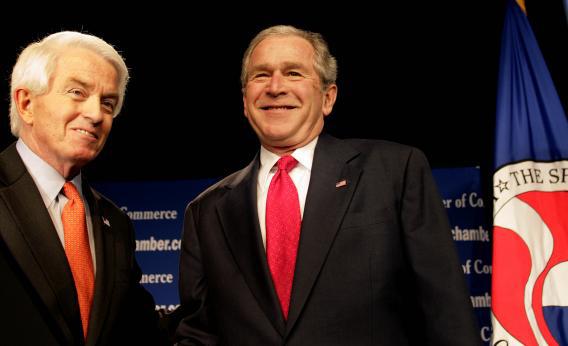

In a political system as decentralized and laden with veto points as the one we have in the United States of America, it’s ultimately very difficult to do anything properly on a sustained basis unless there’s widespread buy-in throughout the political system. So I think the dim view that Tom Donohue and the US Chamber of Commerce take toward the position that the Volcker Rule should be strengthened in the wake of JP Morgan’s “fail whale” trade has implications far beyond the specific dimensions of the Volcker Rule rule-writing process.

The basic point is that you might think that America’s roster of non-financial business executives would be a powerful lobby for sound financial regulation. After all, the financial panic of 2007-2008 was ruinous to share prices across the board. If a poorly regulated financial system can lead to widespread economic devastation, then the CEOs of non-financial companies—especially in sectors things like retail and restaurant chains, durable goods manufacturing, utilities, and transportation—ought to be very interested in preventing that kind of devastation. But what you see in Donohue’s comments yesterday, and in the US Chamber’s attitude throughout the Dodd-Frank debate, is nothing of the kind. There’s no support for the basic approach of Dodd-Frank, no support for strengthening any of its weaker provisions, and no support for alternative approaches to restraining the financial sector either. The whole thing is regarded as a very standard left-right dispute in which the business community has a whole stands in solidarity with financial institutions’ desire to be regulated as laxly as possible.