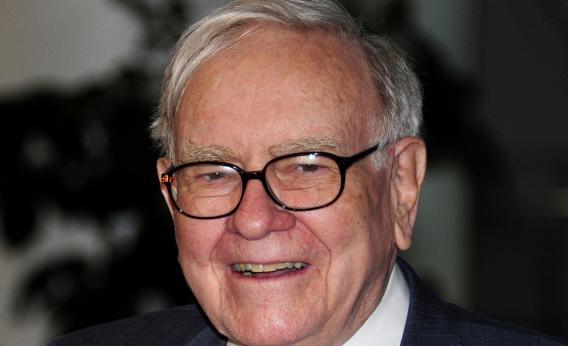

This year’s Woodstock of Capitalism could turn into the revenge of the nerds. For the first time in the history of the closely watched annual gathering of Berkshire Hathaway shareholders, financial analysts have been invited to pepper Warren Buffett with questions in front of the 35,000 or so who will gather for the event. It’s the latest sign that times may be a-changin’ for the company.

The presence of spreadsheet-wielding Cliff Gallant of Keefe, Bruyette & Woods, Jay Gelb of Barclays Capital and Gary Ransom of Dowling & Partners won’t necessarily make the event any less festive or overly pointy-headed. But their addition to the trio of business journalists regularly brought in to pose questions should at least subtly reorient the meeting in a welcome way from the Oracle and his longtime right-hand man Charlie Munger to the nitty-gritty of the sprawling $200 billion conglomerate.

Berkshire has come a long way since the two octogenarians teamed up to create one of the most successful investment companies in the world. Their insights are still highly sought after at the Omaha powwows. But Berkshire has become much more than a glorified mutual fund. Big ticket purchases like railroad Burlington Northern and chemical manufacturer Lubrizol underscore the shift. As far as returns go, earnings from operations will increasingly become more relevant than stock picks.

Buffett’s recent diagnosis of prostate cancer, though it looks manageable, is also a reminder that he and his homespun touch won’t be around forever. So it’s not a bad idea to bring in the pocket-protector set to hopefully grill the Berkshire boss on some of the particulars that can get overlooked in the quest for his views on topics as wide-ranging as how to parent rich kids. It’s even more true now that the company’s book value has become so incredibly difficult to estimate - and can trigger future stock buybacks.

It could make for a slightly more sober affair. That may be a relief to some shareholders, especially after last year’s insider trading scandal involving potential Buffett successor David Sokol tainted the affair. Even the Woodstock generation eventually had to grow up.

Read more at Reuters Breakingviews.