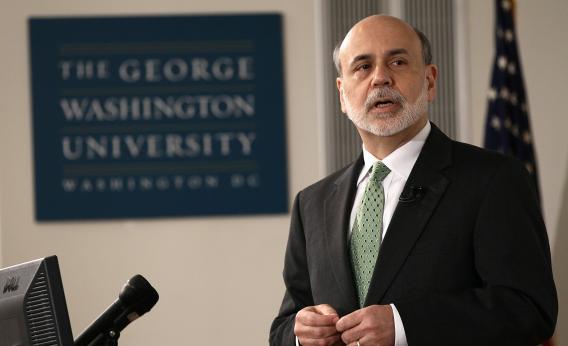

In a speech today to the National Association of Business Economists, Ben Bernanke sounds mostly cautious notes about Recovery Winter offering what I would say is an unduly bearish forecast about the near term. Joe Weisenthal characterizes this as part of Bernanke’s dovish communications strategy, in which he avoids optimistic forecasts as a way of signaling that rates will stay low for a long time. That may be what’s happening, but as Betsey Stevenson and Justin Wolfers point out, this sort of Eeyore communications strategy has problems. Is Bernanke’s signal that now would be a good time to invest in structures, business equipment, and automobiles because rates will stay low for a long time or is the signal that now would be a terrible time to invest in structures, business equipment, and automobiles because the economy will stay depressed for a long time?

If Bernanke wants us to invest in structures, business equipment, and autombiles, what he needs is what they call a Tigger strategy—just say we’re climbing out of a steep hole so rates will stay low for the next 18 months come what may. That way you definitely want to invest in structures, business equipment, and automobiles ASAP if you have the ability to do so. Chicago Federal Reserve Chairman Charles Evans and some of his colleagues offered a more formal treatment of this idea and a somewhat more restrained version of the Tigger strategy (complete with a more digified Greek name) last week, and I hope Bernanke and the main Fed staff in D.C. are thinking that over carefully.