Less than 24 hours before passing its tax overhaul through the House, the GOP revised the legislation to include a paid family leave tax credit. Why aren’t paid leave advocates celebrating?

The tax credit would return a small percentage of every employee’s wages to any company offering at least two weeks of paid leave to their employees through their annual tax return. This incentive would expire after two years.

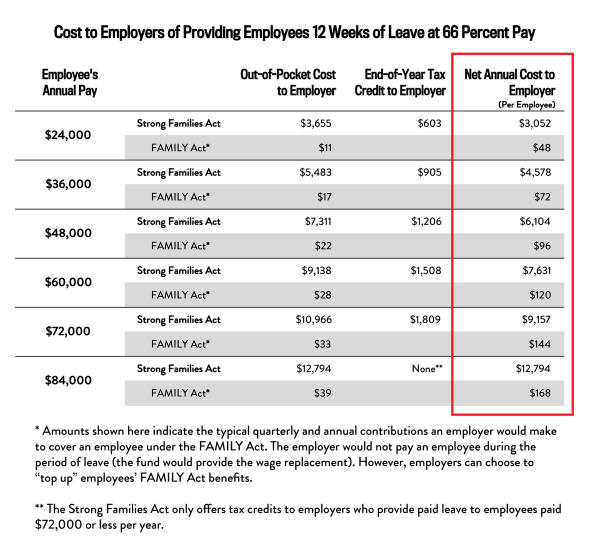

Vicki Shabo, vice president for workplace policies and strategies at the National Partnership for Women & Families, says that this bill is only a drop in the bucket of support to businesses already taking the lead on this issue. The provision provides “a very small tax credit to businesses that voluntarily provide at least a minimal level, two weeks, of paid family or medical leave,” said Shabo. “What that practically means is a very small amount of money, 12.5 percent to 25 percent of the employee’s wages, at the end of the year as a tax return for too little time off.”

Shabo thinks this incentive is destined to fail for many reasons even if it makes it through the Senate and the Senate passes the bill: Tax credits designed to promote social policy are strategies that haven’t shown results in the past; the amount of money returned is too small for small businesses to enact new policies; the incentive expires after two years.

Ellen Bravo, an expert on paid leave and co–executive director of Family Values @ Work, agrees. Bravo believes this tax cut is too small for even big businesses to take up within the two-year time limit. Bravo argues the tax legislation will ultimately be detrimental to efforts to pass paid leave legislation at the federal level. At its best it will affect paid leave policy for just a handful of organizations at a high cost to taxpayers, and at its worst the incentive will function as a tax giveaway to big corporations simply for maintaining that status quo. Bravo says that even conservatives agree tax cuts like these would not benefit the people who need it most: small businesses and working families.

“That is why we are wary of taking a step in the wrong direction,” added Bravo, “It would be a travesty for people to think that they could check off a box on paid leave and then leave the majority of American people behind.”

Bravo believes the insertion of the cut was a last-ditch attempt at making the bill seem good for working families and not just for the wealthy: “If politicians are under the gun for a tax bill that clearly is giving huge tax breaks to the most powerful and the wealthiest and not doing enough for small businesses, families, and everyday Americans, they have to include something that makes them look better, and there are politicians looking for window dressings, because they know paid leave is popular, and this tax bill is not popular overall.”

Shabo, however, saw the cut as a good sign for the direction of the national conversation on paid leave: “The fact that this issue is being addressed in Republican written legislation is certainly a milestone in the recognition that America needs to solve its paid leave crisis.” America is the only developed country without even national paid maternity leave guaranteed. Shabo’s organization, the National Partnership for Women & Families, drafted and fought to pass the 1993 Family and Medical Leave Act, which guarantees unpaid leave to many American workers, and it is excited about the real conversations gaining traction on paid leave policies across party lines.

According to both Shabo and Bravo, lawmakers should use the national interest in paid leave as a catalyst to revisit the research on paid leave and look to states that have passed bills with bipartisan support as evidence this could work.

“States are paving the way to a national solution,” Bravo remarks. Washington state recently passed a comprehensive bipartisan paid family leave policy and brought multiple community stakeholders together to pass one of the most generous paid family leave bills in the United States. People employed in Washington are guaranteed 12 weeks of paid leave funded through weekly paycheck contributions by both the employer and employee.

Shabo thinks paid leave legislation at the federal level still stands a chance: “If people could take off their ideological hats, comprehensive and inclusive paid family leave should absolutely be a reality.”