Imagine it’s a year from now, and Democrats have managed to win back the House of Representatives. If you’re a GOP incumbent who has just suffered a crushing defeat, you will presumably feel pretty despondent. But don’t despair, my forlorn Republican friend—it is I, Reihan Salam, time-traveling mystic! With the aid of my Cosmic Temporal Whirligig, I will now transport you back to Nov. 7, 2017, when massive Democratic gubernatorial victories in Virginia and New Jersey gave you a glimpse of your bleak present here in 2018. Now that I’ve given you this new lease on life, what will you do differently? Will you make exactly the same mistakes, leading me to cackle with glee? Or will you defy expectations, fix those errors, and inspire me to crack a thin-yet-appreciative smile in the manner of Herman Cain?

I’m obviously not an impish time-traveling genie. (Or am I??) But I’m hardly alone in believing that 2018 could be a Democratic-wave election. Donald Trump is profoundly unpopular, and he appears to be dragging the GOP brand down with him—an impressive feat given that the economy is humming along and the unemployment rate is as low as it’s likely to go. If the nation were to experience any kind of economic hiccup, one assumes Trump’s slide would accelerate. Already, Democratic challengers across the country are surpassing the fundraising totals of GOP incumbents, and a growing number of Republican lawmakers are choosing not to run for re-election, in part out of a recognition that the party’s prospects for 2018 do not look particularly bright. This week’s gubernatorial races demonstrated that college-educated Democrats in well-off suburbs are highly energized. Short of a miracle, Republicans representing districts won by Hillary Clinton are doomed. If Democrats can make inroads in working-class white districts, the dam will break and Speaker Nancy Pelosi will be back for her revenge.

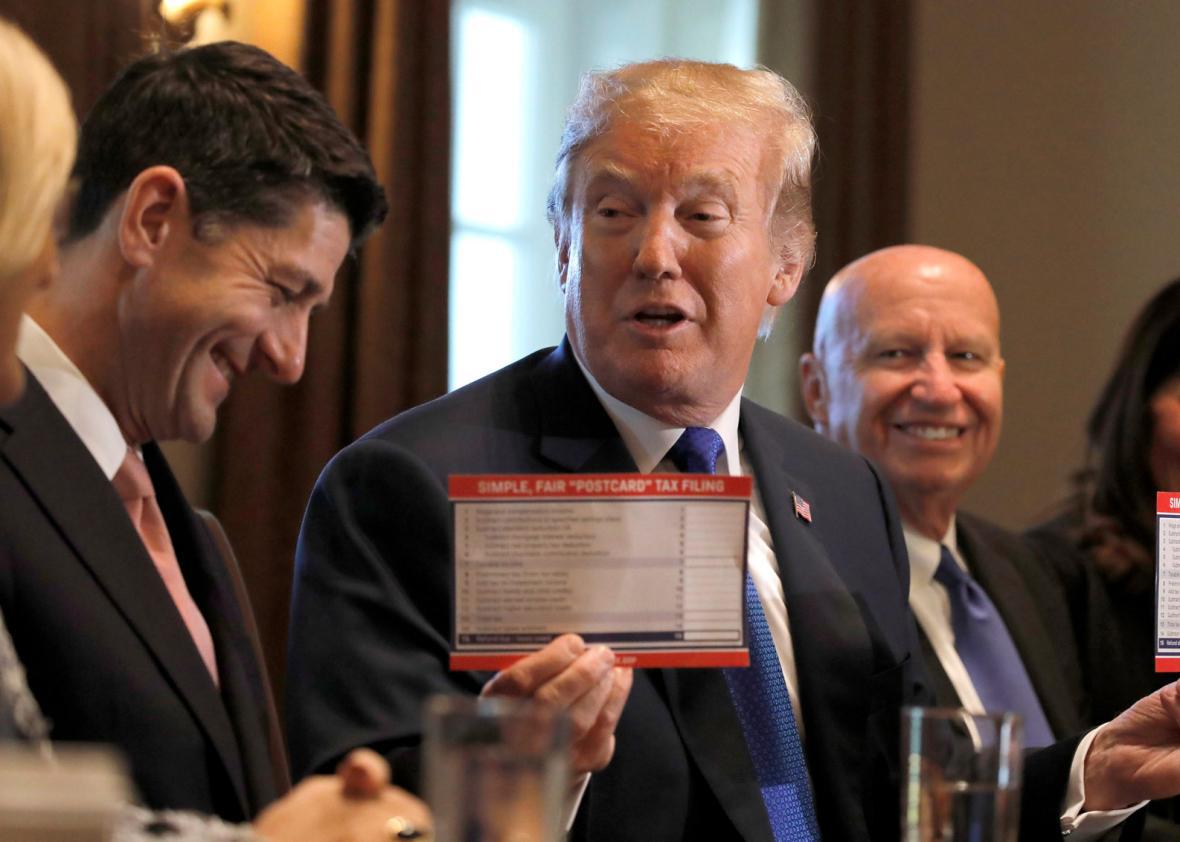

So now’s the time for Republicans to think hard about what they can do to save their skins. Their best bet would be to re-jigger the Tax Cuts and Jobs Act, the centerpiece of the GOP’s domestic policy agenda, which is very much at risk. There is much that can be said about the substance of the TCJA. For now, though, let’s take a completely cynical—or if you prefer, strategic—approach. What changes can Republicans make to the legislation that would help them win in 2018?

As it stands, the TCJA drastically reduces the tax burden on corporations while offering only modest benefits to the vast majority of middle-income households. In political terms, at least, this gets things backwards. What Republicans really ought to be doing is ensuring that middle-income households get a very large, very visible benefit while doing just enough for America’s corporate titans to keep them from bolting to the Democratic Party.

It’s not hard to imagine what such a package would look like. Instead of cutting the corporate tax rate to 20 percent, you’d cut it to 30 percent. You’d also allow businesses to fully deduct the cost of their investments in the first year (which will make businesses that make lots of investments really happy). At the same time, you’d limit their ability to deduct interest expenses (which will make businesses that load themselves up with debt really sad). This more modest business tax reform would cost less money than the cuts spelled out in the current bill, yet it would spur productivity-enhancing investment. As an added bonus, keeping the corporate tax rate at 30 percent would eliminate the supposed need for the TCJA’s 25 percent tax rate on “pass-through” income, one of the bill’s more controversial, and most expensive, provisions.

Businesses will no doubt complain if their corporate tax cuts shrink. But would Speaker Pelosi offer them a better deal? Of course not. Republicans must simply remind corporate leaders that while they might prefer a deeper tax cut, they’d fare far worse if Bernie Sanders were the one rewriting the tax code.

Paring back the TCJA’s corporate tax cuts and eliminating the special pass-through rate will leave hundreds of billions of dollars to ease the tax burden on working- and middle-class families, for whom income taxes matter far less than payroll taxes. Here I’d recommend following Marco Rubio’s lead. The Florida Republican has emerged as his party’s most vocal champion of expanding the child tax credit and of making it refundable against payroll taxes. Ernie Tedeschi, a former U.S. Treasury economist, has observed that making the child credit refundable against payroll taxes would make the credit much more beneficial for nonrich households. What does that mean for you, GOP incumbent? It means you’d have something to crow about on the campaign trail—something far more compelling than an enormous corporate tax break.

Needless to say, re-jiggering the TCJA in this fashion will meet with intense GOP resistance. There are those in the party who believe that prioritizing the slashing of corporate tax rates is a principled move, one that should take priority over reducing the burden of the payroll tax on low- and middle-income households. I, Reihan Salam, time-traveling mystic, have one simple question for these Republicans: Are you willing to lose your seats over that principle? Even if it means you’re just paving the way for President Sanders to collectivize American agriculture? Those are the questions they need to ask themselves, because that’s exactly what’s at stake. The massive corporate tax cut you vote for today might be the last one you’ll ever be in a position to vote for.