American culture endlessly valorizes successful businessmen. But since at least the time of Schumpeter, economists have understood that capitalism is defined more by its failures than its successes. In a market economy, even rich and powerful executives go bust when afflicted by bad luck (or when they make poor decisions). So it’s worth taking a closer look at some of the failures out there—the 10 biggest bankruptcy filings of 2011.

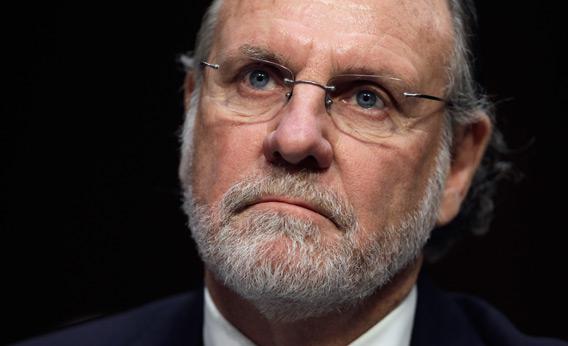

1. MF Global: Leading the list—by far—was the spectacular collapse of Jon Corzine’s brokerage.* With $41 billion in assets, MF Global’s bankruptcy counts as one of the top 10 in American history. But while the specter of a former governor, former senator, and former Goldman Sachs executive pissing away an inconceivable amount of money in risky bets on southern European sovereign debt seemed to many to be the very epitome of dysfunctional finance, Corzine’s comeuppance is in some ways a success story for the system. Corzine made bad bets. He lost money. He’ll lose his job in disgrace and may face legal consequences. The firms who lent him the money he used to make reckless bets will themselves lose money. The (wealthy) people who entrusted their assets to him will lose money. Handing cash over to a well-connected political/financial figure turns out not to be a no-risk gamble. And the American economy can handle the firm’s dissolution without prompting wider chaos.

2. AMR Corp: Coming in at No. 2, with $25 billion in assets, is American Airlines’ parent company. American is fundamentally a victim of not having declared bankruptcy when the other airlines did. Now it’s seizing the unique opportunities offered by bankruptcy to squeeze its unions for a better deal.

3. DYNEGY Holdings: At No. 3 is a long-troubled Texas power plant operator that nearly collapsed back in 2002 after some Enron-esque trading shenanigans. Dynegy’s filing is unusual in that this has generally been a good year for the utility industry and the company initially tried some unusual legal tactics that it hoped would leave shareholders unscathed and in command of profitable assets. These failed, however, and Dynegy eventually went all-in on bankruptcy.

4. PMI Group: The aughts have not been a very fun time to be in the mortgage insurance business, and when Arizona regulators seized PMI Mortgage Insurance, the jig was more or less up for its parent company. When judges declined to reverse the seizure, the company filed for Chapter 11, leading to a $4.2 billion bankruptcy.

5. NewPage Corp: It doesn’t take a genius to see why the paper industry might be in structural decline, but that didn’t stop Cerberus Capital Management from taking NewPage Corp private in a 2005 leveraged buyout deal. Consequently, the company headed into the recession with high debts and dubious business prospects, and this year, it filed for a $3.5 billion bankruptcy to try to negotiate better deals with bondholders. The process has left a wide array of contractors out in the cold as unsecured creditors, even as the bankruptcy judge approved bonus payments for executives. (The same thing happened to me a couple of years back when the Tribune Company went bankrupt in another leveraged buyout gone sour.)

6. Integra Bank Corp: Smallish regional banks can go bust just as easily as the huge multinationals, and on July 29 the Office of the Comptroller of the Currency shut down Integra Bank N.A. of Illinois, Indiana, Kentucky, and Ohio as insolvent. The FDIC was appointed as receiver, insured deposits were shifted to the Old National Bank of Evansville, and the parent company filed a $2.4 billion bankruptcy the next day.

7. General Maritime Corp: You probably haven’t heard of the tanker bubble, but in recent years the shipping industry has been plagued with problems: too many boats and falling earnings. The same glut of ships that’s reduced revenues has simultaneously reduced the value of shipping firms’ assets on hand, so in November the world’s No. 2 operator of midsized tankers filed for protection. The resulting $1.8 billion bankruptcy should be settled by debt-to-equity conversion under the auspices of Oaktree Capital Management.

8. Borders Group: Borders Group’s $1.4 billion bankruptcy wasn’t particularly large but stands out because it’s a household brand name and also because it’s unusual for such a big firm to enter full-scale liquidation. But Borders turned out to be a company nobody wanted to own, no matter what the debt structure, and it may be a harbinger for other big-box retail chains in the Internet era.

9. TerreStar Corp: TerreStar was the proud owner of the world’s largest commercial telecommunications satellite, and was the original progenitor of XM Satellite Radio. But with the radio unit spun off, there turned out not to be much money in satellite-based telecommunications, leading to a $1.4 billion bankruptcy in February and the takeover of the company by EchoStar, the parent company of Dish Network. An interesting subplot here is that TerreStar owned a fair swath of broadband spectrum that could end up playing a role in the looming reconfiguration of the U.S. mobile phone industry as AT&T and Deutsche Telekom decide how to proceed now that federal regulators have blocked Telekom’s sale of T-Mobile to AT&T.

10. Seahawk Drilling: A mere minnow of a bankruptcy at $625 million, Seahawk lacked the size, diversification, and sound financial fundamentals it would have needed to survive the slowdown in coastal drilling touched off by the BP spill in the Gulf of Mexico. Its fleet of rigs was sold to Hercules Offshore to raise funds to pay off bondholders.

MF Global aside, this was a relatively quiet year for bankruptcies considering the poor economy. The good news for bankruptcy fans is that things picked up near the end of the year, as European sovereign debt woes made it more difficult for heavily indebted firms to roll over their obligations. Since nobody expects the European situation to be sorted out anytime soon, that means next year should feature an extended period of choppy waters for troubled firms and perhaps a spike in Chapter 11 filings.

Correction Dec. 28, 2011: This article originally misidentified MF Global as a hedge fund. (Return to the corrected sentence.)