This is the first article in a special Slate series, “The Next Silicon Valley.”

Tech pundits love to place bets on where the “next Silicon Valley” might be. But to make a decent wager, first you have to consider the origins of the original. Given that life is chaotic and chance always plays a big role, I don’t think one can identify a sufficient cause for Silicon Valley. But I can cautiously discuss four necessary factors that might make another fount of innovation possible.

Factor No. 1: Easy Research Money

The history of Silicon Valley goes back far before the dawn of the personal computer in the late 1970s. It even goes back before the big semiconductor firms of the 1950s and their significant partnerships with Stanford. Silicon Valley today is almost exclusively consumer-focused, but for decades it was primarily industrially and militarily focused, and much of the work was speculative or highly specialized.

Obscure 19th-century abstract mathematics and geometry had unexpectedly paid off in Einstein’s relativity theory and then in nuclear weapons in the 1940s. So by the advent of the Cold War, the powers that be worried that anything could potentially be weaponized. The Cold War created such an atmosphere of paranoia that the U.S. government eagerly threw money at academic and technological projects of uncertain utility. Most famously, the Defense Department’s Advanced Research Projects Agency—created in response to the Soviet Sputnik launch in 1958—gave us ARPANET (beginning in 1969 or thereabouts), the robust packet-switching network that 20 years later, with some political assistance from Al Gore, became the Internet.

Two regions in particular enjoyed an influx of government money: Silicon Valley and Massachusetts’ Route 128. Both had existing technology bases, large-scale military investment, and top-class research universities (Stanford and Berkeley near Silicon Valley, MIT and Harvard near Route 128). And both yielded a tremendous amount of mid-century startups and larger firms: Hewlett-Packard, Fairchild Semiconductor, Varian Associates, and Xerox PARC in Silicon Valley, Honeywell, Raytheon, Digital Equipment Corporation, Wang, and BBN on Route 128. Government money served as a buffer against failure, while the cash flow into top engineering universities (Stanford and MIT chief among them) allowed for rapid research improvements in semiconductors and their applications in computers, radios, phones, and televisions. For the consumer, this work didn’t visibly explode until the PC revolution of the 1980s. Apple Computer could never have gotten started without work that was originally funded and intended for the military-industrial complex.

Factor No. 2: Easy Startup Money

Silicon Valley overtook Route 128 in terms of both profits and innovation in the 1980s, largely because the firms of Route 128 remained too attached to the basic research paradigm. Companies like Digital (DEC), Sun, and Symbolics methodically generated new systems (including Digital’s legendary PDP-11 minicomputer, Wang’s pioneering word processors, the LOGO programming language, and the interactive-fiction Colossal Cave text adventure). But they didn’t recombine into smaller, more agile startups that could yield more consumer-oriented products. When I interviewed at DEC in 1997, the place felt distinctly middle-aged. I met very smart engineers who had been working on a single piece of Unix for 20 years—making elegant technological advancements, but doing little that would expand their market. They were happy, but consumer “innovation” in the Silicon Valley sense was not a priority. It was little surprise that DEC was subsequently purchased and pretty much liquidated by Texas PC maker Compaq—the son slaying the father. Many of the other famed research labs of the 1970s and 1980s, from Bell Labs to BBN, fell into similar patterns. BBN had won the initial contract for the “outlandish” ARPANET proposal in 1969 and had figuratively broken the ground of the Internet, yet they were wholly absent when it came time to cash in on the foundation they had built.

Whereas in Silicon Valley, beginning sometime in the mid 1970s and exploding in the 1980s, a new breed of commercial consumer firms began to supplement and surpass the industrial firms. A company like Apple, founded in 1976, could get started far more easily because there was a looser and more enthusiastic model of investment, as well as a longstanding computer hobbyist scene far larger than that of Route 128. Steve Jobs and Steve Wozniak came out of the distinctly amateur hobbyist scene—not academia or business. They were able to migrate into the corporate and technological world while bringing hobbyists with them as both customers and employees. Plus, time was on their side: Technology had reached a point at which its applications overflowed into the consumer market.

As the government had been, venture capitalists needed to be willing to fund companies in a very speculative and hands-off manner, leaving the founders with ownership and control of the companies. (Legendary company Fairchild Semiconductor flopped as soon as the founders foolishly sold their controlling interest to investors.) The VCs also needed to accept that most of them would not prove profitable. In the words of analysts Martin Kenney and Urs von Burg, “What is important is the decision to fund businesses that have no clear and significant profitability.”* This encourages bubbles of various shapes and sizes, of which we’ve seen at least two since the 1990s. But a decade later, people remember the undervaluation of Amazon, Google, and eBay more than they remember the overvaluation of Pets.com, 1-800-Flowers, and pretty much everyone else. You have to fund a lot of sperm just to get one or two to the egg.

Factor No. 3: Mobility

In startups and even larger Silicon Valley firms, it was expected that people would move around a lot; staying at a job for more than five years could look bad on a résumé. That liquidity allows for greater recombination of ideas, but also makes it far easier for dead-end startups and companies to fail that much faster, as their top talent leaves for other places. There was a large exodus from Microsoft to Google in the early part of the 2000s, which angered Steve Ballmer enough that he threw a chair at one employee who was jumping ship. This mobility encouraged the much-vaunted but oft-foiled “creative destruction,” economist Joseph Schumpeter’s term for the increased innovation caused by letting bad companies and ideas fail as quickly as possible. In our age of lemon socialism, creative destruction among large corporations is increasingly rare—but the mobility of top talent in Silicon Valley encouraged it. Working for a failing company was not considered a black mark—staying at one was.

There’s another second layer to this sort of mobility, which has to do with social class. It’s a cliché to say that the West Coast is less stratified and etiquette-conscious than the East Coast, but having worked in both, I see quite a bit of truth to it. When the indigenous hobbyists of Silicon Valley entered the burgeoning technology business, there was less antsiness about culture clashes arising from hiring blatant eccentrics or people lacking in social decorum. Wozniak and Jobs had few of the credentials of many of their Silicon Valley startup brethren, and hobbyists were far from polished people (see Steven Levy’s classic 1984 book Hackers for just how unpolished). But social mores were evidently not strong enough to block access.

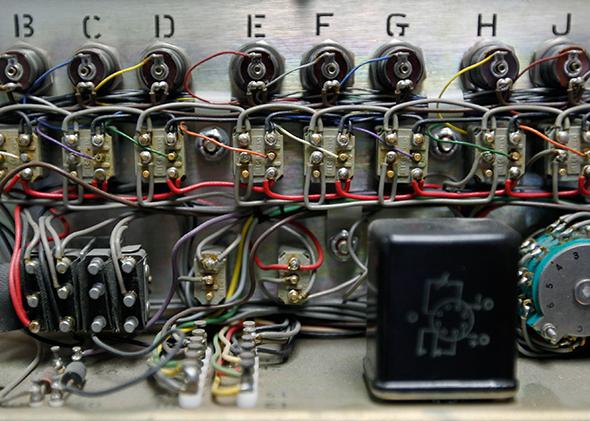

Going further back, consider Russell and Sigurd Varian, who in 1948 founded Varian Associates, the largest microwave-tube manufacturer of the 1950s. Products of an arty, Theosophist upbringing (their parents helped start the utopian community Halcyon, Calif.), the Varians were non-Marxist socialists who pioneered employee ownership and profit-sharing and stated that their “principal commodity is human intelligence.” Craziest of all, in 1958 the Varians actually expressed regret for developing atomic bomb fuses. (“Keeps you awake at night sometimes,” said Sigurd, whose depression was complicated by his conscience.)

Hardly free of economic and social inequality, Silicon Valley was still socially porous enough to allow rough-hewn startups to absorb top-quality talent and eventually displace more prestigious and credentialed companies. The many weirdos who helped established Silicon Valley from the 1930s to the 1980s—not the slick VCs who try to control it now—would have a harder time getting their feet in the door now.

Factor No. 4: Patience

Humans are famously short-term thinkers— businessmen most of all. As the adage goes, a businessman will sell guns on Saturday to the revolutionaries who execute him on Sunday. Yet as Timothy Sturgeon chronicles in his incisive “How Silicon Valley Came to Be,” the causes of Silicon Valley’s boom lie in latent trends that are over 100 years old. While Stanford engineering dean Frederick Terman —often called “the father of Silicon Valley”—certainly boosted innovation and networking in the area in the mid–20th century, he was hardly the instigator of those trends. Terman was “as much a product of local ferment in electronics as he was its catalyst,” Sturgeon writes. Threads of amateurs, academics, and professionals in the telegraph, radio, vacuum tube, and television industries had been developing quietly in the entire Bay Area since the beginning of the century.

This long pattern of subtle growth arose from a combination of enthusiastic and obsessive people, a surfeit of funding, a tolerance and even encouragement of risk-taking and failure, and one of the most dynamic technology sectors the world has ever seen. (Compare transistor efficiency advances to those of batteries, which they outpace by a factor of millions.) Silicon Valley companies also profited from being left alone—that is, not having the eyes of the world on them expecting immediate results. The paradox of trying to engineer another Silicon Valley is that the micromanagement done in trying to create the “right” environment is almost certainly sure to kill the chaotic and freewheeling enthusiasm and aimless entrepreneurship that was required for the real thing. There may well be another Silicon Valley, but it demands an investment that can’t be accelerated: time.

Correction, Dec. 2, 2013: This article originally misspelled Martin Kenney’s last name.