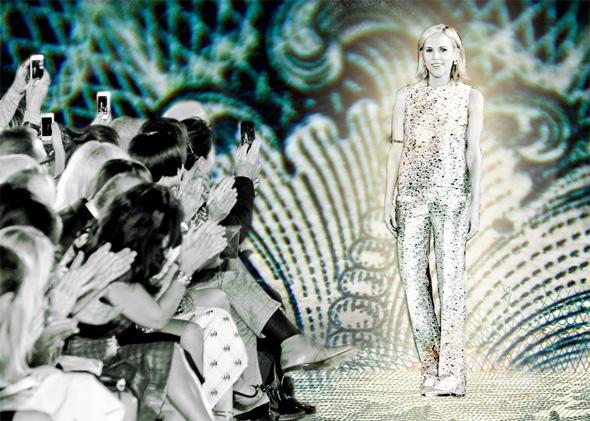

The new titans of business are now also the best dressed. Take a glance at the Bloomberg Billionaires list: As of this writing, the third wealthiest person in the world is Amancio Ortega (net worth $64.2 billion), the founder of Spanish clothing chain Zara. No. 15 is luxury goods magnate Bernard Arnault ($33 billion), chairman of LVMH Moët Hennessy Louis Vuitton SA; just a few places behind is Stefan Persson ($29.3 billion), chairman of Swedish retail giant H&M. In the past year, a noteworthy crop of high-end designers made their first appearances on the Forbes richest-billionaires list, including Tory Burch, Dolce & Gabbana’s Domenico Dolce and Stefano Gabbana, and Diesel founder Renzo Rosso. Brunello Cucinelli, with his eponymous label of suits and $2,000 cashmere sweaters, has reportedly sailed past the 10-figure mark while the ubiquitous Michael Kors is on the brink, if he hasn’t crossed it already.

High-end (or highish-end) fashion is the provenance of a new class of billionaire. “It’s the bifurcation of the world,” says Milton Pedraza, CEO of the Luxury Institute, a research and consulting firm. “People talk about the 99 percent and the 1, but it’s really more like the 80 percent and the 20. That top number of consumers is growing exponentially, and as a result, premium and luxury brands are surging.” With an expanded consumer base in China and other Asian markets as well as in Europe, Russia, the Middle East, and the Americas, the luxury market has boomed; according to the consulting firm Bain & Co., these consumers worldwide have spent roughly $292 billion in 2013 alone.

“Up until fairly recently, fashion was this small, impenetrable world that didn’t really communicate with regular people,” says Barneys New York creative ambassador (and Slate columnist) Simon Doonan. Thanks in part to the democratizing influence of the Internet and shows like Sex and the City and Project Runway, “fashion has become a global spectator sport,” Doonan says. “Is it any wonder then that these designers are becoming billionaires?”

Oddly or not, demand for higher-end goods has only grown since the recession. “Today’s consumers want lasting value for their dollar and are willing to pay more for a better quality product because they see it as a good investment,” Pedraza says. “It’s not just the super-rich doing this. Young people are saving up to buy. So are people from lower income levels. The aspirational buyer may be able to afford only one piece, but they are still buying—and there are a lot of them.” Analysts at Goldman Sachs predict that the luxury market will double over the next 10 years.

With such fertile conditions for the growth of fashion billionaires, what sets a Tory Burch or a Dolce & Gabbana apart from the rest? “It’s about creating a lifestyle that is genuine, with keen attention to detail,” says Gabriella Santaniello, managing director of retail market research at Wedbush Securities, a financial services and investment firm. “There is an authenticity to how these designers represent their brands, which is reassuring to the consumer who wants to be part of that world.” From Tory Burch’s lacquered, Palm Beach-inspired boho-chic to the Italian movie-idol glamour of Dolce & Gabbana, from Michael Kors’ jet-set signifiers to Diesel’s artfully grungy rock-star style, “these are all incredibly clear brand identities that come from having exceptional vision and the resiliency to weather the enormous challenges that come with sustaining a global fashion company,” Doonan says. (The savvy would-be fashion billionaire will also note that accessories continue to outperform apparel. According to Bain & Co., accessories—particularly leather goods—make up 28 percent of total revenues, and that number is expected to keep growing.)

“It’s one thing to come up with a great idea,” Doonan continues. “It’s another to produce the item in a timely manner and not get killed by inventory that you can’t sell.” He points to Tory Burch and her best-selling Reva flat as a perfect example. “When Tory Burch introduced her flats [in 2006], women were all about high heels,” Doonan says. “Tory understood that they needed a glamorous alternative to give their feet a rest without feeling like a schlub. So she came up with the Reva. But just as importantly, she figured out the logistics of production so that she had enough of them at the beginning when the trend was peaking.”

Designers in pursuit of 10 figures not only need great timing—they also need speed. “We used to say it takes forever for a brand to evolve, but that elevation occurs a lot faster these days,” says Pedraza. The increased velocity is partly due to the appetites created by online and social media marketing.

“Part of the success of these companies is that they now have tools that were not available 10 years ago,” says Santaniello. Companies can post sneak peeks of lines on their websites and social media to create buzz that can go global in an instant.

“People in Egypt or Brazil or Russia will want the same brands that you want,” says Pedraza, and thanks to the brands’ online stores as well as the e-commerce likes of Net-A-Porter and Yoox, they can get their hands on them as easily as someone in New York, Paris, or London.

So amid such a fertile landscape for hatching fashion billionaires, we asked our experts: Which designers will likely be next to pass the 10-digit milestone? Doonan picks Alexander Wang, the 29-year-old creative director of Balenciaga and head of his own ready-to-wear label; Jack McCollough and Lazaro Hernandez of the popular womenswear and accessories brand Proenza Schouler; and Tom Ford, with his line of menswear, womenswear, beauty products, and accessories. (In a recent interview with the Business of Fashion, Ford says his company is positioned to make $1 billion sometime in 2014.) Pedraza bets Reed Krakoff, who parted ways with Coach this past fall to focus on his own line, could also make it in the next several years; Santaniello points to handbag maven Rebecca Minkoff, whose DailyCandy breakthrough came less than a decade ago.

All three of our experts, however, were quick to name one man: Marc Jacobs, who left Louis Vuitton earlier this year to focus his energies on his own label—with an eye to an initial public offering in the coming few years. “His split focus probably slowed down his brand,” says Santaniello. “But now that he’s pulled that together, Marc Jacobs could definitely be fashion’s next billionaire.”