A permanent corporate tax rate of 20 percent is not just a major component of Republicans’ tax reform legislation. It is the whole point. The Republican theory of economic growth hinges not just on cutting the corporate rate nearly in half, but on ensuring that the change is lasting, so businesses have the certainty they need to make long-term investment decisions.

But Republicans have not done what’s necessary to achieve a permanent corporate tax rate of 20 percent. Sure, the House and the Senate have each passed legislation for a corporate rate of 20 percent that doesn’t sunset, but they were only able to achieve this through the shortcut of partisan legislation. Future partisan legislation, coming from the next unified Democratic government, will prove that that 20 percent rate was more like Republicans’ opening bid, and not the United States’ long-term policy.

Reaching that permanent 20 percent figure drove every step of the recent process.

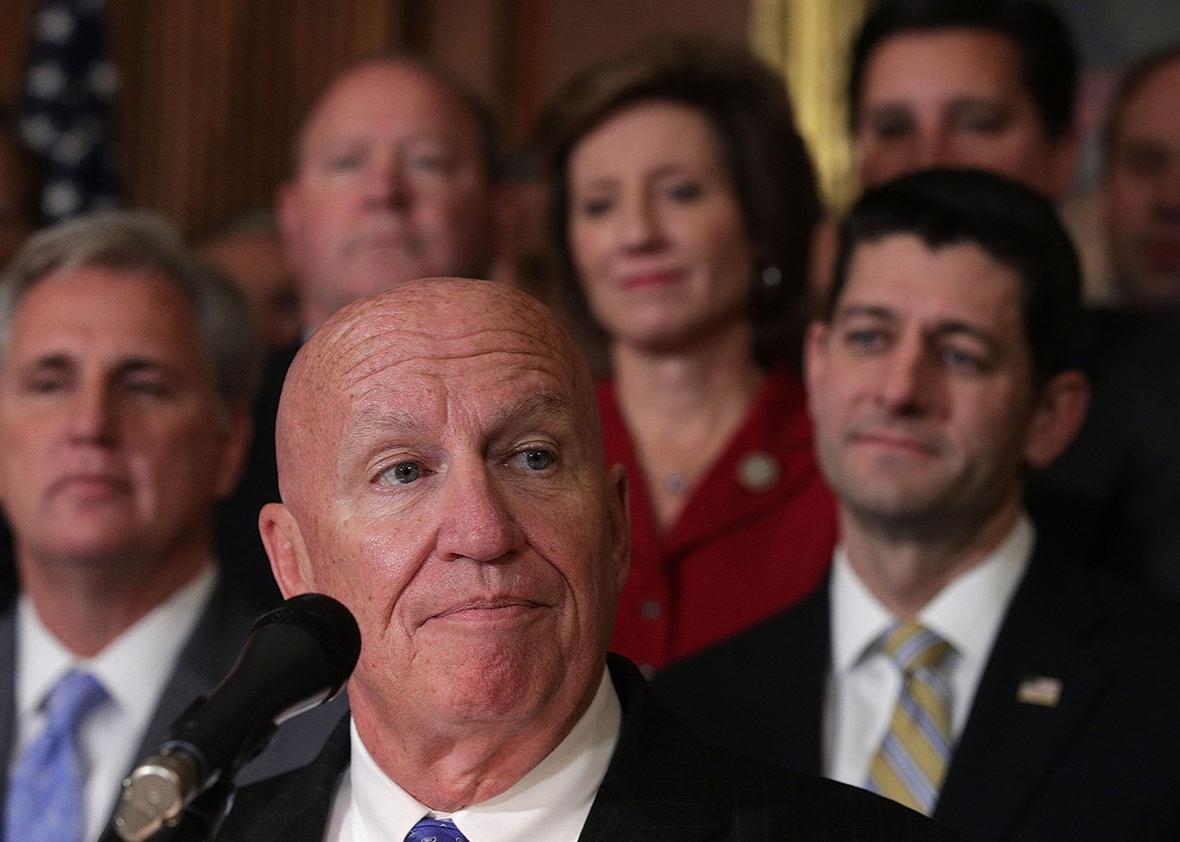

The day before House Republicans released their first draft of the Tax Cuts and Jobs Act, Texas Rep. Kevin Brady, chairman of the Ways and Means Committee, informed reporters that they probably couldn’t find a way to make the corporate tax cut permanent. When it sunk in that this would mean the unraveling of their entire project, Brady tried a little harder. Ways and Means Republicans decided at the last minute to sunset other provisions—such as a pair of new $300 family tax credits—after five years in order to cover the cost of the permanent corporate tax cut. The logic behind such a “cliff” gimmick is that there’s no way future Congresses would allow popular items like $300 family tax credits to expire in five years. They weren’t willing to set the corporate rate up for such a cliff, saying it would signal too much uncertainty to business.

The Senate faced similar moments of doubt over making the rate permanent. When Utah Sen. Orrin Hatch, chairman of the Senate Finance Committee, had to bring his bill into compliance with reconciliation rules that govern what’s allowed in the fast-track, filibuster-free process, he chose to sunset the individual provisions in the tax bill, even though it meant a projected tax increase on individuals in the out-years. Since the tax bill couldn’t increase the deficit after 10 years under the Byrd rule, Hatch and Finance Committee Republicans just sacrificed the individual side, in order to pay for the permanent 20 percent corporate tax rate. Later in the process, when several Republicans senators demanded costly adjustments and suggested slight hikes to 21 or 22 percent in the corporate rate to pay for them, it looked like the bill’s managers might have to nudge the rates up to bring those votes onboard. Instead, they chose to pay for these provisions by retaining versions of both the corporate and individual alternative minimum tax—a policy they really don’t like. Whatever it takes, though, to keep that permanent 20 percent corporate rate.

There will be further pressures in the conference committee to move the rate upward a point or two, and President Trump—who had earlier made the 20 percent rate a “red line” for negotiations—signaled a surprising openness to it over the weekend. Expect the supply-siders in both chambers, though, to beat back these pressures once again as they put the finishing touches on their signature legislation.

So businesses can just take that permanent 20 percent rate to the bank and make decisions accordingly, right? Nope. Because Republicans skipped the tough part that truly determines permanence: political buy-in from the other side, which, at some point, will get its say on the matter.

Consider one of the significant pay-fors in the Senate bill, which the conference committee will likely adopt to include in the final report: the repeal of the Affordable Care Act’s individual mandate, worth about $338 billion in net savings. Democrats, in their effort to achieve their long-sought goal of comprehensive health care reform, passed the Affordable Care Act in 2010 without any Republican votes. That naturally made its repeal a central plank of the Republican agenda. Though the GOP hasn’t been able to muscle through a repeal-and-replace bill this Congress, they’ll continue to pick away at the ACA for as long as they can—and they’ll achieve a major part of that in this tax bill. The ACA was Democrats’ opening bid on comprehensive health care policy. Republicans are now having their say.

In passing this tax bill along party lines, Republicans are giving the Democratic Party a platform for whenever they retake the government: Repeal the Republican tax bill. Democrats won’t be able to undo all of it, but they might be able to pass a bill that raises the corporate rate to 30 percent—giving them roughly a trillion dollars, by the way, to spend on something else, assuming they even bother to offset the cost of anything going forward. All law takes a bipartisan imprint at some point, and partisan legislation is only the beginning of a process.

The 20 percent corporate rate in the Tax Cut and Jobs Act will be statutorily permanent but politically provisional—and thus temporary. In refusing to court Democratic support for the process, Republicans further unravel their already dicey argument that this permanent 20 percent corporate rate will dramatically and broadly bring prosperity. If corporations really do need the certainty of permanence before acting on a 20 percent tax rate, they won’t find it here, making the bill little more than a temporary cash transfer to stockholders.