This article originally appeared in Vulture.

On February 5, 2011, New York City’s LCD Soundsystem announced its extravagant farewell. On April 2 of that same year, the indie collective said that it would play its final show at the highest heights of Big Apple performances: Madison Square Garden. Presale tickets were available in person at Mercury Lounge and through Ticketmaster and Bowery Presents—but only a select few fans got them. “1500 for a single ticket? Fuck you, scalpers. You are parasites. I HATE you,” tweeted the band’s official account the next day.

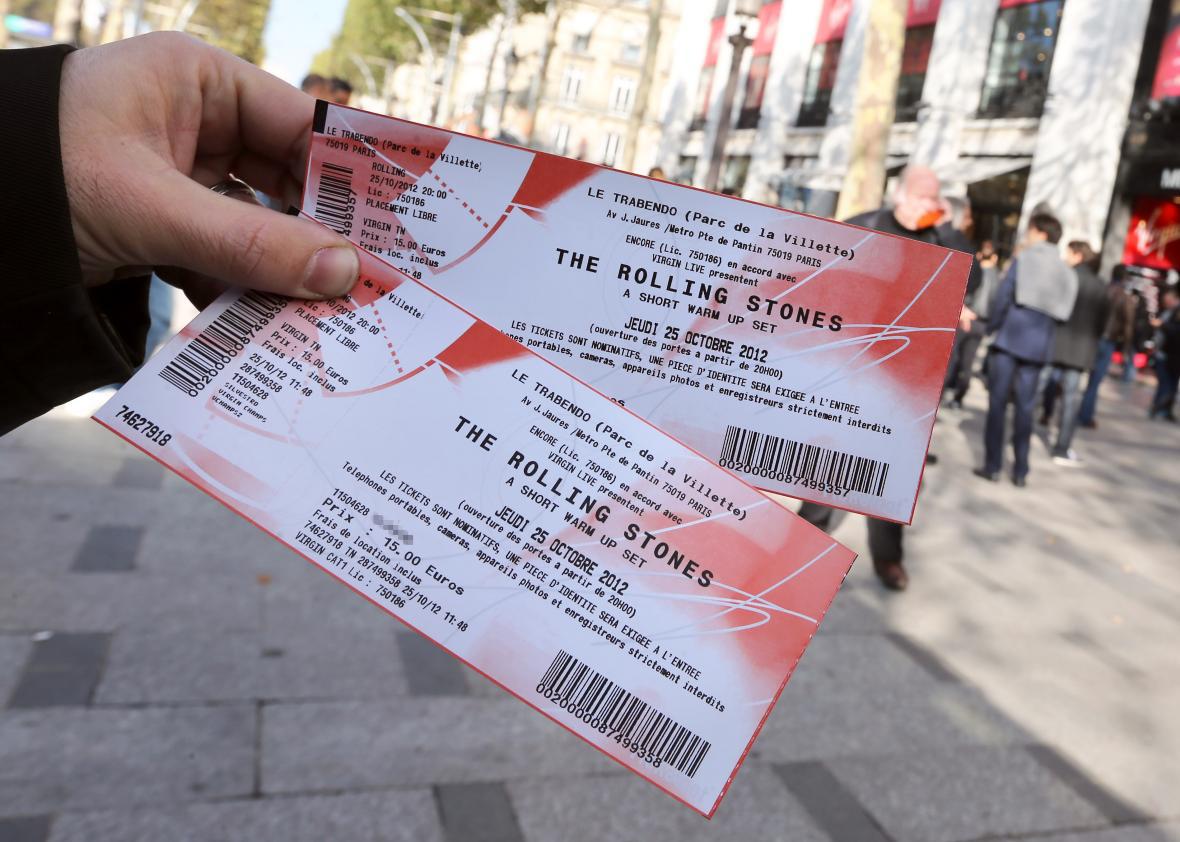

The general tickets became available three days later. They were instantly snatched up and were being resold on the secondary market at a staggering $350,000 a ticket. LCD Soundsystem front man James Murphy was understandably upset, unleashing a diatribe on the band’s blog with a post titled “Fuck You, Scalpers.” He vented about the unfairness of it all, how he and his bandmates weren’t even able to get tickets to their own show when they tried. And as a solution, he wrote that “OBVIOUSLY we’re going to look seriously at the way we sell these tickets.” They announced four more shows at Terminal 5, a much smaller venue, as a way to make it up to the fans, slinging potshots at scalpers, referring to an invisible “they” as “you fucking fuck” and “shitbags.” Concertgoers were required to show an ID and credit card for entry each night of the show when picking up tickets from will call.

LCD Soundsystem reunited much earlier than anyone expected, playing a circuit of headlining festival shows in 2016. Everything seemed neatly arranged for the group: They got top billing at Coachella and Bonnaroo, but were met with criticism that the reunion was a cash grab after milking fans just five years prior with the promise of a finite conclusion. The band persevered, criticism be damned. There were no ticketing fiascoes at the festivals—in fact, everything went smoothly right up until this March, when they announced a headlining residency of five shows to open Bowery Presents’ new venue Brooklyn Steel, an 1,800-capacity concert hall in Williamsburg. Tickets went on sale for $59.50 via AXS, on March 30 at noon, for the April 6 to 11 run. They sold out instantly, and eight minutes later, were on StubHub for up to $315. By the day of the first show, a pair were listed at $1,074.60 on the reselling platform.

“LCD tickets on stubhub are speculative and almost certainly bullshit, DO NOT BUY THEM. E-tickets aren’t even released until day of shows,”tweeted an angry Al Doyle, a member of LCD Soundsystem. He continued: “Basically over 30,000 people tried to buy tickets all at once; we’re scrubbing every purchase to make sure they’re authentic. #lcd.” A few days later: “Re. lcd shows; very few tix went to bots; just many more people wanted tickets than were available. Don’t pay stupid money on secondary sites. We’ll play shows in NYC again. It’s not the last chopper out of Saigon.” (LCD Soundsystem did not respond to numerous requests for comment.)

It’s tall talk from a band that ramped up demand just five years earlier by going through the motions of saying good-bye, only to return and face tangential ticketing problems years later. It also raises the same questions that have persisted for decades, far before LCD even formed: Why do bands, in 2017, have to comb through their own tickets sold to determine their legitimacy? What sort of initiatives are taken on the state and federal level to prevent both legal and illegal behavior that precludes actual fans from buying tickets? What good are those initiatives? Does the artist have any responsibility in this? Who is really to blame for the vast web of problems in the ticketing industry?

When a band like LCD Soundsystem decides to go on tour or stage a residency, a promoter such as Live Nation or Bowery Presents works with them to help determine where they’ll play and how tickets will be priced and distributed, often through holds for industry insiders and presale programs for companies like American Express. This is where the majority of tickets are sold, and on average, 46 percent of tickets remain for the general public. The venue itself—Madison Square Garden or Brooklyn Steel or the like—gets a piece of the fees tacked on to ticket sales, while the vendors—Ticketmaster, Ticketfly, AXS—act as the primary market, making their money from service and convenience fees for an annual value of $25 billion. These primary ticketing companies often allow, and even encourage, users to resell tickets, sometimes on their own platforms.

It’s here where the chain breaks and crosses over into the secondary market—reportedly valued at $8 billion—where companies like eBay’s StubHub and Live Nation’s TicketsNow allow users to resell tickets at prices as determined by the seller. In the first 24 hours after tickets go on sale, an estimated 20 percent appear on secondary sites. This is often where tickets end up when scalpers and brokers use methods like creating bots to bypass captcha technology and scoop up a large number of tickets, or by creating numerous identities and buying tickets on prepaid credit cards that can be loaded up with cash at a local CVS or Rite Aid to take advantage of paperless ticketing. They make a profit by engaging in price gouging, selling the ticket for much higher than face value, and gaining an upper hand on the real fans.

In the end, the promoter risks getting screwed out of money that scalpers get with price inflation, artists get screwed out of providing an ideal concert experience and, most of all, fans get screwed by an unfair market.

“It feels like an injustice. It’s the sense of, ‘I don’t know who’s screwing me, but I feel screwed,’” says David Marcus, EVP of Music at Live Nation. “How do we make sure that the primary industry recaptures that value? Because that’s where the art is being created, that’s where the business is being taken, that’s where the fans are. The extent that there’s $8 billion in activity in a secondary marketplace? Shame on us. That’s the primary industry’s weakness and inefficiency and failure to do what we can do for artists and fans.”

To the primary market’s credit, some successful initiatives have been taken over the years to curtail this sort of behavior, making it more difficult for scalpers to use traditional methods to cut in line. In March, Live Nation and Ticketmaster announced their verified fan presale technology where fans can register ahead of sale dates by providing personal information that’s vetted by the companies. Fans then receive a code that allows them to purchase tickets and beat the scalpers at their own game. To date, more than one million users have registered for verified fan services.

So far, it’s been effective. In addition to partnering with acts like the 1975 and Ed Sheeran, Live Nation/Ticketmaster most recently worked with Twenty One Pilots for five homecoming dates in Columbus, Ohio, taking place at venues of varying size between June 20 and 25. All of them sold out. The spillover to the secondary market was almost nonexistent by industry standards. There are zero tickets available for the first three shows on StubHub, and, according to Live Nation/Ticketmaster, the subsequent pair of shows had resale on the secondary market at a rate of 4.1 percent and 3.7 percent. As of this article’s publication, available options were hovering around 350 tickets per show at arenas that seat up to 18,500 patrons.

By using the verified fan program, the company has reduced scalping on the secondary market by 90 percent, says Marcus. That leftover percentage is something that artists and the industry have to simply accept as unavoidable. “Some of this will never be able to be improved on,” says Chris Woltman, manager of Twenty One Pilots. Up until they partnered with Live Nation/Ticketmaster, their methods for combating scalpers and bots were “limited,” but as their fan base surged, they decided to use the available technology to improve fan experience. “It’s about putting as many real fans into these venues and have them not have to pay overinflated prices. We’re gonna fight hard to keep that going,” Woltman says.

Songkick, which began as a concert-discovery platform and now sells tickets on presale, says that it was the first to implement technology to limit the number of scalpers taking advantage of the system. The company, which operates in 61 countries, has worked with artists like Metallica and Red Hot Chili Peppers to prevent tickets from ending up on the secondary market, estimating that tickets are four times less likely to end up on secondaries and more than $50 million has been saved in what would normally be included in scalper markups.

Most recently, Songkick worked with Adele for a ticket percentage of her 2016 overseas tour as well as the four-night conclusion at London’s Wembley Stadium this year, when they sold two-thirds of the overall house. Fans had to sign up on Adele’s official site in order to gain access to the Songkick presale; the company determined that one out of every five entries were likely registered by scalpers. The result: Less than 2 percent of tickets for the Wembley shows ended up on the secondary market, whereas the industry average hovers around 20 percent.

“The proof is in the numbers,” says Matt Jones, CEO of Songkick. “I don’t think anyone else has got anywhere near where we have with those numbers … Obviously, nothing’s a perfect system. It’s only been out on the market for a couple of years. So for us, we’re constantly refining it. We’ll continue to make that better but I think this idea of artists selling direct through their own channels is ultimately going to yield better results.”

Jack Johnson, the breezy singer-songwriter who tours every few years, partnered with Songkick for presale on his upcoming summer trek. As with verified fan, Songkick scaled back sales on the secondary market to 1.5 percent of all tickets sold. Josh Nicotra, GM of Johnson’s Brushfire Records since 2005, says that they’ve taken a number of steps over the years to double down on scalping, from creating general-admission pits at venues in lieu of ticketed seating to remove the incentive for scalping of premium seats, to rolling out batches of tickets across various sale windows to allow fans of different income levels to purchase at a salient price point.

“I got positive feedback on how recent presales had gone with Songkick and saw that when Adele put on her fan presale, only a small percentage made its way onto the secondary market,” says Nicotra. Still, he echoes the sentiment that the prospect of a balanced ticketing system isn’t an immediately achievable prospect. “It’s not airtight, it’s not a perfect seal … Something like doing a presale with a company like Songkick isn’t going to fix the entire problem. But it is an effort to do whatever we can to face the realities to do everything that is feasible to get those tickets into [fans’] hands first.”

If this all sounds overwhelmingly press-release driven and positive, that’s because it is. Ticketing companies want the public to know that their system is working. Right now, it does work, with little margin of error, at least on the presale front. What it takes, though, is an artist who’s willing to keep their fans’ interests in mind. Some industry insiders interviewed for this story suggested that many artists don’t care who buys the ticket, so long as it’s sold. The turnaround on the secondary market, and the uptick in pricing, is of no consequence to them if there’s a sellout on the primaries. There have also been whispers in the industry that some artists will pull inventory from the primary market to sell on the secondary market in order to boost tour income. It’s the ultimate fan betrayal, taking place right in front of the fans’ eyes.

Since the aforementioned technology is relatively new, some artists who do consider this a serious problem have taken matters into their own hands. As album sales decline, musicians often make the bulk of their income through touring and merchandising. One of the most vocal has been country titan Eric Church, an arena act who, in February, canceled 25,000 tickets for his 60-city spring tour in order to combat scalpers and treat fans to a show they could afford. He’s taking the LCD Soundsystem approach of combing through lists of ticket buyers and determine if they’re legitimate or not.

“We run it through our system and have some of the flags,” says Fielding Logan of Q Prime, which manages Church and the Black Keys. “The system identifies some of the suspicious behavior and then we have to go through in a pretty laborious process with common sense and gut instinct to basically highlight the orders, the people who are buying tickets [to] resell them. We don’t care if you observed the six-limit ticket on the show. If we have evidence that you’re a ticket scalper, we take you down to zero.”

Some critics have speculated that the accidental cancellation of actual fan-purchased tickets could result in lawsuits. “But,” says Logan, “Eric aims to be a big pain point for scalpers so next time around, when scalpers go to some [artists like] Justin Bieber or Luke Bryan who don’t care quite as much about the issue, [scalpers] know that if they go and buy Eric Church tickets, it’s not worth it.”

Then comes the responsibility of the secondary market, and what sort of stake they have in the reselling process. For them, profit is made similarly to how the primary market makes its income: through fees. The general stance across the entire industry is that reselling tickets should be encouraged between fans only, with regulation in place to ensure that the ticket was legitimately purchased. But weeding out the scalpers takes substantial measures and, like on the primary market, the success rate isn’t always perfect.

StubHub, arguably the biggest contender on the resale market, is clear about how it does business. In the fourth quarter of 2016, 1.3 tickets were sold per second on the site. Gross merchandise value for the last year stood at $4.3 billion, while revenue itself came in at $0.9 billion. During a conversation with Laura Dooley, who handles the company’s public policy, she explained that StubHub works to verify the quality of sellers and inventory on the site, conducting regular security checks on sellers by scanning their profiles against criminal databases to confirm no prior misconduct and, in some cases, holding onto money from buyer to seller until after the event to legitimize the authenticity of the ticket.

A prevalent issue in the ticketing industry is speculative tickets—as mentioned by LCD Soundsystem’s Doyle in his Twitter tirade—referring to the phantom tickets that scalpers put on sale prior to public sale in hopes that they can secure a ticket that’s cheaper and better once they’re actually made public. StubHub is aware of the practice and says that while in its user agreement speculative ticketing is prohibited, it’s difficult to determine if the ticket is in fact speculative or from a presale for fan clubs or credit-card companies. What they don’t meddle in is the pricing of tickets sold on their platform.

In essence, StubHub carries the same perspective on price gouging and regulation as many others from the industry interviewed for this story. “StubHub has very little if not nothing to do with setting the prices of the inventory that you see on our site,” says Dooley. “The prices are set and controlled by third-party sellers. It’s an open market, it’s a free market, we let the sellers price their tickets at the rate they think they can get, and I think what you’ll often find is that there are outliers in this process.” A lot of times, she says, it’s self-regulating. “What we find is that tickets will be priced at a full range, but there’s only a certain market rate that’s really selling to the public, and it has a way of working itself out.” That, of course, is based on the seller adjusting the price based on the proximity to the actual show date combined with demand for the ticket.

So where does the government, both state and federal, stand in all of this? Regulation has been a hot-button issue for decades. Many states have their own laws, none tougher than New York’s, which has the most aggressive constituents and leaders pushing legislation to ensure a fairer marketplace. As far back as 1922, Governor Nathan Miller signed an anti-scalping law for what he saw as “gross profiteering” in the industry. Resale was capped at $2 above face value and eventually up to 20 to 45 percent, remaining in place for roughly 70 years—up until the New York attorney general issued a report in 1999 determining that underground brokers were breaking the law left and right. By 2007, New York decriminalized resale of tickets for profit and instead focused on regulating the industry through a licensed system. Three years later, the law was altered to ban the use of bots, mandate “reasonable” service fees on the primary market, and bar the use of non-transferable paperless tickets.

In January 2016, the New York attorney general’s office released an extraordinary ticket-sales report that breaks down just how unregulated the ticketing market currently is. Through voluntary means and the use of subpoenas, the attorney general ascertained that between 14 popular shows staged by artists like Justin Bieber, Kanye West, and Keith Urban, 20 percent of tickets were held upfront for insiders. Ten shows—Jay Z & Justin Timberlake, Steely Dan, Fleetwood Mac, and more—reserved over 50 percent of tickets for presales, none earmarked for fan clubs. The use of bots was overwhelming. For U2’s 2015 MSG show, one bot purchased 1,012 tickets in one minute; another scooped up 520 tickets in three minutes for Beyoncé’s August 2013 show at Barclays Center; and one bot collected 522 tickets in five minutes for One Direction’s June 2013 show at Jones Beach.

“My office’s report was one of the most exhaustive examinations of why it’s so difficult for ordinary fans to find tickets,” Attorney General Eric Schneiderman said in a written statement to Vulture. “Our work—including the report, the new legislation passed at my urging to crackdown on bots, and my office’s millions of dollars in settlements and ongoing investigations—are informed by in-depth investigative work and direct consultation with the ticketing industry, artists, and others. As a result, prosecutors have—for the first time—the tools to begin to keep up with the pervasive bad actors who take advantage of consumers. The major industry players themselves will have to step up and take a more active role if they are serious about transforming this rigged system.”

The use of bots is just one of the most glaring problems, according to reps from the New York attorney general’s office. They also point to price floors, where resellers might not be able to sell lower than face value if the demand calls for it, as well as delayed delivery of PDF tickets on resale platforms. In November, almost a year after the report was issued, New York made strides in regulation in response to the report. Governor Andrew Cuomo signed legislation to create new civil penalties for anyone who uses bots to game the system, which would be prosecuted as a misdemeanor with a fine of up to $1,000 or double the resale value, as well as up to a year in prison. The order took effect in February, and although there haven’t been any prosecutions, reps for the AG’s office emphasized that there are sensitive ongoing investigations that they could not discuss in detail.

Beyond the state level, one of President Barack Obama’s final flicks of the pen came on December 14, 2016, when he approved the Bots Act (or the Better Online Ticket Sales Act), first introduced on July 13 of that year by Senator Jerry Moran of Kansas. It prohibited “unfair and deceptive acts and practices relating to circumvention of ticket access control measures,” offering criminal penalties under the Federal Trade Commission Act. It’s the first time the use of bots has been regulated on the federal level, and a momentous step forward for the ticketing industry, pending its enforcement. (No one interviewed for this story could confirm that action on the federal level has taken place.)

Why, then, with all these measures in place, do fans still get edged out? One insider claimed that it was because AEG’s AXS, which handled ticketing for the LCD Soundsystem shows, employs an antiquated system that simply couldn’t handle the volume of users. (AXS did not respond to numerous phone calls and email messages requesting comment.) And in the end, Al Doyle claimed that it wasn’t bots after all, but simply the influx of fans trying to snatch up tickets at once. It makes sense.

It’s situations like these that lead industry insiders to wonder if there are other alternatives that could improve the fan experience. “Transparency” was a word that came up several times while reporting this story—which would include letting fans know how many tickets are being allotted for presales, industry holds, and public sales; who exactly is reselling your ticket; what the original price of the resold ticket was before you actually purchased it; why tickets are priced the way they are; and what those pesky fees mean. Today, it feels like everyone has a story about how they hit refresh until the second tickets went on sale, only to get stuck in digital waiting rooms and timed out, or how they bit the bullet and paid three times face value on the secondary market so they could get into a show. It’s unfair, and unfortunately, it’s still fact.

See also: The Music Industry Finally Had a Good Year in 2016 Thanks to Streaming and Drake