This post originally appeared in Business Insider.

Two academics from the University of Virgina got a hold of the trading records of SEC employees—then they built a mock hedge fund to see how it would do. The results are all in a paper presented at UVA’s Darden School of Business.

The academics, Emory University professor Shivaram Rajgopal and Georgia State University accounting Ph.D. candidate Roger M. White found that SEC employees tend to sell a company’s stock before the SEC takes enforcement action against the company.

The result, they wrote, were abnormal returns of about 4 percent for the market in general, and about 8.5 percent for the U.S. stock market. That’s significant. While an SEC employees’ stock purchases are normal, their stock “sales appear to systematically dodge the revelation of bad news in the future,” according to the paper’s findings.

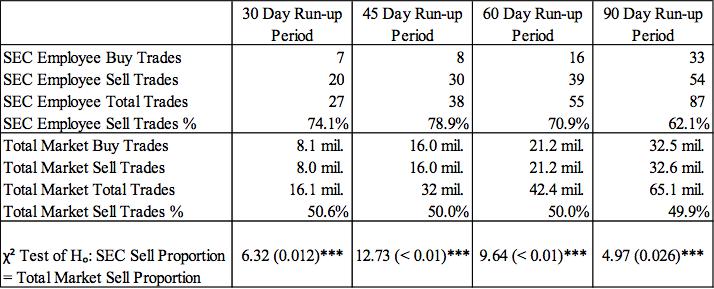

Check out the table below. It shows that 60 days before an enforcement action, when the market is selling at a rate of about 50 percent, SEC employees are selling at a rate of 71 percent. The SEC employee rate of sales increases as the enforcement action approaches, while the wider market’s pretty much stays the same.

Shivaram Rajgopal/Roger M. White

Rajgopal and White specifically found a high volume of SEC employee sales from 2010 to 2011 before enforcement action in Bank of America, General Electric, Citigroup, Johnson and Johnson, and JP Morgan.

This information was obtained through the Freedom of Information Act, and the identities of specific SEC employees that traded on this information is unknown. In fact, this kind of information wasn’t even recorded until 2009, when a new rule required SEC employees to get clearance from an ethics committee before stock trades.

In a statement to the Washington Post, the SEC said that this can all be explained. Before an employee works on a case, they must divest themselves from any interest in the company. So it makes sense that employees sell their stock in a company before enforcement action. It just happens to also be profitable.