On Wednesday, Rex Tillerson, the chief executive officer of ExxonMobil, said the oil giant doesn’t invest in renewable energy because “we choose not to lose money on purpose.”

The implication, of course, was that it’s difficult—even impossible—to realize a return on investments made in solar and wind. That may be true for a company like ExxonMobil, which has a market capitalization of more than $350 billion. But it’s not impossible for an entity that has a much smaller net worth.

For example, me.

When I saw Tillerson’s comment, I decided to go back and look at a tiny investment I made in renewable energy a couple of years ago. And it turns out it’s paying off quite well. (Note: This column doesn’t endorse or recommend investments, and I don’t invest in individual stocks.)

In the spring of 2013, I was working on an article about new funding models for solar energy and came across Solarmosaic. The company, based in Oakland, California, was crowdfunding to finance the construction of large solar power systems that could be placed atop schools or commercial buildings. (It has since shortened its name to Mosaic.) The idea was to pool funds from individuals and lend the money to a third party that would construct or purchase the solar panel systems on top of buildings. The borrower, in turn, would sign a power purchase agreement, or PPA, with the building owner under which the building owner would buy the output of the panels at a comparatively low, fixed price for a period of 20 years. That stream of monthly payments received by the owners of the solar panel system would be funneled to Mosaic in the form of loan payments—interest and principal. Mosaic, after taking a small fee for its expenses, would redirect that stream of cash into the accounts of investors as interest and principal payments.

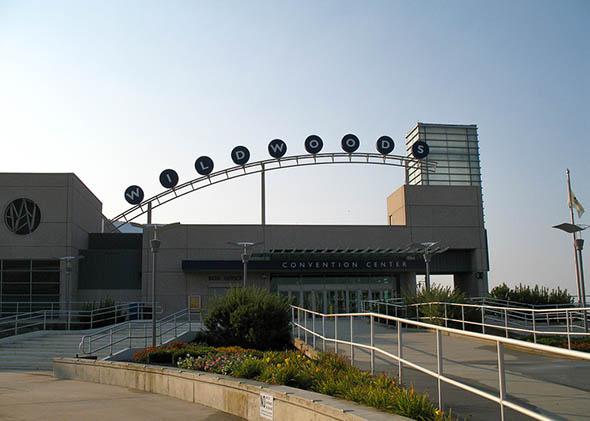

To see if it would really work, I opened a Mosaic account and spent $100 to participate in a loan made to a solar project built atop the Wildwoods Convention Center in Wildwood, New Jersey. The facility, owned by the New Jersey Sports and Exposition Authority, is run by the Greater Wildwoods Tourism Improvement and Development Authority. It sits along the ocean, just north of Cape May.

After Mosaic raised the funds from me and hundreds of other investors, it made a $350,000 loan, at 5.5 percent interest, to Energy Finance Corp., an entity formed to own the system. To pay back the loan over 114 months (a little less than 10 years) Energy Finance Corp. could count on two streams of revenue. First, under a 20-year PPA, it would sell the electricity produced by the panels to the convention center, starting at a rate of 11 cents per kilowatt-hour. Second, the company would sell the SRECs—solar renewable energy credits—that it would be granted for the power it produced to the Atlantic City Electric Co. (Utilities buy SRECs to comply with regulations requiring them to support the generation of renewable energy.) The combination of these two revenue streams, it was promised, would be more than enough to cover the principal payments and 5.5 percent interest. The panels will produce slightly less power as they age. But the PPA calls for the price the convention center will pay to rise by 3 percent per year, which should help keep the payments steady over the term of the loan. After taking a 1 percent annual fee for its expenses, Mosaic promised investors a return that would average 4.5 percent annually. (This is all laid out in the prospectus.)

How has it worked? Well, it’s been 26 months. And so far, it’s worked exactly as advertised. According to Mosaic, this project has made more than 30,000 on-time monthly payments to investors. Every month, like clockwork, payments are credited to my account. The payments vary by month—typically 89 or 90 cents between January and March, $1.01 in the spring and fall months, and $1.61 monthly in the summer. Why? The payments are based on the power produced, which in the Northeastern United States varies significantly from the short winter days to the long summer days.

Thus far, the 26 payments I’ve received have included $10.52 in interest and $19.32 in principal. Backing out the $1.42 in platform fees I’ve paid, the total return has been $9.10—which comes out to an annualized return of almost exactly 4.5 percent.

Which is not bad for a fixed-income investment. Interest rates have been suppressed in recent years by the Federal Reserve and by slow economic growth. It’s difficult to get any yield at all. Ten-year U.S. government bonds—the safest asset known to man—pay interest of just 2.13 percent per year now. My solar-backed 10-year pays twice as much as that. But it carries more risks. Unlike governments bonds, it can’t be traded. I’m stuck holding it for the 114-month duration of the loan. And things could go wrong. The convention center could get destroyed in a hurricane, the panels could degrade faster than expected, we could face a plague of darkness.

But those are relatively remote prospects. And in the meantime, the payments flow in regularly. When investments in solar energy are structured conservatively, it turns out, the returns can be as reliable as the rising sun.