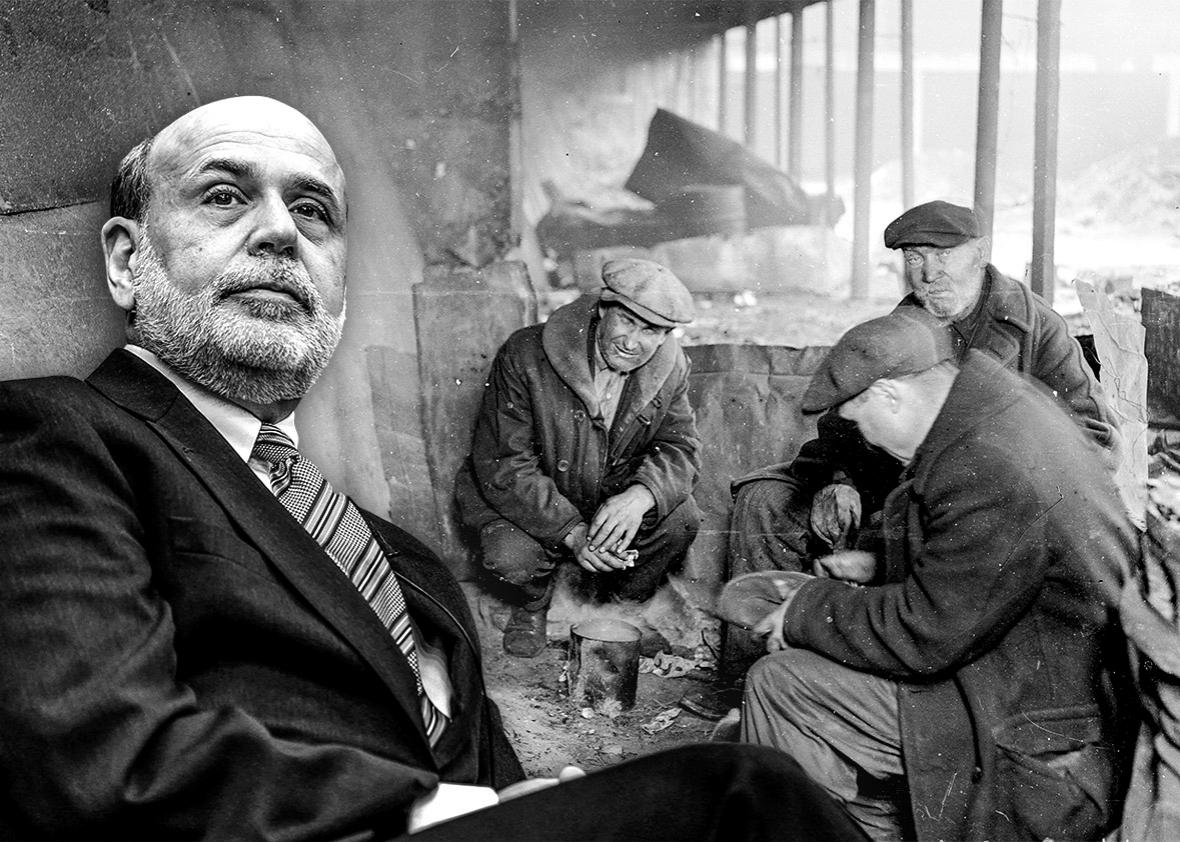

In his just-published memoir, Ben Bernanke repeats his claim that he failed to rescue the Lehman Brothers investment bank in September 2008, while he was chairman of the Federal Reserve, because he believed that he lacked the legal authority to do so. This claim is a convenient excuse for the biggest mistake in the government’s response to the financial crisis. While the Lehman collapse did not cause the crisis, it significantly worsened it. Bernanke, along with Bush administration Treasury Secretary Henry Paulson and Federal Reserve Bank of New York President Timothy Geithner, is responsible for this blunder. He can’t blame the law.

The law in question is section 13(3) of the Federal Reserve Act, which authorizes a Federal Reserve Bank, with the board of governors’ approval, to make loans during a crisis to nonbanks like Lehman if the loan is “secured to the satisfaction of the Federal Reserve bank.” It is this vague bit of language that blocked a loan, according to Bernanke. Because, he says, Lehman was insolvent, the Fed couldn’t lend to it.

The problem with this argument is that the Fed rarely allowed legal niceties to stand in its way during the crisis. Back in March 2008, it had arranged for a transaction in which it effectively purchased $30 billion of Bear Stearns’ toxic assets. Technically, the Fed (along with JPMorgan) loaned money to a trust called Maiden Lane, but because the Federal Reserve Bank of New York owned the equity in the trust, it received the proceeds from the sales of the assets once the loans to it and JP Morgan were paid off. Section 13(3) authorizes loans only; it does not authorize the Fed to buy assets.

Subsequently, in the AIG rescue, the Fed demanded that AIG transfer 80 percent of its equity into a trust, which ultimately paid the proceeds to the Treasury—exactly where the Fed’s profits go. A federal court recently held that the Fed effectively acquired the equity, which is not authorized by the law, as the Fed’s lawyers apparently knew at the time of the transaction. (Disclosure: I worked as a lawyer on this case on behalf of the plaintiffs.) Still later, the Fed bought unsecured short-term debt from corporations—again, in violation of section 13(3), which authorizes only secured loans. The Fed also made billions of dollars of loans against the type of toxic asset that filled Lehman’s balance sheet—believing (correctly as it turned out) that those assets were significantly undervalued by the market.

The Fed pushed against the boundaries of the law in these instances because it believed that strict interpretations of the law would block actions that it needed to take in order to save the financial system. And the phrase, “secured to the satisfaction of the Federal Reserve bank,” invites the Fed to exercise discretion by relying on its own judgment when evaluating collateral or a borrower’s prospects for repayment. If the Fed was willing to push forward against the law in these other cases, then why not for Lehman?

Lehman’s major problem was illiquidity. It owned valuable assets but could not sell them off during a panic, except at fire-sale prices that would drive it into insolvency. Officials in the New York Fed believed that Lehman was “narrowly solvent,” according to the New York Times. Later, the Lehman bankruptcy examiner Anton Valukas would find that Lehman’s own valuation of its assets, on the basis of which it claimed to be solvent, was not unreasonable. This is hardly a ringing endorsement, but surely it was enough to allow a loan “secured to the satisfaction” of the Fed.

Bernanke’s claim that he believed that Lehman was insolvent is also hard to credit in light of his efforts to facilitate a sale of Lehman to Barclays Bank. The Fed was ready to provide a loan to make this happen. But if Lehman were insolvent, then Barclays—one of the largest banks in the world—would have choked on its carcass, possibly imploding itself, with consequences for the financial system even worse than the Lehman collapse. Bernanke would not have helped Barclays acquire Lehman if he had believed that Lehman was insolvent. In fact, Barclays’ willingness to buy Lehman was evidence that Lehman was not. Bernanke also has never explained why a “small” loan to facilitate Barclays’ acquisition of Lehman would have been lawful if a “large” loan to save Lehman itself was not.

There are other inconvenient facts. The Fed loaned significant sums—as much as $28 billion in one instance—to Lehman through its Primary Dealer Credit Facility in the months after Bear Stearns’ collapse. It must have believed then that Lehman could repay the loans. Even if Lehman were insolvent by September, the Fed could have saved it before its financial position deteriorated. The failure to act earlier was itself a choice, not compelled by the law.

Why, then, did Bernanke & co. fail to rescue Lehman? The answer that emerges from Bernanke’s memoir—largely consistent with the memoirs and testimony of Paulson and Geithner, and reporting by journalists—is that (1) anti-bailout sentiment was loud and intimidating; (2) Lehman’s counterparties had had months to prepare for its failure; (3) a Lehman rescue would encourage recklessness among creditors; and (4) Congress would get angry if the Fed lost money on its emergency loans. While many sophisticated investors and officials rejected these worries, they weren’t unreasonable. But, in the end, these worries were wrong.

Milton Friedman and Anna Jacobson Schwartz famously attributed the extraordinary severity of the Great Depression to the Fed’s failure to supply emergency loans during a series of liquidity crises, which caused the collapse of the nation’s financial system. This was a catastrophic failure by the Fed to exercise authority Congress had given it—as if firefighters decided not to put out a building that was on fire and instead allowed the fire to spread through the rest of the city. In a 2002 speech in celebration of Milton Friedman’s birthday, Bernanke, who has written important scholarship on the Great Depression, declared:

I would like to say to Milton and Anna: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.

But in failing to rescue Lehman, the Fed “did it again.” While Bernanke quickly recognized his error, and deserves credit for the ensuing round of bailouts, which, along with the Troubled Asset Relief Program statute, finally ended the financial crisis, historical accuracy requires us to recognize that Bernanke, not the law, is responsible for the Lehman blunder. For a scholar of the Great Depression, this must be a bitter irony.