Money supply is rising fast, so where is the inflation? U.S. consumer prices rose 0.4 percent in February, but that was mostly gasoline. Year-on-year, inflation is above the Fed’s 2 percent target but not by much. Yet money supply is going through the roof. Either inflation is on the way, or Milton Friedman should lose his Nobel prize.

Friedman argued that “inflation is always and everywhere a monetary phenomenon.” He proposed that central banks should increase money supply at a constant annual rate, ignoring economic cycles, so as to minimize self-reinforcing bouts of inflation and deflation.

What has happened in recent years is a long way from Friedman’s recommendation. Broad money supply, whether by the so-called M2 measure or the St. Louis Fed’s money of zero maturity - a proxy for the M3 metric - is up almost 10 percent over the past year, while the adjusted monetary base, a narrower measure of money, is up over 18 percent. Friedman’s idea was that the money supply should increase at the same rate as real GDP. Other things being equal, the implication of money supply rising at 10 percent while real GDP has expanded less than 2 percent over the past year is that inflation should be running at more than 8 percent.

The relationship can be delayed. For instance, U.S. monetary policy became unusually expansive around 1965, whereas inflation did not hit 5 percent a year until 1969 and only topped 10 percent in 1974. The so-called velocity of money, essentially the pace at which each dollar is spent and recycled, is also a factor. The 2008 crash and the subsequent deleveraging process may have subdued velocity.

Nevertheless, assuming as recent data suggest that the U.S. economy is now recovering from the 2008 shock, velocity should rise to more normal levels. Applying Friedman’s theories, that in turn could bring a rapid acceleration of inflation.

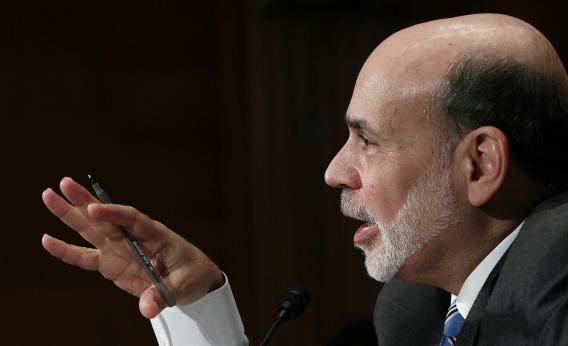

Meanwhile, Federal Reserve Chairman Ben Bernanke and most of his colleagues believe that inflation will remain muted, justifying near-zero interest rates until late 2014. If Bernanke proves right, he’ll look smarter than the 1976 Nobel Committee.

Read more at Reuters Breakingviews.