Interest rates have been falling once again. The yield on the 10-year U.S. Treasury, which acts as a global benchmark of sorts, dipped as low as 2.44 percent last week, which is well below where rates began the year—and lower than at most points throughout the 20th century and into the first decade of the 21st.* At no point between 1961 and 2011 were rates as low as they are now, and for most of that time, the yield on the 10-year was above 6 percent.

One of the consequences of this period of extremely low rates is that anyone who wants or needs higher returns has started to look elsewhere. Hence the widespread appeal in recent years of emerging market bonds that were once seen as speculative at best. This also explains the flood of money into a category once seen as dicey at best: junk bonds.

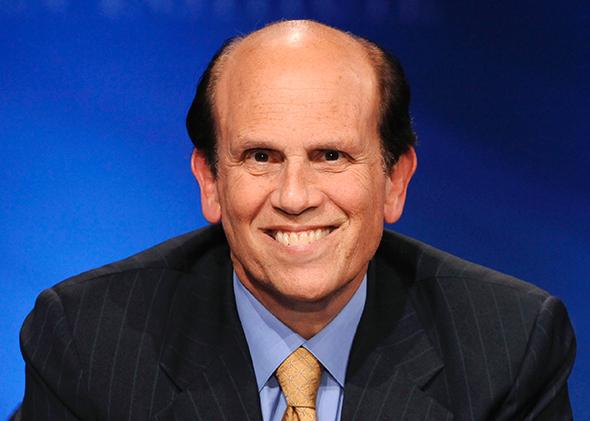

Junk bonds are back, though in truth they never went away. In polite company and tony investing circles, they are now known as “high-yield bonds” for the simple reason that their level of purported risk demands higher rates to entice investors. “Junk bonds” evokes images of 1980s corporate excesses, so perfectly captured in Connie Bruck’s masterpiece The Predators’ Ball. Junk in the ’80s was the purview of Drexel Burnham and Michael Milken, and when scandal engulfed both at the end of the decade, junk bonds saw an already shady reputation get shadier.

Flash forward 30 years to today. Now, bond funds looking for outperformance are putting more assets into junk bonds, which yield several percentage points more than their more staid sovereign and corporate brethren. A more vanilla set of high-grade bonds—let’s say, German government bonds and G.E. —might return 2 percent to investors in today’s climate. Junk bonds returned nearly 7.5 percent in 2013.

But all this money pouring in—$2 trillion at last count—will inevitably raise concern about a bubble, or if not that, then at least a market that is setting up for some nasty surprises. Jeffrey Gundlach, a leading bond manager who has ridden the junk wave quite profitably, now believes that too much money is sloshing around the space. He has begun to pull back, concerned that a correction or worse is on the way.

The larger point is not whether these investments turn sour. Maybe they will—that possibility is always part of the spectrum. The animus and anxiety, however, are part of a market psychology that still veers toward an assumption that things are out of whack and bubbles are forming here, there, and everywhere.

Step away from the short-term market call, however, and the movement of money into junk bonds makes eminent sense. Or rather, it makes sense if you believe that the financial system is not on the verge of another collapse. If that happens, then yes, many of the companies that have issued junk bonds will default and implode, creating a world of pain for investors left holding the nearly worthless debt. But if that implosion doesn’t happen and the financial system remains stable, then today’s returns on what is classified as “junk” might seem not only reasonable but even high in comparison to what they might be in a few years.

We’ve lost track of what these bonds actually were and are: Instruments that allow riskier ventures to be funded. Historically, risk didn’t necessarily mean financial risk. The rise of modern Las Vegas was facilitated by junk bonds because traditional banks wouldn’t lend to an industry considered to be (for good reason) the playground of the mafia. There aren’t many more surefire business ventures than owning a casino in the right location. But they just couldn’t get funding.

Today, with so many banks chary of risk and forced by a new regulatory framework to be more diligent than they were in the early 2000s, the only way more speculative, untested, and creative companies can finance themselves is by turning not to banks, but to the marketplace. When these companies raise debt, they are first graded by a ratings agency such as S&P, Moody’s, or Fitch, which assigns the debt a rating based on an analysis of the company’s debt, metrics, and its chances of meeting its obligations under a variety of scenarios. Companies that are seen as riskier get a lower grade, and then lower ranks are considered “junk.”

It might come as a surprise that companies rated “junk” include the likes of Sprint, T-Mobile, and Chrysler. They’re rated junk because they all require massive amounts of spending and take on high levels of debt. These are hardly sketchy companies.

In a world where the cost of capital is cheap and perhaps getting cheaper, however, the primary risk is not that rates will spike and a business won’t be able to meet its debt payments. The primary risk is that the business itself will fold. And on that score, most companies that successfully raise debt in public markets have passed enough scrutiny that they can repay their debts. There is very little equivalent in the bond market of the almost non-existent lending standards that existed in the mortgage markets in the early 2000s. Firms whose bonds are rated junk, therefore, may be riskier than GE or U.S. Treasuries, but they are likely to be much less risky than the market thinks.

The statistics bear that out. The default rate for junk bonds—1.7percent—is the lowest since 2008, and far below the 4.5 percent average since the early 1990s. You can view this the calm before the storm. Through that lens, low levels of default are simply a product of too much easy money, thanks to central banks still providing too much easy money. If and when that dynamic changes, so the thinking goes, rates will spike, and we will see a wave of defaults that will more than justify the moniker “junk.”

We won’t know until we do, but it may be that the markets and investors have it just about right: Absent crisis or a sharp, sudden rise in rates, capital is cheap and many companies are being treated as riskier than they are. This is happening only because of the expectation that we are in a lull rather than a new, long-term trend of cheap capital and low rates, which markets can provide more than traditional banks can. If that’s the case, then it is time to stop viewing these investments as junk and start viewing them as simply one more investment opportunity—one with perhaps more risk, but hardly one giving signs that the herd is galloping toward the cliff. And if the financial system does implode again, it won’t be because of junk bonds—how they perform will be among the least of our worries.

Correction, June 2, 2014: This article originally misstated that the yield on the 10-year U.S. Treasury dipped as low as 2.44 percent this week. It dipped last week.