This article originally appeared in Business Insider.

Sales at the Gap continued to drop in November, as its roundly-criticized “Dress Normal” fall campaign failed to drum up interest from consumers.

Gap’s comparable sales for November were down 4 percent versus a 2percent increase last year. Sales were down 7 percent year-on-year in October and declined 3 percent in September. Gap’s other brands, Old Navy and Banana Republic, saw sales increase this last month—so this is a Gap-specific problem.

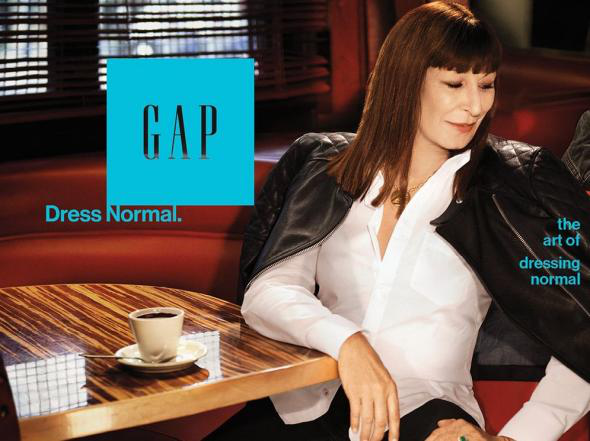

The retailer launched a global, celebrity-filled “Dress Normal” brand positioning, created by ad agency Wieden+Kennedy in August. The aim was to promote a more coherent brand globally and to claw back sales lost to rivals such as H&M and Uniqlo. The advertising campaign—which ran across TV, print, social, digital and in-store—featured celebrities including Elisabeth Moss, Michael K. Williams and Anjelica Huston “dressing normally” and encouraged viewers to make their “actions speak louder than clothes.”

“Dress Normal” was a big gamble. In general, fashion brands seek to be “aspirational,” meaning they present their customers with a fantasy of what they could be like—if only they would buy the brand’s clothes. “Dress Normal” seems to be the opposite of that, and its ineffectiveness on sales will reconfirm the “aspirational” rule for other fashion advertisers. Here is an example:

Gap

In a press release Gap described the campaign as a “rallying cry to be confident in who we are by dressing how we’re most comfortable.”

But the new positioning didn’t receive a warm reception. Janney Capital Markets analyst wrote in a note reported by BuzzFeed:

“The look and feel [of the Gap’s fall season] is minimalist and androgynous and supported by an ad campaign of ‘Dress Normal…While intended to be provocative and ironic, we believe the fall floor set may be, in a word, too ‘normal.’”

Jezebel described the campaign as “blah,” and quoted other analysts saying Gap had “missed the mark” by jumping on the “normcore” bandwagon.

Gap’s new CEO Art Peck was forced to defend the campaign earlier this month, telling BuzzFeed it was a “work in progress” and that it will still live on through 2015, despite the criticism.

The campaign will also continue despite the loss of two senior marketing executives responsible for the advertising push.

This week AdAge reported Gap’s global CMO Seth Farbman will be leaving the company early next year. The announcement of his departure came just two months after Apple hired Gap’s number two marketer Marcela Aguila, a move that was thought to be related to the launch of the Apple Watch wearable device.

Gap

The weak results of the Gap retail brand in November were, however, propped up by the other brands the Gap group owns. Old Navy reported an 18 percent increase in sales (versus a 3 percent uplift last year), while Banana Republic posted a 2 percent uplift (compared with a 1 percent increase in 2013.)

In Gap’s most recent quarter, Q3, the company reported a 0.1 percent drop in net sales to $3.97 billion.

See also: Don’t Expect Discounts At Gap This Fall