This week, the Congressional Budget Office projected that the federal government would earn roughly $127 billion from student lending during the next 11 years.* That estimate is down a bit from previous figures but is surely high enough to infuriate liberals like Sen. Elizabeth Warren, who tend to regard the idea of a profitable student loan program as fundamentally indecent.

While browsing the CBO’s data, however, I noticed something intriguing about those fat-sounding profits: Most of them don’t come from undergraduate lending. The Department of Education is really making its killing by loaning money to grad students. And, with all due respect to any disgruntled J.D.s or Ph.D.s reading today, there’s really nothing wrong with that.

First, the big picture. Through 2024, the CBO expects our government to rake in a $149 billion profit on new direct loans to students. Grad school lending will generate about three-quarters of those returns, which fall to $127 billion once you subtract administrative expenses and costs associated with the discontinued guaranteed lending program.

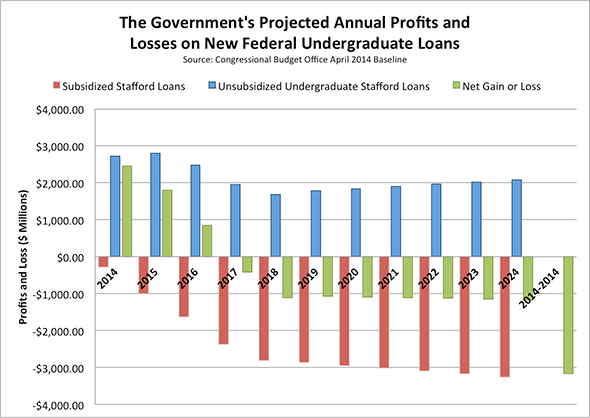

At the same time, the government will lose a small amount of money on direct loans to undergraduates, which make up more than half of its lending operation. While the Department of Education makes a profit on unsubsidized Stafford loans to college goers, it takes a hit on subsidized Staffords that go to low- and middle-income undergrads. When everything shakes out, the programs combine for an 11-year, $3 billion net loss.

Chart by Jordan Weissmann

A quick note for the curious: If you click through to the CBO’s projections, you won’t see these numbers spelled out. Instead, you have to multiply the annual loan volumes by their “subsidy rates.”

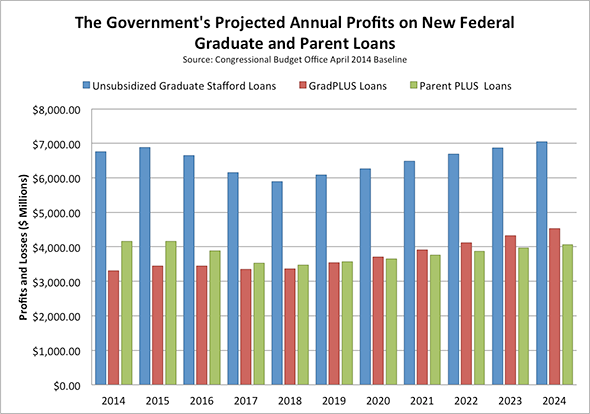

Now back to those grad schoolers. Their loans, which are shown in red and blue below and now make up about one-third of the government’s yearly lending portfolio, are expected to yield almost $113 billion over the 11-year window before admin costs. Once again, that’s three-quarters of the government’s direct lending profit. Graduate students are such lucrative customers because they pay higher interest rates than undergraduates and don’t default all that often. For the government, they’re low-risk, high-reward borrowers.

Chart by Jordan Weissmann

Here’s where the government is expected to make a bit of money off of undergraduate students: lending to mom and dad. Parent PLUS loans, which are only available to the parents of undergrads and are shown in green above, are expected to rake in a bit more than $42 billion over 11 years. Parent loans make up a mere tenth of the total undergraduate portfolio. But again, thanks to low default rates—unlike other student loans, they involve a light credit check—and high interest rates, they yield a nice return for the Department of Education.

Conservatives will argue that the government’s student loan profits are an illusion created by bad accounting. The debate is long and technical, but their basic qualm is that when the government calculates its expected returns, it misleadingly chooses not to factor in all of the same risks that a bank would, such as a possibility of a downturn in the entire market. But the feds do not actually face the same risk as a private investor, because, among other things, it doesn’t have to worry about going bankrupt. Pretending that it does would only inflate the on-paper cost of its lending programs.

It’s also possible, however, that grad school lending will turn out to be less profitable than the CBO now expects, for reasons completely unrelated to budget math—for instance, if more borrowers than expected flock to income-based repayment, which offers loan forgiveness after 20 years. That, in turn, would cut into the government’s bottom line.

But let’s assume, for the sake of argument, that those projected profits from graduate lending are real. If so, they’re probably not something we should be worked up about.

There’s a strong argument that the government has an obligation to keep undergraduate education affordable, because it is quickly becoming a required stepping stone for life in the middle class. Few would argue, however, that Washington has an imperative to keep graduate education especially inexpensive. A relatively small slice of Americans ever get an advanced degree, and the financial benefits of doing often outweigh the costs. It’s true that the high price of grad school might keep some talented professionals, such as doctors and lawyers, out of public service, which is a concern. But that’s why the government offers loan forgiveness to government and nonprofit workers.

So long as the feds don’t charge utterly usurious interest rates—and if they were, the private sector would likely step in and siphon off more customers—then making a profit on lending to MBA students and their ilk doesn’t strike me as fundamentally wrong. Of much greater concern is the possibility that limitless government lending is allowing grad school tuition to spiral out of control. If that’s the case, making loans even cheaper might turn out to be counterproductive.

There is a question, however, about what to do with these profits. Some might suggest lowering the lofty interest rates charged on parent loans, which indirectly hit undergraduates, or further subsidizing Stafford loans. But perhaps instead of making borrowing inexpensive, the government should focus on using its budget to cut down student borrowing altogether—say, through grants. After all, cheap debt is still debt.

*Correction, June 16, 2015: This article originally misstated that the CBO’s 11-year estimate window was 10 years.