Anxious middle-class families and students are struggling with rising tuition costs, growing inequality, and fewer clear paths for upward mobility. The prescription has long been to get a good education for a good job and good life. But what is “good,” and how are you supposed to pay for it? The answer isn’t as clear as it once was. With total student loan debt in the U.S. topping $1 trillion, it seems like a bad time to talk about how an anti-poverty program became a middle-class entitlement program. Designed as part of Lyndon Johnson’s Great Society vision of a war on poverty, the Higher Education Act of 1965, which established financial aid assistance for students in need, had a clear goal: to give the poor an equal shot at college. Today, more than half of all students use federal financial aid to pay for college, but the program’s anti-poverty focus has been replaced with a fuzzy affordability mission. More middle-class families are using programs designed as an anti-poverty solution, and poorer students are getting short shrift.

I made a pretty straightforward argument in the New York Times to this effect: If we are not clear as to what financial aid programs are supposed to do, they will work best and most for students with the resources to work the system. Commenters at the Times took issue with the idea that middle–class families do not deserve government assistance just because they have done all the right things and worked hard and prepared their kids well. They are right that tuition costs are outpacing the ability to pay, but we disagree on what financial aid is supposed to do—and that is not an accident. When financial aid went from addressing poverty to finding a fair way to help all students pay for college, it made strange bedfellows of students who have competing interests.

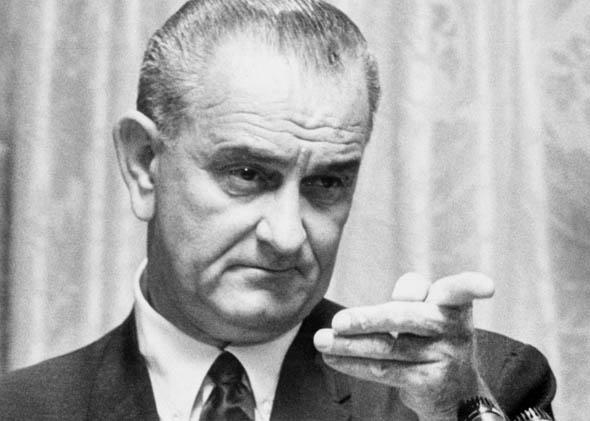

When I know what a thing is supposed to do, I know how to measure how well it is doing that thing. When financial aid was clearly about leveling the playing field for poor students by helping them do what wealthier families had for generations—pay for college—we had a good idea of how to gauge the success of financial aid. Ronald Reagan said of Johnson’s war on poverty that “poverty won”—a dig at Johnson’s social security and welfare programs. But Reagan never could have said federal financial aid had failed, because by almost any measure it was a success. With the means to pay for college, a record number of women, African-Americans, and low-income students changed the face of higher education in the 1970s.

How do you sell a successful program as a failure? Beginning with the Reagan administration, conservative rhetoric recast an anti-poverty mission as anti-equality. According to this line of thinking, by focusing on increased diversity in higher education, federal financial aid programs penalized wealthier families whose only crime had been playing by the rules and winning at life. By reducing Pell Grants, requiring tax forms for the poorest recipients, and reducing government subsidies of student loans, the government made the assumption that—as with the infamous “welfare queen” myth—the poor were prone to committing federal aid fraud.

While we think of “fair” as an absolute measure, in reality “fair” is awfully relative. Poorer students need financial aid to afford college, but are more likely to come from schools, families, and communities that cannot guide them through the process. At the same time, wealth advisers and elite media counsel wealthier families on how to leverage cheap financial aid money to protect family assets like investments and home equity. In practice, this is how inequality is reproduced. Financial aid reform largely focuses on making college more affordable. Like “fair,” that sounds reasonable—until we ask, Whose measure of “affordable” are we using?

For wealthier students, achieving “affordability” may mean going to a more prestigious private or out-of-state college instead of taking the cheaper in-state option. For the poorest students, affordability may mean going to college instead of not going to college. Both are worthy goals, but when one program tries to serve them both, a muddled mission makes it hard to choose whose needs come first.

One example of this conflict is the requirement to submit your family’s income information on the Free Application for Federal Student Aid, known as FAFSA. The process is designed to dole out grants and loans based on how much a family needs the help. But the form doesn’t necessarily give an accurate reflection of a family’s true wealth—it doesn’t ask for home equity value, for example. Wealthier people tend to own homes with more equity. Homeownership is the primary form of wealth-building in this country—and it is primarily a concern that poor people don’t have.

If relatively wealthy homeowners can withhold relevant data from the FAFSA, why do poor students with almost every other indicator of high financial need have to provide family income information to get financial aid? Poor students can be estranged from parents because of incarceration, illness, or countless other reasons. (On Twitter, one reader of my Times piece recounted losing a Pell Grant due to lack of information from an estranged parent.) But without providing their parents’ income information, most cannot get financial aid; a lengthy, daunting appeals process often results. If we were clear about whom financial aid should serve most and best, then changing the form for poorer students would be a no-brainer.

But that hasn’t happened, and neither have a host of other financial aid reforms that have been proposed over the years. The result is that even though financial aid was founded and expanded to stymie inequality, unequal experiences of what’s fair have made a Great Society program just another entitlement for the wealthiest few who know how to game the system.