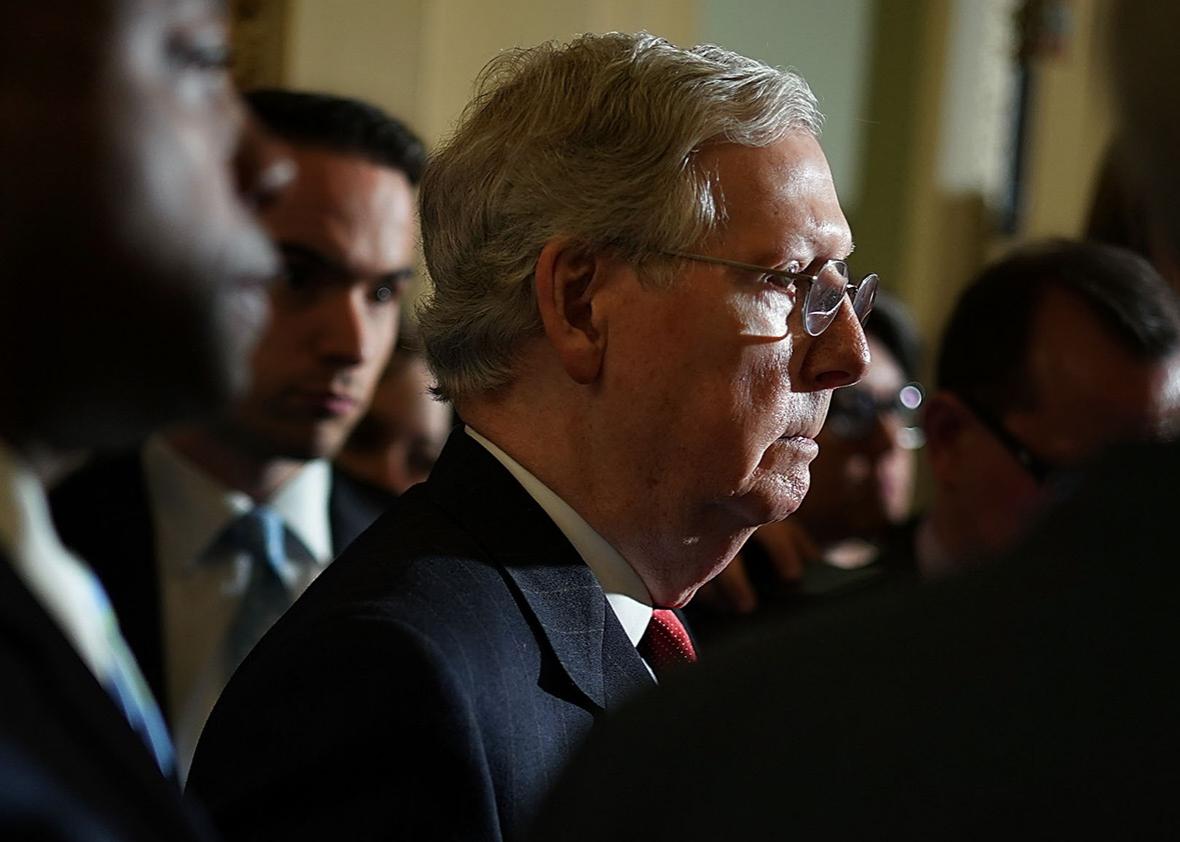

Senate Majority Leader Mitch McConnell’s plan is for the Senate to begin floor consideration of the Republican tax reform bill on Tuesday, pretend to have an open and sincere amendment process, and pass it by the end of the week. It may well work. For a proposal that’s only marginally more popular than Republicans’ universally despised health care reform efforts, their tax reform plans have met surprisingly soft resistance moving through Congress.

McConnell is operating on a tight timeline. President Trump has publicly pushed to sign a bill by the end of the calendar year, leaving little additional time to reconcile the Senate legislation with the one already passed by the House. And any lingering delays would only give Democrats more time to marshal their opposition.

The bill that the Senate Finance Committee cleared a couple of weeks ago might not pass the chamber. McConnell will need to accommodate several different clusters of senators with pet concerns that are often in conflict with one another. This may sound familiar. Repeatedly tackling controversial issues on a partisan basis with narrow margins for defections is a legislative nightmare doomed to repeat itself.

Maine Sen. Susan Collins didn’t see many red flags in the Senate bill when it was first unveiled. Now she does. The “biggest mistake” in the bill, she told CNN on Nov. 19, was tossing repeal of the Affordable Care Act’s individual mandate into the mix. The provision was included to nudge tax rates down and to earn the support of conservatives like Arkansas Sen. Tom Cotton, Kentucky Sen. Rand Paul, and Texas Sen. Ted Cruz. The trade-off, of course, is that such a move undermines health care markets and increases premiums. It also awakens opposition to the bill.

Collins has offered leaders a choice for regaining her support: Either drop the provision or pass two additional bills to “mitigate” the impact of repealing the mandate—the Alexander-Murray bill to stabilize the insurance market, along with a reinsurance bill she co-authored with Florida Sen. Bill Nelson. Collins said, further, that she’d like to see those bills passed before they consider tax reform.

McConnell won’t spend precious legislative floor time on these bipartisan health care bills when he’s in a race to get tax reform finished. The more workable path, as Tennessee Sen. Lamar Alexander himself has said, would be to earn the president’s endorsement of Alexander-Murray and attach it to the end-of-year appropriations package.

This wouldn’t solve all of Collins’ problems with the bill. It would, however, go a long way toward winning the support of Alaska Sen. Lisa Murkowski, who wrote in an op-ed on Tuesday that she supports repealing the individual mandate. Do not expect the two moderates to be linked at the hip the way they were on various Obamacare repeal bills over the summer. The reconciliation instructions allowing for filibuster-free consideration of the tax bill also tasked the Senate Energy and Natural Resources Committee, which Murkowski chairs, with finding $1 billion in savings. Murkowski has put forward a bill to open up part of the Arctic National Wildlife Refuge to drilling. This is a sort of Holy Grail for Alaska Republicans, giving Murkowski a strong incentive to get to yes.

It may seem quaint, but there are also still a few Senate Republicans concerned about how a gaping structural revenue shortfall will affect the national debt.

Arizona Sen. Jeff Flake is retiring, which gives him the unique license to vote according to previously stated principles. Flake is a deficit hawk, and he’s so far unconvinced that dispersing $1.5 trillion in debt-financed tax cuts complies with the whole deficit-hawk ethos. Trump has responded by calling him names on Twitter.

Tennessee Sen. Bob Corker is also a deficit hawk who is not seeking re-election. His concerns are a bit different than Flake’s. Corker is fine with the $1.5 trillion price tag—which he should be, since it was a deal he negotiated. But he wants to ensure that the “dynamic” score of the tax bill shows at least $1 trillion in new revenue over 10 years resulting from economic growth. Neither the House nor the Senate bills have received a dynamic score from the Joint Committee on Taxation yet. But the Tax Policy Center’s dynamic estimate last week showed that the macroeconomic effects would only produce $169 billion in new revenue over the first decade. In other words: not even close to what Corker is looking for.

The picture will hardly improve for deficit hawks once leaders accommodate Wisconsin Sen. Ron Johnson. Johnson is the only declared no on the bill as currently written. He’s concerned that the package treats large corporations more lavishly than small businesses. (What did he think this process was all about?) Some adjustment will need to be made to win him back. And reopening the section on pass-through entities could prove costly and require offsets that irritate some other segment of the GOP caucus.

Then there are the wild cards. Unlike with the health care bill, Arizona Sen. John McCain seems satisfied with the process so far, though that could change when leaders begin scrambling to make major changes a few hours before the vote. Paul could draw up some ambitious demand, like a permanent ban on discretionary federal spending, in exchange for his vote. There are likely other quiet types with concerns that we don’t fully know about. What’s up your sleeve, say, Jerry Moran?

We should expect the Senate to pass something. They built in $1.5 trillion to distribute however they saw fit when they passed their budget. Expect them to find a way. But the thing that they pass could look quite a bit different from what they have written.