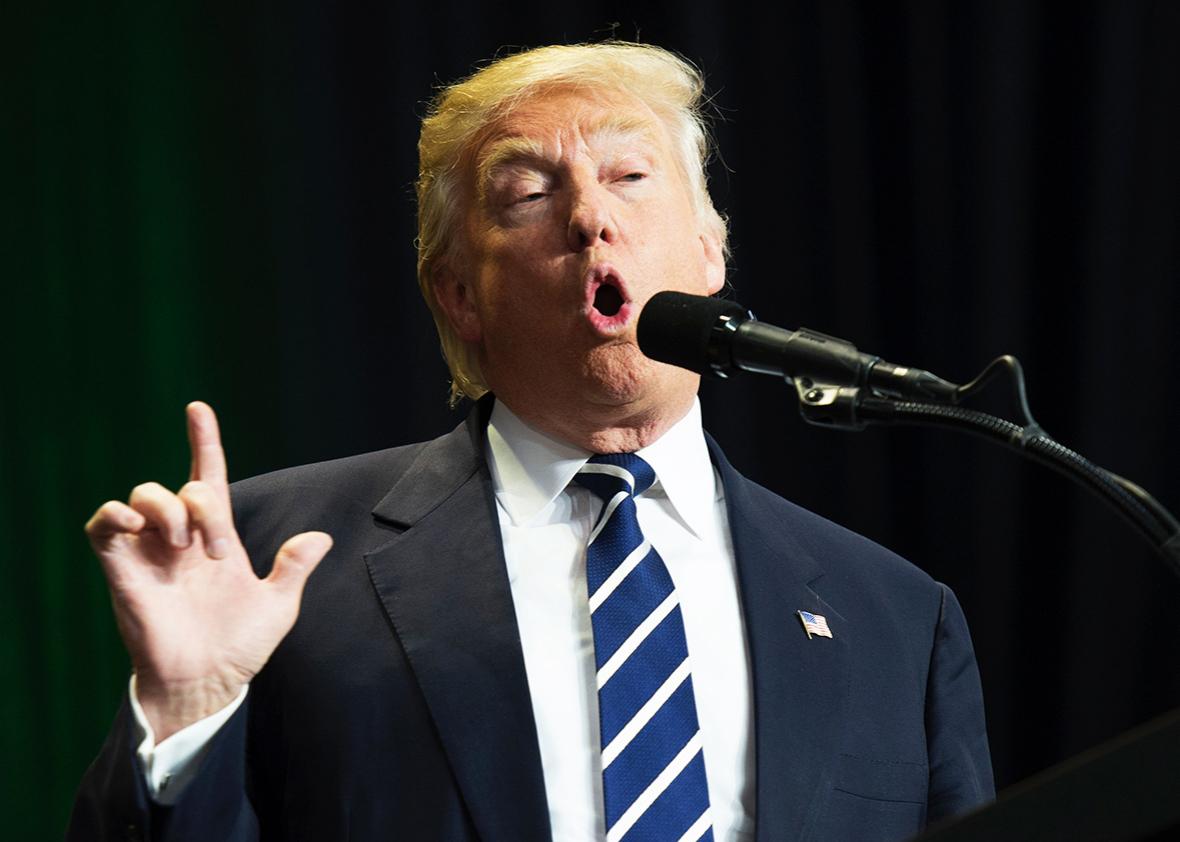

Admit it: There was something a little entertaining about Donald Trump’s unbridled rhetorical assaults on his political, professional, and personal opponents throughout his presidential campaign.

But now as the president-elect, it’s clear that his Twitter persona wasn’t a shtick—it’s a dangerous inability to mediate his instinctual reactions in favor of a more thoughtful, critical tone. His tweets are news events, an indication of his intentions as president, and will produce reactions in the economy that could range from a minor fluctuation in the value of a particular stock to something more dramatic that constitutes a market event.

For instance, on Dec. 6, Trump tweeted, “Boeing is building a brand new 747 Air Force One for future presidents, but costs are out of control, more than $4 billion. Cancel order!” The tweet came shortly after a briefing that included information on the Boeing contract, according to a New York Times report. It took only 10 seconds, according to the calculations of Nanex, a market analytics firm, for Boeing stock to start trading down, ultimately sinking the stock value by 1.6 percent. For Boeing Co., that kind of shift is meaningless and happens several times a day. Trump’s tweet occurred during pre-market hours in an inactive stock, and the Air Force One contract accounts for only a small percentage of the company’s bottom line. Nearly a week after his Boeing tweet—almost as if to even the score—he did the same thing to Lockheed Martin, tweeting complaints about the costs of F-35 fighter jets (even though that information is old and has been widely available).

But the market was better prepared this time. Mind you, Lockheed experienced an even greater loss than Boeing—2.5 percent—but Lockheed’s stock began trading down prior to Trump’s tweet, indicating that investors might have had some foresight to dump their shares. This could mean that investors are monitoring Trump’s statements and market analyzing tools more closely—after all, the president-elect made comments about the F-35 a day prior without singling out any of its manufacturers. Or, it could mean something more insidious: that Trump, or someone in his camp, tipped investors off that Trump was going to specifically call out Lockheed on Twitter. This would amount to insider trading, which is a criminal act, but an unlikely occurrence here. In the Los Angeles Times, Michael Hiltzik noted that “pre-market trading tends to be light, so a largish trade can move the market sharply,” making the dip prior to Trump’s tweet look more violent than it really was. Still, Hiltzik says, “It’s not enough to say that Trump’s tweets thus far have had only a limited and temporary effect on stock prices. Even that much is a gift to professional traders, who can profit handsomely from short-term moves, even more so if they reflect a knee-jerk overreaction and are promptly reversed.”

Researchers have been investigating the relationship between social media, news media, and stock movements for some time. A 2011 study based on sentiment analysis and data mining algorithms determined that microblogs, as the study classified the still-nascent Twitter, do have an impact on investor trading behavior. “Microblogging is one such channel where sentiments of irrational investors spread quickly with the continuous streaming of information. Specifically sentiment, represented by opinions, plays a vital role in this diffusion,” the study concluded.

Just a couple of years later, their hypothesis got some real-world support. In 2013, a fake tweet emerged from the official account of the Associated Press announcing: “Breaking: Two Explosions in the White House and Barack Obama is injured.” Some investors on and near the New York Stock Exchange trading floor panicked, causing the Standard & Poor’s 500 Index to sink by 1 percent. Though the market recovered, the news wire’s fake tweet “wiped $136 billion from the S&P 500 index in about two minutes,” according to Bloomberg. The erroneous tweet, for which a Syrian hacking group claimed responsibility, forced financial experts to consider the ability of a 140-character message on a young social media platform to move markets in a big way.

It would be prudent for Trump to start thinking of his tweets as fragmented presidential addresses. The market will certainly treat them that way. According to data compiled by the Wall Street Journal Market Data Group going back to 1961, market jumps often followed State of the Union addresses. The most significant reaction followed President Clinton’s Jan. 27, 2000, speech, when the Dow Jones Industrial Average fell 2.6 percent. Because the State of the Union address is traditionally where presidents identify their national priorities and legislative agendas, as major news items, they typically are followed by a significant market reaction.

Trump, obviously, hates wasting time on formalities and prefers to speak in tweet, no matter the topic. Recently, in six consecutive tweets, Trump outlined his intentions to significantly reduce taxes on corporations and levy a 35 percent tariff on businesses that move jobs out of the United States:

Those are some pretty important announcements—the type that would usually come at a press conference (which Trump loathes—he hasn’t held one since July) or an event like the State of the Union. There’s a good reason for that: A press conference or major address lets investors know they should anticipate big news, something that might affect the market.

But these sorts of seemingly out-of-the-blue tweets about major policy could cause panic in the market—especially once he’s president, and especially if the informal nature (and Trump’s own temperament) makes it difficult for investors to determine whether he truly intends to see them through.

And there’s something else to consider. It is also possible for the president to profit off of the power of his tweets. Jordan Libowitz, an ethical law expert from Citizens for Responsibility and Ethics in Washington, says that if Trump tweets out an attack on a company, and it turns out he has an investment in a competitor, “We now have a case where the president could use the presidency for his own bottom line.” (Trump says that he sold all of his stocks in June, but we don’t know what stock holdings his various businesses might have.)

Trump’s tweets will continue. He likes the idea of having a direct line to the public and doesn’t show any sign of tweeting in a less off-the-cuff fashion. But financial markets are volatile and based on the moods and sentiments of fallible investors. If Trump’s not careful—which, it’s safe to say he’s not—his Twitter account could prove to be a liability for the economy.

This article is part of Future Tense, a collaboration among Arizona State University, New America, and Slate. Future Tense explores the ways emerging technologies affect society, policy, and culture. To read more, follow us on Twitter and sign up for our weekly newsletter.