As Obama begins his second administration, the reality is that, as with most incumbent presidents, his biggest legacy-defining achievements are behind him. His mostly successful response to the financial crisis is in the past, and it seems unlikely that he will sign into law any bills on the scale of his health care overhaul. But whether that legacy looks good or bad four years from now will hinge largely on the pace of the ongoing economic recovery—something that he has remarkably little control over.

The good news for the president—and the country—is that the odds of recovery are pretty good. One defining feature of last year’s campaign was that the winner seemed destined to inherit a recovery and a fortuitous situation in which even an average four-year run of economic growth would look great compared to Bush’s second term or Obama’s first. What we’ve seen since the election confirms that. November and December jobs numbers came in OK. House prices are rising and construction activity continues to grow. The eurozone is still mired in recession, but the risk of contagious financial blowup now looks very low. The budget deficit, though high, is falling and set to continue falling for years.

But the triumph, such as it is, is largely one of diminished expectations.

The American economy has outperformed its peers in Europe, Japan, and the United Kingdom. It has exceeded the typical recovery in the wake of a financial crisis. But compared to pattern of other recessions in American history, it’s been extraordinarily weak. The end of a recession is typically characterized by at least a short spurt of very fast bounce-back growth. Firms rehire workers they’d laid off months earlier, and new businesses take advantage of depressed prices to grow at superspeed. That hasn’t happened this time around. The economy went from freefall to stable to steady growth without ever having that catch-up moment. Consequently, the employment rate is ticking down slowly and the share of the overall population with a job has been essentially flat since the economy hit bottom.

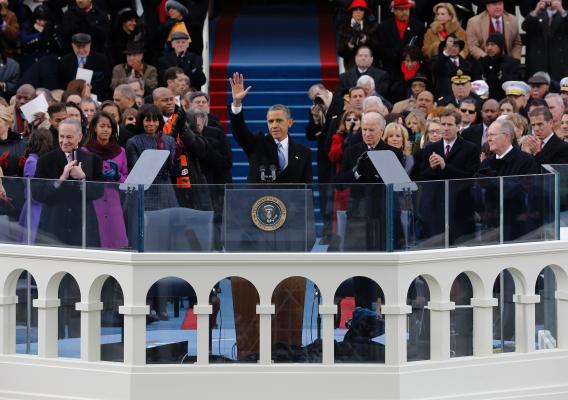

In his second inaugural address, Obama had essentially nothing to say about changing that. He observed that “an economic recovery has begun” sandwiched between a promise that “a decade of war is now ending” and the observation that “America’s possibilities are limitless.”

The choice to essentially ignore the question of boosting the pace of labor market recovery was disappointing, but in a way it was refreshing. Presidents and presidential candidates have a tendency to overpromise—to commit themselves to things they lack the constitutional or statutory authority to affect.

In Obama’s case, the last plausible moment for a meaningful economic stimulus measure came and went in December. The administration entered the fiscal cliff negotiations with an ambitious program to boost the economy with a payroll tax extension and the main provisions of the American Jobs Act. Republicans were, of course, skeptical. The administration folded quickly, preferring to put its negotiating muscle behind the goal of higher taxes on high-earning Americans. By sealing the fiscal cliff deal and then forcing House Republicans to back down over the debt ceiling, Obama averted a major stumbling block to recovery. But future budget negotiations will focus on exactly how much spending should be cut, and perhaps what kind of taxes will go up. Boosting the economy with short-term spending or temporary tax cuts is off the table.

That’s OK as long as the economy keeps plugging along. It probably will do so, but of course nobody expects a recession or a financial crisis. If we run into trouble, Obama will have few tools at his disposal.

The real responsibility for addressing any future disruptions will lie to an even greater than usual extent with the Federal Reserve. Indeed, Obama’s ability to preside over a continuingly recovering economy lies largely with the Fed. Thus far, the Fed’s recently announced unconventional policy approach of promising to keep interest rates low even if inflation temporarily rises above 2 percent seems to be working as planned. With the presidents of the Boston and Chicago Federal Reserve Banks rotating in, the new lineup of members of the Fed’s Open Market Committee should be even more pro-growth than last year’s. But one never knows what the future will hold. A recurrence of the kind of commodity price spikes that characterized the first half of 2008 could derail monetary stimulus just as they did five years ago.

But the most likely scenario is continued steady-but-not-spectacular growth that makes Obama look pretty good even without further dramatic legislative gains. Piling on a bit more than 100,000 jobs per month won’t lead to strong wage growth or cure the Great Recession’s legacy of long-term unemployment. Still, it should be ample to keep the unemployment rate on a downward trajectory. That, in turn, will associate the Affordable Care Act in people’s minds with a time of economic growth, and seal Obama’s legacy as the president who cured the economy. But he’d better keep his fingers crossed, because if anything unlikely happens, he’s going to find that he’s operating with little margin for error and few opportunities to provide additional boosts.