Here’s a policy riddle for you: Over the past several decades, the American safety net—that vast web of benefit programs aimed at helping low-income households in the U.S.—grew briskly. And yet, by at least one economist’s measure, our spending on the very poorest families dwindled. What happened?

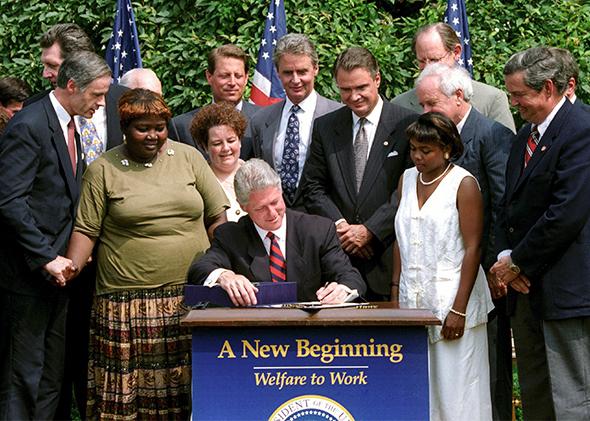

Bill Clinton happened, for one. Earlier this month, Johns Hopkins University professor Robert Moffitt presented new research showing how Washington has gradually shifted its anti-poverty dollars away from the most destitute Americans and toward people whom voters tend to think of as “the deserving poor”—which is to say, working parents. He found that families living far below the poverty line, who are often unemployed, now receive less money from the government than they did in 1983; meanwhile, families living just above the threshold receive significantly more. Clinton’s 1996 welfare reform legislation, Moffitt argues, is a major reason why.

Looked at as a whole, the entire safety net has clearly gotten wider, even when you remove programs like Social Security retirement benefits, Medicare, and Medicaid from the equation. Moffitt shows that per-capita spending on means-tested programs, such as food stamps, Supplemental Security Income, and the Earned Income Tax Credit, increased 89 percent between 1986 and 2007.

But Moffitt shows how that overall expansion masks key changes that have cut benefits for families with incomes that amount to less than 50 percent of the poverty line. Most important was the end of welfare as America knew it. In order to encourage more single mothers to enter the workforce, the Clinton administration eliminated the old Aid to Families With Dependent Children, which had served as an open-ended federal commitment to help poor parents. Its replacement, Temporary Assistance for Needy Families, includes work requirements, and only gives states annual grants that don’t grow with inflation. As a result, welfare spending, which traditionally reached the poorest of America’s poor, has plummeted, and has been redirected to mothers who are employed.

Much of the safety net’s growth, meanwhile, was concentrated in tax credits, which tend to benefit working families right under or right over the poverty line. As Moffitt notes, the Earned Income Tax Credit, which was expanded by both the Reagan and Clinton administrations, gives its biggest benefits to households that make between $10,000 and $20,000 per year.*

Using the Survey of Income and Program Participation, Moffitt finds that single parents with incomes below 50 percent of the poverty line received 35 percent less in 2004 than they did in 1983. By contrast, families that earn between 100 to 150 percent of the poverty threshold receive 74 percent more benefits.

Moffitt halts his analysis before the 2008–09 recession in order to capture long-term trends before the government began efforts to counteract the downturn, by extending unemployment insurance and encouraging states to enroll as many families as possible in food stamps. Yet, even with those increases in spending, an earlier paper of Moffitt’s on the safety net and the recession suggests that, as of 2010, the poorest of the poor are still receiving less support on average than they were in the early 1980s.

There is one potential weakness in Moffitt’s analysis that I think critics may seize on. When he calculates how much money poor families received from the government in 2004 versus 1983, he does not include Medicaid benefits, in part because his data source doesn’t track them. Moffitt argues that if he were to include Medicaid spending, he would also have to add on the value of employer-provided health care, which goes untaxed, so the distribution of spending across families wouldn’t change greatly. That may be the case. But because per-patient Medicaid spending has risen with time, it could change the math on whether the very poorest families actually get more or less in benefits than they did during the Reagan era.

That shouldn’t distract from the broader trend that Moffitt is illustrating. The safety net was once designed to lend cash support to the very poorest Americans. Now, it mostly helps the moderately poor. The idea, again, was to encourage more work. But at a time when jobs are scarce, it feels like we have turned our backs on those who need help most.

*Correction, April 12, 2016: This article originally misstated that the Child Tax Credit was not refundable, and thus unavailable to anybody who did not pay taxes. It is partially refundable. (Return.)