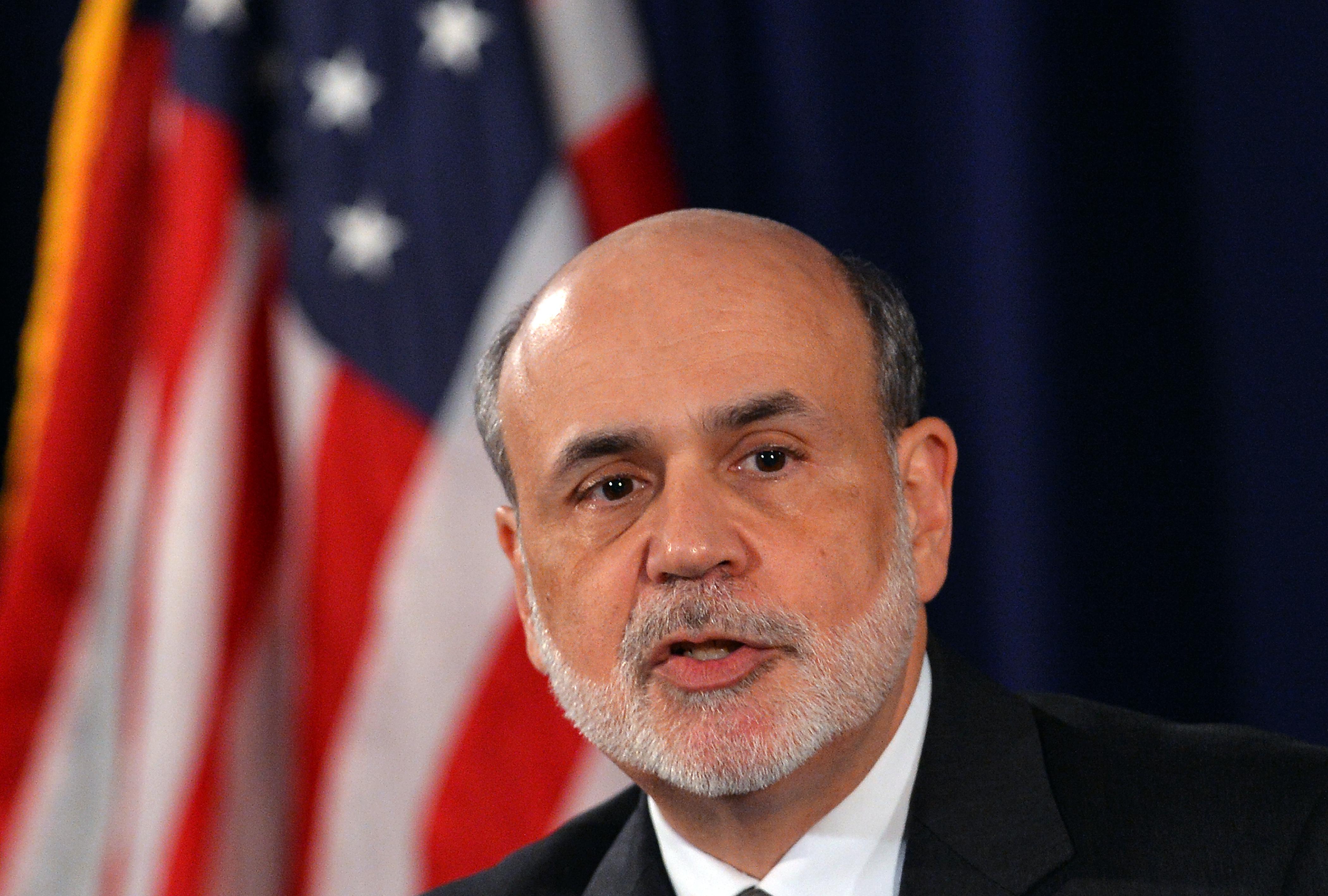

The third round of quantitative easing announced by Federal Reserve Chairman Ben Bernanke last week gives the economy a great chance of strengthening in the months to come. But predictably, new moves from the Fed gave rise to new criticisms—contradictory ones, one generally coming from the right and one generally coming from the left—that highlight the two biggest myths about monetary policy around today.

The first is the idea that loose money “punishes savers,” a myth Mitt Romney himself seemed to subscribe to in remarks made at a fundraiser. He said that “as the Federal Reserve keeps on trying to stimulate the economy by printing more money there’s a cost to that,” including “the value of your savings goes down.”

But does a loose money supply actually erode the value of your savings? Rampant inflation certainly destroys the value of savings, but does a small expansion of the money supply? When the Fed increases the money supply—and especially when it pairs such increases with words suggesting it might be willing to tolerate a little bit of extra inflation as the economy recovers—it does erode the value of whatever cash you’re keeping around the house. But people don’t—and shouldn’t—save for retirement by hoarding coins in their sock drawer. You save money in a 401(k) or IRA that owns stocks and bonds, you put money in an interest-bearing bank account, or you purchase individual investment vehicles with a broker or an online service. A little cash lying around the house is convenient, but not an important part of any sensible person’s saving strategy. And a growth-oriented monetary policy doesn’t hurt people saving in normal ways, even if it leads to a somewhat faster pace of inflation, because their return on investment rises even as inflation rises.

Older conservatives are perhaps thinking of the bad old days of the 1970s. During that decade, the consumer price index increased more than 2.5 percent every year. In the second half of the decade, it increased at least 5 percent and as much as 13 percent per year. That’s a whole different scale of inflation from what’s under consideration in current monetary policy. Today the question is whether the rate of increase can be allowed to peep temporarily above 2 percent. That ’70s inflation really did punish savers, and not just because it was high enough to produce serious economic distortions. That’s because those were the days when Regulation Q capped the interest rate banks were allowed to offer on a savings account. This was a nominal cap, not adjusted for inflation, so when the inflation rate got high the real value of the interest rates paid collapsed.

Today’s banking system isn’t like that. Interest rates are set in the market, and consumers have access to a range of savings vehicles such as money market accounts that didn’t exist in the ’70s. If inflation were to rise to 3 or even 5 percent, interest rates would simply rise to compensate as banks competed for customers’ money.

For more evidence that loose money doesn’t destroy savings, look what happened to the stock market after the QE3 announcement. There was unmistakable surge. Those who own stocks are also savers. Stocks surge when the economy is thriving. There is a strong, and rational, belief that QE3 will improve the economy overall, which will boost share values.

This brings us to the liberal myth that, as popular progressive blogger and economist Duncan Black put it, the purpose of monetary easing is to goose financial asset prices. It’s true that some economists think the so-called “portfolio balance effect” (basically, your investments are doing better so you feel richer and spend more) is an important channel for monetary policy, but it’s hardly the key thing. A recession is mostly a drought in investment—both business activity and homebuilding—caused by a mismatch between the amount savers want to save and the amount investors want to invest. The desirability of new investment depends in part on whether you think other people will also be investing. Stimulative monetary policy tries to coordinate expectations around a higher path of investment and growth.

When it works that shows up in the stock market. Share prices aren’t a great long-term indicator for overall economic health because they could go up for either of two reasons. On the one hand, growth might accelerate. On the other hand, the profit share of national income might rise. But in the short term, QE3 can’t do anything to the profit share. The increase in stock prices either reflects pure coincidence or else expectations of faster economic growth. The fact that shares have gone up routinely after each round of Federal Reserve quantitative easing and after each round of stimulus from the European Central Banks suggests it’s not a coincidence. These moves aren’t giveaways to stock owners and they’re not punishing savers either. They’re win-win economic policy that the economy badly needs.