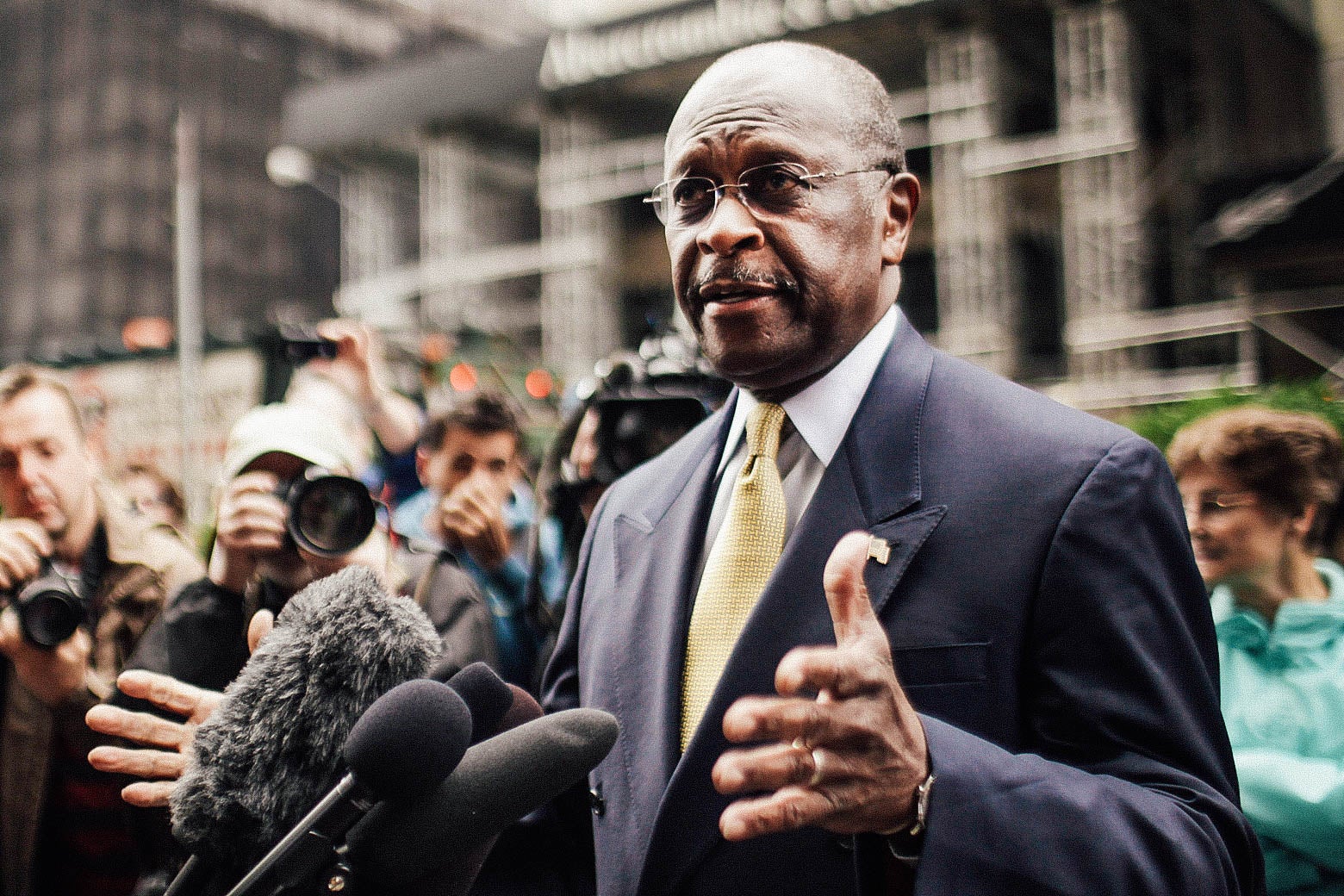

Herman Cain’s tenure at the Federal Reserve makes many conservatives queasy—even if they can’t agree on what he did there. According to Alex Jones, from 1992 to 1996 Cain was “Kansas City Board President of the Federal Reserve Bank.” According to a Cain fan at Ricochet, Cain was merely a “member of a Federal Reserve District Board.” In his book, This Is Herman Cain!, the candidate calls himself a former “head of the Kansas City Federal Reserve.”

Maybe the mainstream media has figured this out? Maybe not. According to the Atlantic, he was a “Federal Reserve Chairman.” According to the Huffington Post, he was a “director of the Kansas City Fed.” It was Cain’s only high-profile government role, and 15 years after he finished it, the public that might make him president has no idea what it was or meant.

What did Herman Cain do at the Fed, and what does it tell us about him? The answers: “Not much,” and “a little more than not much.”

There are 12 regional Federal Reserve Banks. Each has a nine-member board of directors, composed of three commercial bankers (Class A, in Fed jargon), three people from nonbanking sectors of the economy (Class B), and three captains of industry from the region (Class C). Cain was Class C. In 1992, he joined the board of directors at the Kansas City branch of the Federal Reserve. In 1994, he was chosen to chair the board.

What does the board of directors actually do? Every month that Cain was there, board members would meet, talk through the economic developments and data in their areas, and offer some advice. Fed economists would listen. The research would be taken up to Kansas City Fed President Tom Hoenig, who could use it however he deigned to use it.* “They’re a source of economic information for the bank,” explains Bill Medley, public information director for the Kansas City Fed. What’s their single biggest contribution? They recommend the discount rate, or what the Fed charges for loans. “But that,” says Medley, “has to be approved by the board of governors.”

That means that Cain’s role was chiefly as a charismatic guy who ran meetings well and corralled good advice. He was not an economist. In This Is Herman Cain!, the candidate recalls the Fed job as a Frank Capra-esque affair; a lunch with the branch manager turned into a pitch for an unexpected job.

“I thought: Wow, the Federal Reserve wants me to serve on one of its boards!” writes Cain. “That was something I had never really thought about, but it seemed pretty prestigious.” It was a learning experience, too. “Looking back on my time at the Federal Reserve, it gave me the opportunity to be exposed to macroeconomics.”

Was Cain just some naïf in the ways of high-level Fed policy? Sure. That was the point. His fellow board members would include the head of a petroleum company, a Kansas City housing advocate, and an Oklahoma cattle magnate. Bill McQuillan, the chairman of CNB National Bank in Greeley, Nebraska, overlapped with Cain for three years and shared “puddle jumper” planes with him when they needed to go to the monthly meetings.

“I liked him right away,” remembers McQuillan. “He was a family man. He talked about music a lot. Really, he was a very bright, charismatic guy.”

Cain turned the full power of his charisma on his new part-time job: Making meetings run quickly. “He’d come prepared,” says McQuillan. “His goal was to get all of us engaged in a discussion—maximum participation. He’d open, and say ‘We’ve got these issues to get through. We want to get through them as quickly as possible, and the floor is open for discussion.’ ”

The meetings would last around half a day. “If things were not quite as focused as they should have been, he’d bring them back,” says McQuillan. “He would never make a person feel like they were talking out of turn. He’d say, ‘I appreciate your comments, but in the interest of time, we should move on.’ ”

Funny enough, that’s just how Cain describes his executive style. Whenever he’s pressed on policy, on what to do in Afghanistan, on how to handle a crisis, he has a common refrain: “I’ll summon the experts.” He likes leaders who do the same, which is a reason he praises former Fed Chairman Alan Greenspan. “He would sit patiently and listen to all the reports,” writes Cain in his memoir, “hear everybody, and then come to his insightful conclusion about what we needed to do. He was a very effective leader who did not make unilateral decisions.”

Cain praised Greenspan at last week’s Republican debate, too. Right away, in the unpredictable politics of 2011, it came off like a possible gaffe. Greenspan’s reputation isn’t what it once was, nor is the Fed’s. In the 1990s, the Fed’s dual mandate of keeping inflation low and employment high wasn’t quite so tricky. When McQuillan and Cain were riding those puddle jumpers, joblessness in Nebraska fell below 3 percent. Cain focused on inflation. “When it comes to monetary policy,” fellow board member Drue Jennings told the Atlantic this year, “he was an inflation hawk.”

What does that mean in 2011? It means that Cain wants the Fed to stop worrying about unemployment and focus on keeping inflation low. In his words, the Fed’s “focus needs to be narrowed”: Worry about the currency and let the rest of us worry about jobs. That’s a common Republican critique of the Fed right now, but it’s also a little strange. Inflation hasn’t been a problem since before the Great Recession began.

Cain’s fans—and they include everyone who’s talked on the record about his Fed days— don’t knock him for that. They remember a smart guy from whom everyone expected bigger things. “One time,” says McQuillan, “I remember sitting around the table with him and talking politics. I said, ‘Herman, you’d be a great senator.’ He said it wasn’t the time for that. So I told him he’d make a great president. He looked at me like: Are you crazy?”

*Correction, Oct. 18, 2011: This article originally misidentified Kansas City Fed President Tom Hoenig’s title as Kansas City Fed chairman.