When the market closed last Friday, a share of Barnes & Noble was worth less than $14. By the time the opening bell rang on Monday, that same share was worth more than $25. A couple of days of trading have seen the price settle around $20.

These gyrations are a powerful reminder that financial markets move not only based on highly uncertain forecasts about the future, but also because of the whims of a handful of individuals. Specifically, the book retailer that looked to be on death’s door has been rapidly rescued because someone at Microsoft decided to get into the book business. On April 30, the cash-rich tech giant unexpectedly announced that it was pouring $300 million of startup capital into a new Barnes & Noble subsidiary in exchange for a 16.7 percent stake in the new company. According to basic math, that made the bookstore chain the owner of 83.3 percent of a $1.7 billion company, sending the overall stock price leaping. Beyond giving a shot in the arm to the ailing retailer, this at least holds out the prospect of transforming the e-book industry just weeks after the Justice Department transformed it with an antitrust lawsuit against Apple and several major publishers.

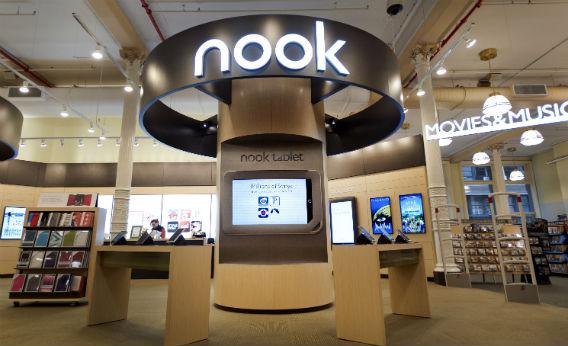

The partnership came together so swiftly that the companies involved didn’t even bother to come up with a name for their new venture, instead provisionally titling it Newco. Newco is made up of Barnes & Noble’s Nook business and its college division, plus a bunch of Microsoft’s money and patents, along with presumably some expertise.

This amounts to a bailout of Barnes & Noble so potentially transformative that it’s extraordinary Microsoft didn’t get a larger equity stake. In principle, Barnes & Noble should have strong prospects in the e-book market. It has a decent device, a brand people recognize and associate with books, and longstanding relationships with book publishers. Its problem is that the other two major e-book sellers—Apple and Amazon—are cash-rich, growing technology companies. Barnes & Noble, by contrast, is a big-box retailing business that’s facing structural decline in the digital era. Over the long haul, it simply wouldn’t have the resources to invest in keeping the Nook platform competitive. Microsoft is the perfect partner. While Microsoft no longer strikes fear into the hearts of men the way it did in its late ’90s heyday, selling Windows and Office to PC users continues to be a ridiculously profitable business. Microsoft’s long-term future is probably bleak, and one possible response to that would be for it to pay out huge dividends while awaiting inevitable decline. But real companies don’t act like that, and instead Microsoft has been throwing its considerable savings around in a quest for growth. That’s brought us Bing, a socially valuable Google competitor that hasn’t yet made any money, the huge push of the Lumia 900, and set of Apple-like copycat retail stores.

And now Nook.

The strategic partnership ensures that Microsoft’s Windows phone products will have a high-quality e-reader and book-purchasing experience via a Nook app and existing retail channel. Presumably, it also means that Nook hardware will transition away from its current Android-derived base and onto Microsoft’s forthcoming tablet operating system. Microsoft doesn’t need Barnes & Noble the way Barnes & Noble needs Microsoft, but this is yet another way to try to channel the firm’s PC profits into a new line of business.

It’s funny to describe a joint venture Microsoft and Barnes & Noble—two companies that dominated the world just a few years ago—as an underdog, but that’s exactly what it is. Still, Newco is bound to be a strong contender. And the pace of change illustrates why all the hand-wringing about competition in the e-book market is misguided. When news surfaced that the DOJ was considering bringing e-book price-fixing charges against incumbent publishers for an alleged conspiracy with Apple, I thought it was ridiculous a ridiculous idea, comparable to worrying about a horse-and-buggy cartel five years into the automobile era. When Justice stepped in, it was immediately followed by Apple and Author’s Guild president Scott Turow denouncing the alleged Amazon monopoly that would result. The theory is that Amazon could sell e-books at a loss, drive everyone else out of the market, and then crush publishers and consumers alike.

It never made sense to think that discounting could somehow drive Apple—the world’s biggest and most profitable company—out of the e-book market. Any loss-leading prices Amazon wants to offer, Apple can easily afford to match. Even if Apple were to temporarily withdraw from selling e-books, its entire infrastructure of iPads, iPhones, and digital retail of movies, books, and apps would still be in place to swoop back in if Amazon jacked up prices. Now Microsoft, too, is in the same position. Like Apple, it has operating margins on its non-book businesses that absolutely dwarf anything in Amazon’s physical retailing operation. Most likely in this competitive playing field with relatively few barriers to entry, nobody is going to make much money retailing e-books. That’s good for consumers, and not so crazy for the retailers either. After all, these companies are all hoping to sell hardware devices that you can read e-books on. Physical devices are much more expensive to produce than extra copies of digital books, so it’s completely reasonable to sell books as a loss-leader for devices. Or maybe some fourth new company will get in the game and change everything all over again. Either way, the speed with which the landscape is shifting means everyone needs to calm down about monopolies and celebrate the fact that digital technology means it’s never been cheaper or easier to get a good book to read.