Earlier this month, the Federal Trade Commission accused T-Mobile of cramming, or adding unauthorized charges to users’ cellphone bills. And now both the FTC and the Senate Committee on Commerce, Science, and Transportation are coming out against the practice and reporting on its problematic ubiquity.

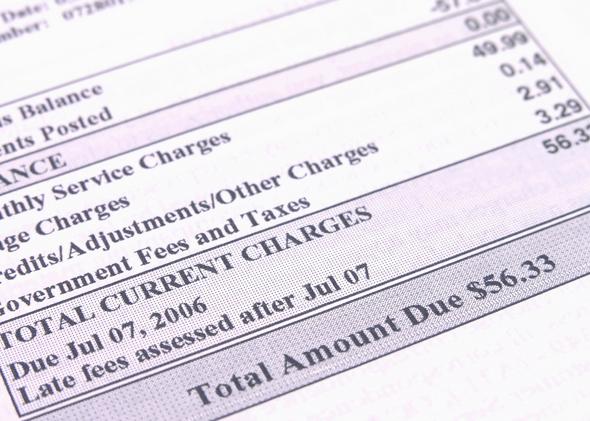

Cramming works by burying deceptive third-party charges in a bill’s list of fees so consumers won’t even notice or will assume the line item is warranted. Cramming dates back to bills for landlines, and telecom companies later evolved to hide charges in extra-cost text messages, known as premium short message services. But even though the practice has mostly been stopped for wired telephones and texts, it lives on in a system called direct carrier billing.

In a report released on Monday, the FTC noted, “In six recent enforcement actions, the Commission has alleged that such practices have cost consumers many millions of dollars, and in just three of these actions, defendants have agreed to orders imposing judgments totaling more than $160 million.”

Meanwhile, in a report released on Wednesday, the Senate committee described cramming as a billion-dollar industry that garners revenues for AT&T, Sprint, T-Mobile, and Verizon. The committee said that these carriers can hold on to as much as 30 to 40 percent of the vendor charges on customer bills, and that the telecom industry has wrongly dismissed cramming as a minor problem when it actually costs consumers millions of dollars a year. The report explains, “vendors using websites and apps connect to carrier billing platforms. Direct carrier billing methods are relatively nascent, and it is not possible at this stage to predict the extent to which scammers will find ways to cram charges on wireless bills.”

The FTC and Senate committee both claim that they will prevent cramming from continuing. The commission concludes that it “will continue to monitor the issue of cramming on mobile phone accounts and evaluate whether other potential solutions—including legislative measures and additional regulatory changes–are necessary to ensure consumers are protected from unwanted and unauthorized charges.” And it outlines five industry best practices that would create a safer environment for consumers:

1. Mobile carriers should give consumers the option to block all third-party charges on their phone accounts.

2. Advertisements for products or services charged to a mobile bill must not be deceptive.

3. It is critical that consumers provide their express, informed consent to charges before they are billed to a mobile account, and that reliable records of such authorizations are maintained.

4. All charges for third-party services should be clearly and conspicuously disclosed to consumers in a non-deceptive manner.

5. Carriers should implement an effective dispute resolution process.

Based on how hard it’s been to shake the con so far, it seems unlikely that this wave of scrutiny will stamp it out for good, but in the meantime consumers can dispute charges they think are unwarranted, and hopefully with multiple agencies working on the issue, it will be easier for customers who think they’ve been wronged to seek protection.