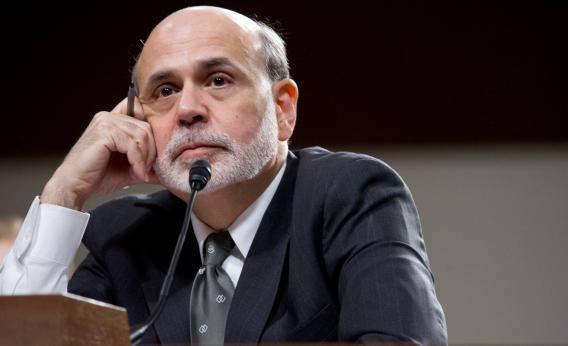

Not for the first time, there are double standards on display in the U.S. Senate. During Federal Reserve Chairman Ben Bernanke’s testimony on Tuesday, lawmakers loudly denounced bank skullduggery to fix Libor rates. Then came demands for Fed action to create U.S. jobs. The latter is at least clearly legal, but it’s still manipulation - and it has far more potential to damage markets for the long term.

Barclays traders’ false London Interbank Offered Rate quotes represented both profit-maximization by traders and institutional attempts to improve the market perception of Barclays by lowering one proxy for its cost of funds. The senators missed this distinction. It matters because the second rationale for dodgy Libor quotes, condoned by UK authorities by some accounts, is a step toward the policy intervention some senators are so keen on.

And it is consistent with the deliberate manipulation that central bankers in the United States, the UK and elsewhere have been undertaking since the crisis erupted, if not before. This has involved many tactics, from direct purchases of government and mortgage bonds by the Fed, to simply maintaining short-term interest rates near zero, far below the level of inflation, as Bernanke’s Fed has done. On Tuesday he seemed ready to try more such interventions if U.S. economic growth remains weak.

While Libor ostensibly governs aspects of $500 trillion or more of derivatives contracts, it has proved hard so far to identify major market consequences of the false quotes submitted - though they could emerge. Action by central banks like the Fed, by contrast, has artificially reduced borrowing rates for governments including the United States that owe trillions of dollars and pushed down the cost of U.S. mortgages, for example. At the same time it has made safe returns hard to come by for pension funds and other investors. It’s no coincidence that S&P Dow Jones Indices reckons companies in the S&P 500 Index face record underfunding of their pensions and other retirement benefits.

These consequences, extending over the whole economy for several years, surely far exceed the impact of a few spivvy Libor traders. The argument for Fed intervention carried weight for many in the heat of the crisis. But to help the economy return to a healthier, less distorted state, the senators would now do well to complain as vigorously about further official market rigging as they do about the unofficial variety.

Read more at Reuters Breakingviews.