On Independence Day, Bloomberg reported the latest triumph of America’s energy boom. Earlier this year America’s daily production surpassed Saudi Arabia’s and Russia’s. Since the boom has continued, the U.S. is likely to close 2014 as the world’s oil champion. It’s all about fracking. As the data for oil production shows (go here, and here), in 2013, the U.S. produced 7.44 million barrels of crude oil per day, the highest level since 1989, and up 49 percent since 2008. When we take into account liquid fuels produced from natural gas, America’s production stands at about 11 million barrels per day and rising.

That’s good news. But it shouldn’t be viewed in isolation. From an economic perspective, success is based on what you do with an abundant natural resource. Norway, for example, has funneled oil wealth into a giant pool of cash ($840 billion and growing) that has become one of the world’s biggest mutual funds. In Nigeria, by contrast, the oil wealth has largely been siphoned off. If you pump a lot of oil out of the ground, subsidize its purchase, and stuff it into gas-guzzling vehicles (like Venezuela and Saudi Arabia do), or burn it to create electricity (like Puerto Rico does), rising production doesn’t help much.

On a macro level, it turns out the U.S. has actually managed the oil boom with some modicum of intelligence. It’s little-appreciated, but the boom in oil production has coincided with a quiet revolution in the way Americans use oil. At the same time we are pumping more, we are using less, and using it more intelligently. Consumption amounted to 18.9 million barrels per day in 2013, which was up from 2012. But that rise followed seven years of net decline, from 20.8 million barrels per day in 2005 to 18.49 million barrels of oil per day in 2012. Between 2005 and 2013, oil consumption fell 9 percent in absolute terms.

Transportation accounts for about 72 percent of petroleum and other liquid fuel use. And this vital sector has become much more efficient in recent years, thanks to the advent of hybrids, the imposition of new standards, and persistently high gas prices. The typical car sold in June 2014 got 25.5 miles per gallon—hardly great, but up 27 percent from October 2007.

The improvement has been even more dramatic in the trucking sector. Companies that own fleets have much more to gain from improving the efficiency of their vehicles than car drivers do. As a result, we’ve seen a host of innovations. Companies are converting vans into hybrids. Transit systems are buying new buses that run on natural gas, which is cheaper and burns cleaner. Today about one-third of the trucks on the road run on clean diesel engines, up from 9.4 percent in 2007. Commercial fleets are simply not burning oil the way they used to. As a result, gasoline consumption in the U.S. in 2013 stood basically where it did in 2002. At 3.2 billion barrels in 2013, gasoline consumption was down 5.5 percent from 2007.

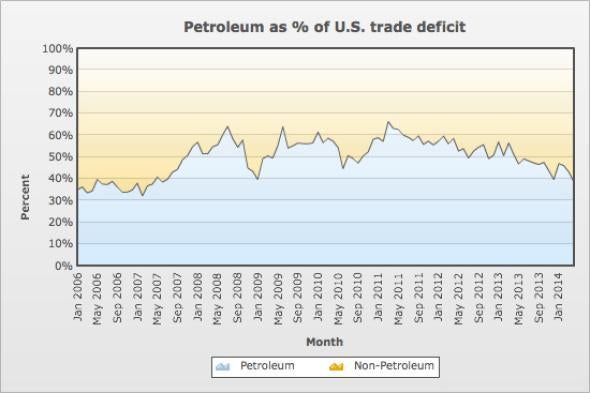

Rising domestic production and falling domestic consumption have led to a sharp decline in the import of oil, which is very good news, as the large and gaping trade deficit has been a persistent problem for the U.S. in recent years. When a country imports more stuff than it exports, it is a drag on economic growth. The volume of imported oil has fallen sharply, from 3.7 billion barrels in 2006 to 2.8 billion barrels in 2013—down 24 percent. Since prices have remained elevated, that means the value of petroleum imports (which matters more than the volume) is falling as well. In March 2011, according to the Census Bureau, oil imports accounted for 66.2 percent of the trade deficit. In April 2014, they accounted for just 38.4 percent.

Courtesy of the United States Census Bureau

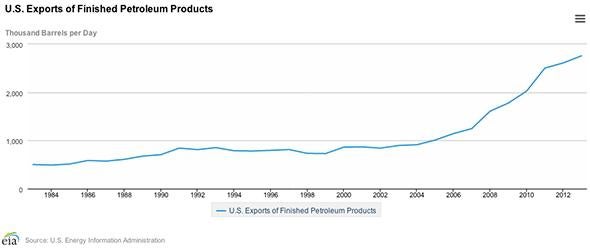

The portion of the trade deficit attributable to petroleum is also falling because exports are rising. There’s a lot of debate now about the potential for exporting oil. The general presumption is that we don’t share any of our hydrocarbon production with the world, but it’s more accurate to say that we don’t export much oil in its crude form. (In fact, last year, the U.S. exported 43.8 million barrels of oil, double the rate of 2012, and up nearly tenfold since 2003, representing only a few more days of production.) But we are exporting plenty of crude oil in different forms, like motor gasoline.

Courtesy of U.S. Energy Information Administration

The U.S. has lots of refining capacity but slack demand. Other parts of the world, including regions close to us, are a mirror image: They have a dearth of refining capacity and sharply rising demand for gasoline. The U.S. has found significant new export markets for refined products like gasoline in South America, Central America, and especially Mexico, where auto sales are rising sharply—about 44 percent of U.S. gasoline exports go to Mexico. In fact, exports of refined petroleum products have soared in recent years, rising from 913,000 barrels per day in 2004 to 2.76 million barrels a day in 2013. In other words, exports of petroleum-related products have risen far more rapidly than production.

The story of energy and the economy is about much more than production. Simple extraction only gets you so far. There are four components of what I’ve dubbed the New Energy Equation: Make more, use less, manage it more intelligently, and take it to the world. With oil, the U.S. is having some success with each of these variables.