This article originally appeared in Business Insider.

Carl Icahn has lost $200 million on Netflix stock since Wednesday, when the company’s stock plunged 27 percent in after-hour trading.

It all fell apart when Netflix reported subscriber growth in its third-quarter earnings report that was lower than expected. Then it cut its growth expectations for the fourth quarter.

It didn’t help either that HBO chose Wednesday to announce that it would launch a streaming-only content service by next year.

Icahn owns almost 1.8 million shares of Netflix, according to government filings dating back to June 30.

This could all be much worse for Icahn. He sold off a lot of Netflix stock last October, making $647 million and cutting his stake in half.

“It’s sort of an Icahn rule,” he said in an interview after the sale, “when you make 5x your money, it doesn’t mean you’re not a long termer … you take some chips off the table … The model of Netflix is an excellent one and it’s very hard to compete … it took me 20 minutes to say, this is going to be one of greats of all time.”

Icahn isn’t the largest holder of the stock, either. That’s Coatue Management, a hedge fund helmed by Philippe Laffont. Coatue holds over two million shares of Netflix.

Netflix added two million international subscribers vs. expectations of 2.36 million and 975,000 domestic streaming subscriptions vs. expectations of 1.33 million.

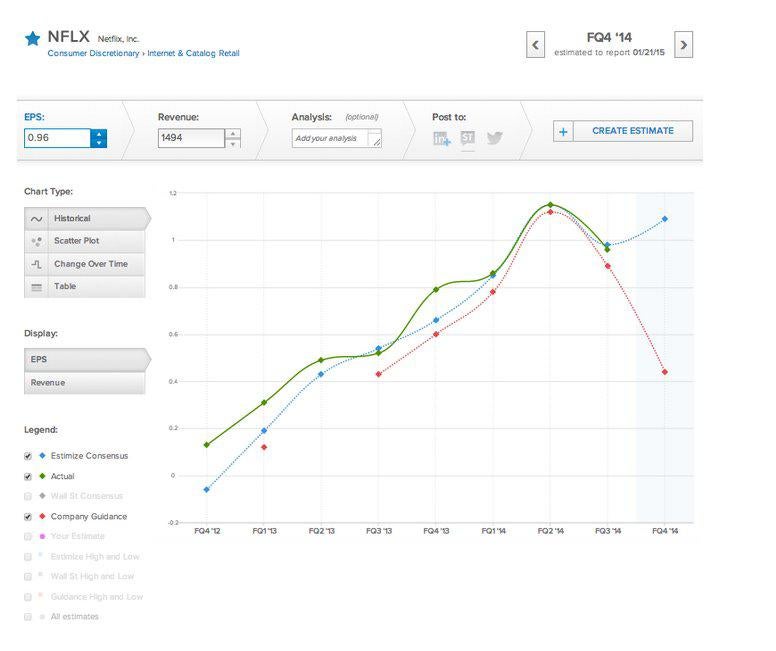

In the chart below, you can see how Netflix’s new estimation of subscriber growth for the next quarter diverges even farther from the rest of Wall Street’s estimates (from Estimize).

The company’s guidance looks as if it’s falling off a cliff.

Estimize

Hastings told CNBC’s Julie Boostein that he believed the decline in subscriber growth was due to a $1 price increase back in May.

“Our best sense is it’s an effect of our price increase back in May,” Hastings said. “With a little bit higher prices, you get a little bit fewer subscribers. So that’s our sense of it. But we can’t be 100 percent sure. We had so much benefit from Orange in Q2 and the early Q3, but that’s what we think.”

Hastings said that the news about HBO was “exciting” and that though it would be a big competitor for the long term, customers would most likely subscribe to both HBO and Netflix. HBO’s price point for its service has not been announced.

Either way, it’s important to keep in mind that HBO is bigger internationally than Netflix. Netflix has 53 million members worldwide to HBO’s 120 million.

That’s a part of the story that could have investors spooked for a while.

See also: Netflix is Getting Totaled