though not empowered to make those decisions, is at least empowered to make some decisions—and important ones too. So the ECB can use the power that it does have to keep the local systems in line, ensuring that national states compete to gain Frankfurt’s favor by implementing the fiscal and labor market policies that Frankfurt wants.

The problem here is that the ECB loses that power if it commits itself to implementing optimal policy. A central bank should be stabilizing the growth path of aggregate demand. But a central bank that’s actually doing that has no leverage over anyone else. It’s got an important job to do and it’s doing the job well. Here in the United States, the Pentagon’s Strategic Command has the power to launch nuclear missiles and destroy the world. In theory, that could give it enormous leverage over tax policy. In practice, the officers who run Strategic Command due their duty rather than threatening to unleash mass death on the planet unless they get their way on unrelated issues.

But while advanced democracies hold the principle of “civilian control” of the military as a cardinal tenet of our political systems, the principle of “central bank independence” has come to encourage central bankers to wield authority outside their domain.

A dangerous and telling precedent comes from the United States where it’s widely believed that Alan Greenspan communicated to the Clinton administration that an agenda of deficit reduction would be rewarded with loose monetary policy while a non-approved agenda would be punished with tight money. This worked out well enough in the end because Clinton committed himself to Greenspanism, congressional Democrats more or less went along, and then Greenspan delivered the goods. As a result, Greenspan got to become the “maestro” and we enjoyed solid growth years. But imagine congress had balked, the deficit reduction package had failed, and then Greenspan tried to punish Congress with tight money. How would that have helped? And yet for the central banker’s veto over policy to be effective, the central bank must retain the discretion to impose inappropriate monetary conditions if it’s displeased. And the ECB is displeased with the behavior of Europe’s wayward southern states. If everyone would agree to act like Ireland and Estonia, then the ECB might agree to implement appropriate monetary policy and growth would be higher. But they haven’t agreed, so the ECB wants to compound everyone’s problems with tight money inflicting needless suffering on everyone involved—including the poor Estonians!

The right thing for central banks to do is to just do the right thing. Provide a steady growth path for aggregate demand and tell politicians that the rest is up to them. The work of fiscal and regulatory policies plays an important role in driving how much demand is translated into real output and how much into higher prices. It plays a role in determining which prices rise, and what sort of real output (more consumer goods? more subways? more health care services?) we get. When the central bank decides it also wants a say in those issues, then the only tool it has is to compound countries’ real problems by adding nominal ones. It’s a disaster.