To feel good again, the world’s financial elite need a growth catalyst like the Internet. America’s shale gas revolution fits the bill. Ask delegates at the World Economic Forum in Davos for their 2013 outlook, and that simple idea features in most answers. It may only surface as a passing reference in conversations around the Swiss ski resort. But in the echo chamber of Davos, the notion that shale gas is a reason to be bullish has become common wisdom.

The argument is familiar. As fracking – the technique to extract gas from shale – takes off, that benefits satellite businesses that serve the industry. That stimulates the broader economy. What’s more, shale lowers energy costs, benefiting American industry by lowering expenses. Factor in a healthier housing market, and you have the makings of a durable recovery in a region accounting for about a quarter of the global economy.

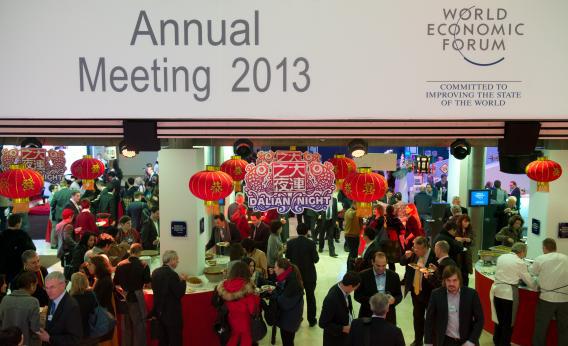

In one form or another, this thesis is being touted by corporate executives, bank bosses and politicians navigating the icy byways of this mountain village. It’s easy to see why. This year, the WEF takes place when the world is more composed than it has been for ages – the acute phase of the sovereign debt crisis is past, yet there is no exuberance either. Masters of the universe feel things are looking up, but they’re mindful of latent risks.

Shale supplies grounds for reasoned optimism. Lower energy prices thanks to abundant natural gas in the United States saved $107 billion, or $926 per household, last year, according to research by IHS. The boom has created 1.7 million jobs already.

But it’s a big leap from this to believe shale will lead a global recovery. Shale is still a small element of the overall U.S. economy. The U.S. oil and gas sector is only 1 percent of GDP, according to Credit Suisse. While it brings advantages, it is more of a mini stimulus than a saving grace, which would require the side effects of shale to be both large and entirely positive. In reality, only a handful of industries – like petrochemicals or fertiliser – will enjoy game-changing benefits.

Then again, maybe the details of the shale thesis aren’t so important. The assurance expressed among business leaders and their entourages in Davos may be misplaced. But confidence, even one derived from gas, can be self-perpetuating. Let them keep believing.

Read more at Reuters Breakingviews.