The debt ceiling is back in the news: Treasury Secretary Janet Yellen said Monday the U.S. could default on its debt as early as June 1 if Congress doesn’t raise its $31.4 trillion debt ceiling. Next week, President Joe Biden will meet with congressional leaders on the issue. More than a decade ago, Annie Lowrey wrote about the pointlessness of the debt ceiling. We’re reprinting that story below. It was originally published May 16, 2011.

Today, the United States officially hit its $14.3 trillion debt ceiling, meaning the country can no longer issue new bonds to finance its debt. The Treasury Department has already started undertaking “extraordinary measures” to keep the country’s bills paid. Eventually, though, the United States will need to do one of three things: default on its obligations, start making drastic cuts in federal spending, or raise the debt ceiling again.

But perhaps there is a fourth alternative, one that will spare us from endless partisan bickering and protect the markets from uncertainty: The United States should just get rid of the debt ceiling, once and for all.

The ceiling is entirely unnecessary for managing the country’s finances. Every year, Congress determines the government’s rates of taxation and spending, and therefore its surplus or deficit. Annual deficits accrue to the overall national debt, which Treasury finances by issuing bonds. The ceiling relates only to the total amount of debt the Treasury is allowed to issue. In and of itself, it does nothing to constrain spending, raise taxes, or otherwise improve the country’s fiscal situation.

The nonpartisan Congressional Budget Office may have explained the dangerous pointlessness of the debt ceiling best: “By itself, setting a limit on the debt is an ineffective means of controlling deficits because the decisions that necessitate borrowing are made through other legislative actions,” it writes. “By the time an increase in the debt ceiling comes up for approval, it is too late to avoid paying the government’s pending bills without incurring serious negative consequences.”

The debt ceiling is a historical relic, the budgetary equivalent of the appendix. Before 1917, Congress needed to approve each and every debt issuance. But when World War I hit, the legislature decided to make the process easier, setting an overall debt limit and letting Treasury issue as many bonds as it needed to stay within it. A century ago, the ceiling made more sense. The government was smaller, with discretionary spending a bigger portion of the federal budget. Having the additional check helped to keep appropriations under control. But now, the debt ceiling does little to encourage smarter budgeting. Most of the country’s debt stems from spiraling mandatory spending on programs like Medicaid, Medicare, and Social Security anyway.

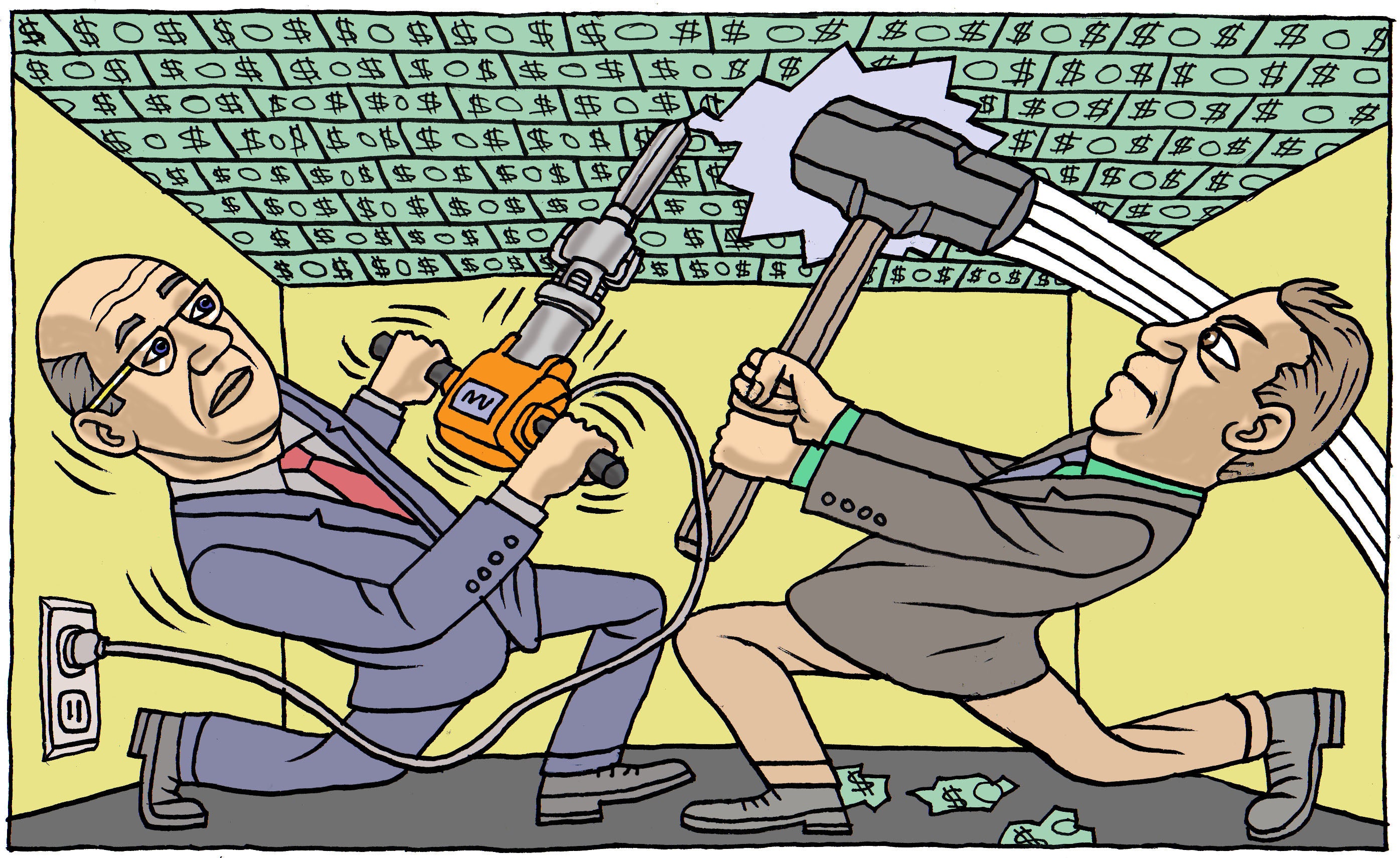

Yet, in the past decade or two, the ceiling has transformed from useless political relic to handy political football: Whenever the country comes close to hitting the limit, the opposition party—whether Republican or Democratic—seizes the opportunity to thwack the other side and refuses to vote to lift it.

Today, for instance, President Barack Obama and other Democrats are slamming Republicans for “playing chicken” with the debt limit, risking spooking the almighty bond market. But back in 2006, none other than Barack Obama took to the Senate floor to hit Republicans for trying to raise it. “Leadership means that ‘the buck stops here,’” he said. “Instead, Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren.”

Again, Congress finds itself at an unnecessary budgetary impasse—and one that threatens real, immediate economic harm. Just six months ago, Congressional Democrats and Republicans together passed a tax deal that obviously required an increase in the debt limit. They extended the Bush tax cuts for all filers, and did not cut spending nearly enough to compensate for the billions of dollars of lost tax revenue. But they did not actually raise it.

Now, Republicans want to tack on extra cuts, and some Democrats are balking. Some more-conservative members of Congress, such as Rep. Michele Bachmann, are even arguing for just leaving the limit as is, and immediately slashing spending $125 billion a month to get it to equal receipts.

At some point, Congress needs to raise the debt ceiling. Until it does, Treasury is moving money around to continue meeting the country’s obligations. But it can only do so until Aug. 2. Then, the country will start to default. That might mean not sending out Social Security checks. Eventually, it might even mean failing to make scheduled coupon payments on bonds—raising the possibility of throwing the world markets into turmoil and causing a worse economic crisis than the recession itself.

That worst-case scenario seems vanishingly remote. The best-case scenario for raising the debt ceiling is that Congress does it quickly—and then moves on to tackling the country’s real, long-term, enormous fiscal imbalance. Given the horrific downside and negligible upside, why not just get rid of it?