This post originally appeared on Business Insider.

Macy’s is diving headfirst into the world of extreme discounting.

Two months after opening the first three stores in a new discount chain called Macy’s Backstage, Macy’s is ramping up the rollout with plans to open 50 new stores within the next two years, the company said Wednesday.

The stores sell Macy’s merchandise and clearance items at discounts of up to 80 percent off.

Shoppers started gravitating toward discount stores during the recession, and many have failed to return to shopping in full-price stores. Once they realized they could get steeply discounted merchandise, they became addicted and haven’t stopped since.

Macy’s shares have declined 32 percent in the past year. Same-store sales have declined for three straight quarters.

Macy’s is also planning to add a Backstage section to 10 of its existing stores. “We are finding that Backstage is definitely attracting a younger consumer,” Macy’s CEO Terry Lundgren said on an earnings call. “And assuming these pilots work, we’ll be ready to roll this concept out as a hybrid model quickly.”

Lundgren said consumers—and especially millennials—are migrating toward lower-priced discount stores. “Particularly over the last two years to three years, there has been a consumer migration to these lower price point options, and so that’s where we know that there’s a consumer interest,” Lundgren said “We just need to get our share of that.”

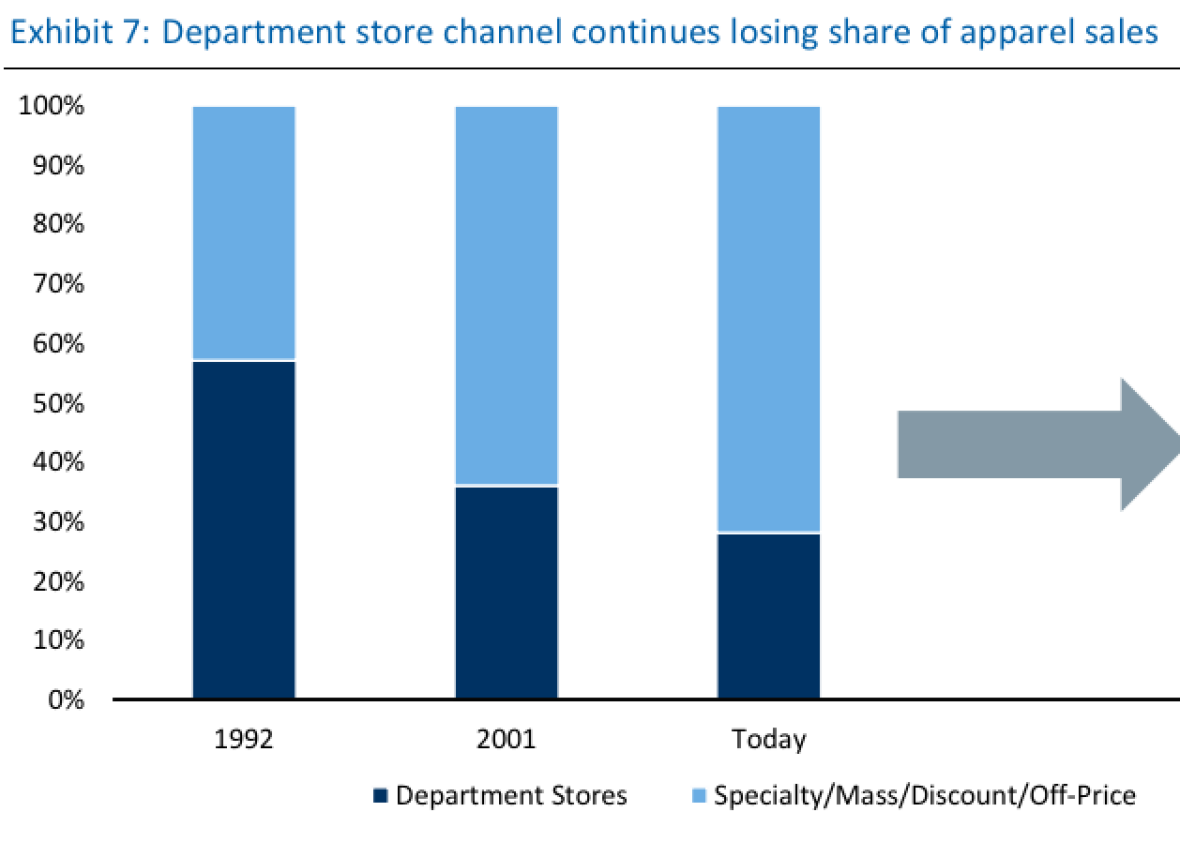

The off-price apparel and footwear market grew to $45 billion in revenues in 2014, which is up 40 percent since 2009, according to RBC Capital Markets. As the off-price market has grown, department stores have been losing their share of apparel sales, as shown by the chart below.

RBC Capital Markets

Lundgren said consumers aren’t contracting spending in the way they did in 2008 and 2009, however. In other words, this isn’t another recession.

They have money to spend, but they just aren’t spending it on clothes and shoes, he said. “They still indicate that there is money to spend if the consumer chooses to do so … We’re just waiting now to see if, in fact, they will,” he said.

This could be equally as alarming as another recession for Macy’s and other apparel retailers, however. It could be a sign that consumers have fundamentally altered their spending behavior to allocate less money to clothes and shoes and more to technology, healthcare, and other expenses.

Retailers like Nordstrom, Kohl’s, and J. Crew have also opened lower-priced outlets to drive sales in the competitive retail environment. But retail expert Robin Lewis believes this strategy is flawed and will hurt the companies long-term.

“Over time as their discount stores outnumber their full-price stores (which is already the case for some retailers); consumers will perceive the flagship brand and the discount store brand to be one and the same,” Lewis writes on his blog, The Robin Report. “Sadly, they will happily continue to shop in the brand’s discount store where they can get it cheaper.”

The resulting “race to the bottom” will send retailers into an “economic black hole,” where they have completely devalued their own brands and trained customers to never pay full price for anything.

“There is now going to be no end to discounting because all the players must dance as long as the music is playing,” Lewis writes. “And it will ultimately drag everything down with it, including brand image, potentially quality and essentially the value of all things.”

Nordstrom has nearly 200 Nordstrom Rack discount stores and 121 full-priced stores in the US and Canada. Kohl’s recently announced that they would be opening discount stores, as well.

Kohl’s is starting with one store in Cherry Hill, New Jersey, that will offer Kohl’s items at discounts of up to 90 percent off. J. Crew has online and stand-alone outlet stores, and just opened a new discount concept called J. Crew Mercantile.

Retailers, including Macy’s, argue that the discount stores are an opportunity to attract younger customers who will ultimately graduate to shopping in their full-price stores.

Lewis says that argument is a “charade.” “The great ‘value strategy’ charade is that retailers actually believe discounting to be a whole new market for them,” he writes. “What they are really succumbing to is a competition for cheap, cheaper and cheapest, when they should be pursuing good, better and best.”

Neil Saunders, CEO of retail-consulting firm Conlumino, also warned that Macy’s Backstage could degrade the price integrity of Macy’s flagship brand.

“The logic behind the move is sound—namely that Macy’s wants to tap into the growing off-price market,” Saunders wrote in a note to clients. “However, we would sound a note of caution that Macy’s must not blur the lines between its mainstream stores and the new concept too much if it is to maintain price integrity within its department store.”