You shouldn’t be picking stocks. That’s the one commandment of modern investment advice, the cardinal rule for how you should safeguard your money. Don’t pick stocks, and don’t even pick particular industries. (What about when you’re on to a sure thing, like my suggestion that you buy Apple’s stock? Save individual picks for a small portion of your money that you’re willing to lose.) Most importantly, unless you have a ton of cash to spare, don’t pay investment managers who try to outperform the market. When you add up their fees and their nontrivial chance of losing relative to the rest of the market, you’re better off skipping the self-proclaimed experts.

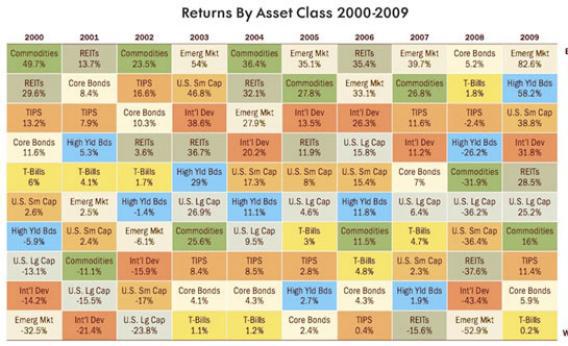

Everyone in the investment world knows this. According to what’s known as Modern Portfolio Theory, rather than trying to beat the market, you should choose your level of risk and create a diversified portfolio of assets—stocks, bonds, commodities, etc.—that matches that tolerance. If you’re young and trying to save for retirement or your kid’s college fund, you should put more of your money in stocks than bonds; if you’re old and looking for stability, keep more in less volatile assets. Finally, you’ve got to keep everything balanced. If you put 80 percent of your money in stocks and 20 percent in bonds, then by the end of the year, if stocks grow faster than bonds, your stock position might have grown to 85 percent. To keep things in balance, you’ve got to sell some of your stocks and buy some more bonds.

All of this sounds totally easy, right? Of course not. For people who have extra money but not a lot of time or facility with investing, there has never been a simple way to invest in the rigorous, disciplined way that experts advise. How should you know which asset classes match your level of risk? Where are you supposed to find the time—and learn the math—to constantly rebalance your portfolio?

These difficulties explain why a lot of people save their money in sub-optimal ways. For instance, you’ve probably got a lot of retirement money sitting around in mutual funds that charge you high fees. Over the long run, those fees could shave tens of thousands of dollars off your return. Or you may have a significant portion of your money in a bank savings account, where you’re gaining almost nothing.

Recently, there’s been a wave of tech startups that promise to help you stop making those kinds of elementary mistakes. I’ve been testing some of them over the last few months. I can report that none is perfect; I think there’s still room in the market for a cheap, easy, killer investment app. But these sites offer some hope that the tech industry is making the financial world more hospitable to regular people.

MarketRiders. $179 per year plus trading fees.

Screenshot from MarketRiders.com.

Of everything I tried, MarketRiders offers the most in-depth tools to create and maintain a disciplined investment strategy. Depending on the size of your account, it could be really cheap, too. But MarketRiders is also the least accessible to people who don’t understand the complexities of investing, and it requires a lot of maintenance work. If you’re not really into watching your money, you’ll want to try one of the other options.

Think of MarketRiders as an automated investment adviser. The site doesn’t manage your money itself. Instead, you keep your funds at a low-cost online broker like Vanguard or Schwab. After you sign up for MarketRiders, you tell it how much you’d like to invest, for what time period, and your risk tolerance. (You can create different portfolios for different purposes, and the site works for both taxable and nontaxable accounts—say, one for your retirement, one for your dream house, one for your kid’s college.) Based on your information, MarketRiders figures out which securities you should buy at your broker. Then it tracks your investments, warns you when they’ve gotten out of balance, and tells you what to buy and what to sell in order to rebalance them.

The nice thing about MarketRiders is that it’s devoted to keeping your costs low. It suggests you buy exchange traded funds, or ETFs, which you can think of as cheaper versions of index funds. If you’re investing $50,000 for your retirement, your typical fees for a MarketRiders-approved portfolio would be about 0.8 percent per year. (Very technical note: The 0.8 percent includes MarketRiders’ $179 fee and the amount you’ll pay on trades for rebalancing, but not the underlying ETF fees, which I’ve left out for a more apples-to-apples comparison with other sites; with those fees added, you’ll pay about 1 percent of assets for a $50,000 account.) The costs go down with the size of your account, so if you’ve got a lot of money to invest, MarketRiders could be your cheapest option. For a $500,000 account, you pay just 0.14 percent in fees, not counting underlying ETF expenses—a price that no other investment manager can even come close to.

But there’s a huge disadvantage to keeping your money in MarketRiders: It could be a lot of work. I try to put a fixed amount of my monthly income into savings. This means that every month, I’ve got to log in to MarketRiders, tell it how much I’m adding in, then go to my Vanguard account and follow its advice. It’s about 20 to 30 minutes of busy work every month—not a lot, but just enough of an annoyance that I’m tempted to skip it. And if you skip it, of course, that defeats the purpose of using a site like MarketRiders entirely.

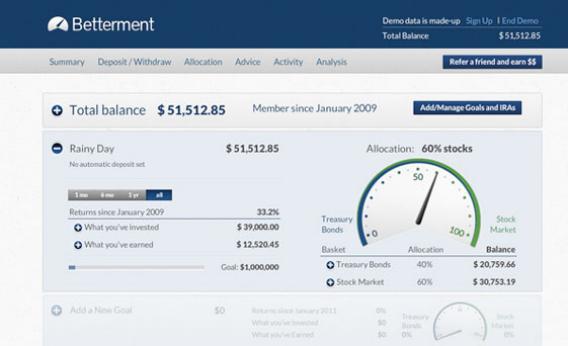

Betterment. Fees begin at 0.35 percent of your assets; as low as 0.15 percent with a minimum of $100,000 invested.

Screenshot from Betterment.com.

This site launched a year ago with the promise of making investing easier, and it has delivered on that goal. Betterment is the easiest investment site you’ll ever use. To start, just sign up and transfer money into the site. Then, all you do is select one lever—the percentage of your money you’d like invested in stocks versus bonds. That’s it: Betterment will take care of diversifying and rebalancing your money. When you add funds into the account, Betterment makes the appropriate trades to keep your account in balance. It all happens in the background, automatically, without you having to lift a finger.

Jonathan Stein, Betterment’s CEO, says the site’s simplicity is meant to reduce anxieties about investing. “We want to help people actually do something with their money—get over the inertia that paralyzes them from taking action,” he told me a year ago, just after the site launched. At that time, I resisted recommending Betterment because its fee structure seemed too high—it was charging a fee of up to 0.9 percent of your assets, not including the underlying fees for ETFs. (Felix Salmon called it “overpriced simplicity.”) In February, though, Betterment radically lowered its prices. Now, if you sign up for an automatic monthly transfer of money from your bank account into Betterment, you’ll pay 0.35 percent of assets. The fee goes down to 0.25 percent with $10,000 invested, and 0.15 percent with $100,000.

For people with not that much money and no extra time, Betterment is hard to beat. The one problem is that, in order to keep things simple, the site doesn’t put your money anywhere beyond stocks or Treasury bonds. If you’re looking to invest for the long term, you should probably have some of your assets in real estate, commodities, and other kinds of bonds, too.

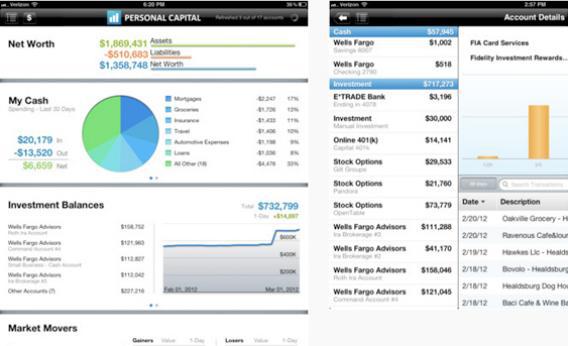

Personal Capital. Investment management fees start at 0.95 percent of assets, with a $100,000 minimum investment. Fees go as low as 0.75 percent for accounts of $5 million or more.

Personal Capital screenshot from iTunes.

“The biggest problem that most affluent Americans face in their financial lives is fragmentation—they’re not in control of their money, they lack the ability to see and think holistically about their assets,” says Bill Harris, a legend in the financial tech world who formerly served as CEO of both Intuit and PayPal.

To solve that problem, Harris’ company has created two products: First, there’s a free “dashboard” that connects to all of your investment accounts to show you just where your money is and what it’s doing. Second, the company offers an investment service designed for the “mass affluent”—people who are wealthy enough to need help sorting out their complicated financial lives, but not quite high-flying enough to afford Goldman Sachs. Harris says that this large market of tech-savvy, less-than-ultra-wealthy people—think of all the millionaires Facebook will soon mint—has been underserved by the financial industry.

If you’re not a millionaire, I’d still recommend you sign up for Personal Capital’s free site, which I’ve found quite helpful. If you’ve got your money in various places—a company 401(k), your spouse’s government pension plan, an IRA you never look at anymore, a 529 college savings plan, and on and on—it can be impossible to manually deduce your asset allocation across all your accounts. Personal Capital produces a slate of useful and stylish graphs to track these allocations. In this regard, it’s kind of like Mint, but with a greater emphasis on investments than banking.

If you are a millionaire, Personal Capital wants to sell you more than just these graphs. While the firm’s investment fees are higher than what you’d pay for managing your money on your own with something like MarketRiders, the fees are far lower than what most other consultants charge for investment management. When you pay the fee, Personal Capital will assign you a wealth manager who’ll look at your overall asset mix and recommend a strategy for your money. This is ideal for people who don’t have the time to mess with a DIY service like MarketRiders—Personal Capital will make trades on your behalf, so you never have to worry that your account is languishing. It will also perform many advanced functions that you probably wouldn’t do on your own, like “harvesting losses” to reduce your taxes. Harris says that by diligently rebalancing your account, by considering all of your financial assets, and by reducing your taxes, Personal Capital will make up for its fees in higher returns.

What’s my verdict, after looking into these three sites? For most people, Betterment is best. Its price and simplicity make for a killer combination. Those who want more options but don’t want high fees should choose MarketRiders. It’s what I’ve been using for my own money for more than a year, and I’ve grown to love it. And if I win the lottery tomorrow? That’s when I’m signing up for Personal Capital’s consulting service.